- SharpLink Gaming boosted its Ethereum treasury to 728,000 ETH ($3.2B), staking most of it, but still reported $103M in quarterly losses due to non-cash impairments and revenue declines.

- Accounting rules forced SharpLink to log an $87.8M paper loss when ETH briefly dipped to $2,300, despite not selling any of its liquid-staked assets.

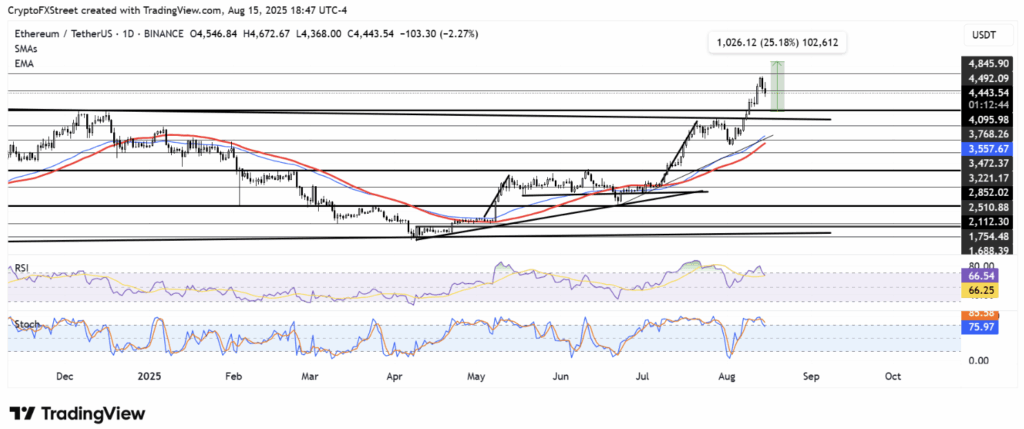

- Ethereum slipped under $4,500, with liquidations topping $169M; support sits near $4,100, while a reclaim of $4,868 ATH could quickly open the path toward $5,000.

Ethereum slipped about 2% on Friday, but the bigger story came from SharpLink Gaming. The company revealed quarterly losses of $103 million—yes, nine figures in red ink—despite stacking its Ethereum treasury to an eye-popping 728,000 ETH, valued at more than $3.2 billion.

SharpLink pivoted into Ethereum earlier this year, moving “nearly all” of its holdings into staking operations. That strategy has already earned the firm 1,326 ETH in rewards. Co-CEO Joseph Chalom defended the approach, saying they’ve raised significant capital and scaled their holdings “in a highly accretive manner.” Still, Wall Street wasn’t impressed—shares tanked 15% after the report, closing Friday at $19.85.

Accounting Rules Hit Hard

Most of SharpLink’s reported loss isn’t from spending but from accounting. U.S. GAAP rules forced the company to book an $87.8 million non-cash impairment on its liquid-staked ETH. Because ETH dipped to $2,300 at one point in Q2, SharpLink had to record that as its lowest value, even though the tokens remain unsold. In other words—paper losses, not realized ones. Revenue also cratered 30% year-over-year, coming in at just $700k.

It’s a stark contrast: billions in ETH locked up and working, but day-to-day business operations showing sharp declines. Since June, Ethereum treasury firms collectively hold more than 2.7 million ETH. BitMine Immersion leads the pack with 1.2 million, making SharpLink’s entry notable but not yet dominant.

Ethereum Price Outlook

Meanwhile, ETH itself has been under pressure. The coin slipped below the $4,500 support line after failing to hold $4,700. That move triggered about $169 million in liquidations, with longs taking the brunt of the hit—roughly $130 million washed out in 24 hours.

If the decline deepens, $4,100 is the next key level to watch. That line has acted as strong resistance in the past, now possibly turning into support. A break below $4,100 could open the door toward $3,500, where both the 50-day EMA and SMA sit as safety nets.

Indicators aren’t screaming bullish either. RSI has cooled off and is now testing its moving average, while the Stochastic Oscillator has retreated from overheated levels. Still, if ETH manages to reclaim its all-time high at $4,868, the story flips quickly, with $5,000 back in play.