- SHIB at $1 would require a $589 trillion market cap

- Token burns cannot realistically solve the supply issue

- Meaningful upside exists, but far below $1

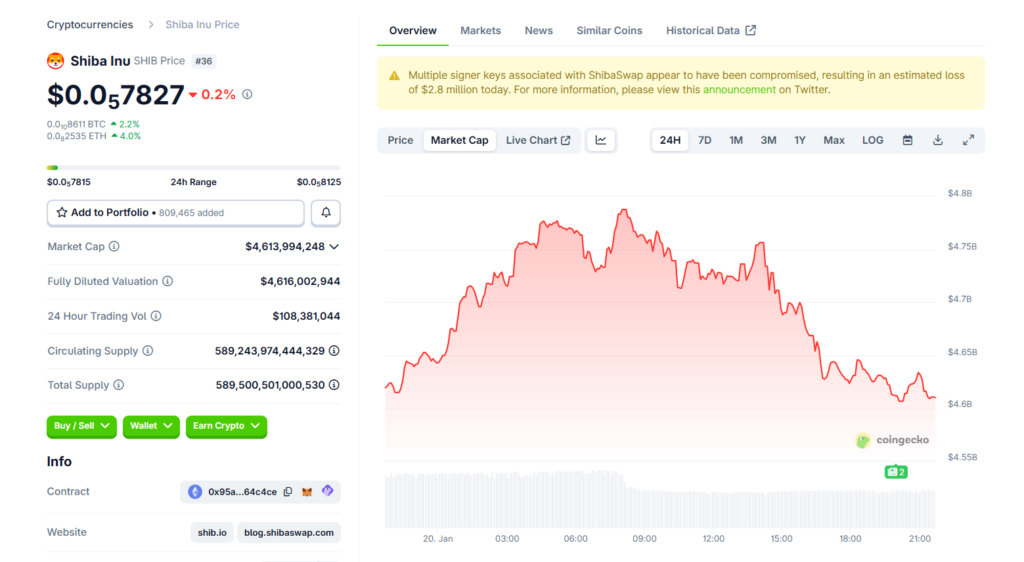

Shiba Inu $1 predictions keep resurfacing across crypto social media, but the numbers behind that target paint a very different picture. At a current price near $0.0000083, SHIB reaching $1 would require a market capitalization of roughly $589 trillion. That figure is nearly ten times larger than the combined valuation of every company in the S&P 500, which immediately puts the idea into perspective. While the question of whether Shiba Inu can reach $1 keeps getting asked, the answer lives firmly in basic supply and demand math rather than hype.

The Supply Problem Behind the $1 Target

Shiba Inu currently has about 589 trillion tokens in circulation, which is the core reason the $1 target is so unrealistic. At that supply level, a $1 price would imply an economy larger than the entire global financial system, let alone the crypto market. Even if SHIB somehow achieved mass adoption, there is no plausible scenario where capital flows of that scale materialize.

The token burn narrative also falls apart under scrutiny. At the current burn pace of roughly 110 million tokens per month, or around 1.3 billion per year, it would take more than 450,000 years to remove enough supply to justify a $1 valuation. Even aggressive increases in burn rates barely move the needle when measured against trillions of tokens.

There is also a misconception that burning supply magically creates wealth. If 99.999% of tokens were burned, holders would simply own fewer units. The dollar value per token might rise, but investor purchasing power would remain unchanged. In real terms, inflation and opportunity cost would leave holders worse off over time.

What Realistic Price Forecasts Actually Look Like

Analysts who focus on data instead of viral price targets paint a much more grounded outlook. Some bullish projections suggest SHIB could reach around $0.00009 by 2026, which would already represent a major move and slightly exceed its 2021 all-time high. That kind of upside would still deliver meaningful returns without requiring impossible assumptions.

Most 2026 forecasts cluster between $0.000008 and $0.000088, depending on market conditions and ecosystem growth. Looking further ahead to 2030, optimistic estimates range from $0.0001 to $0.0006, but those scenarios depend heavily on whether Shibarium gains real adoption and drives sustained on-chain activity.

These projections assume growth, not miracles. They rely on incremental progress, improved infrastructure, and broader crypto market expansion rather than supply eradication or trillion-dollar capital inflows.

Why Shiba Inu Still Struggles Fundamentally

The biggest obstacle to SHIB’s long-term upside is utility. Unlike Bitcoin, which is increasingly treated as a store of value, or XRP, which benefits from payment and liquidity use cases, Shiba Inu lacks a clear demand driver. Only around 1,100 businesses globally accept SHIB, which limits real-world usage.

Attempts to build value through a metaverse, games, NFTs, and a Layer-2 network have so far failed to generate meaningful traction. These initiatives exist, but they haven’t translated into sustained price appreciation or growing transactional demand.

Without a strong use case that creates consistent demand, SHIB remains primarily a speculative asset. Until that changes, expectations of a $1 price point are disconnected from reality, especially in 2026.

Final Thoughts on the $1 Dream

The appeal of Shiba Inu $1 predictions is emotional, not analytical. The math simply does not work under current conditions, and no credible roadmap exists to bridge that gap. Meaningful gains are still possible, but they live far below the dollar mark. Without a breakthrough use case or radical structural change, $1 will remain a headline, not a destination.