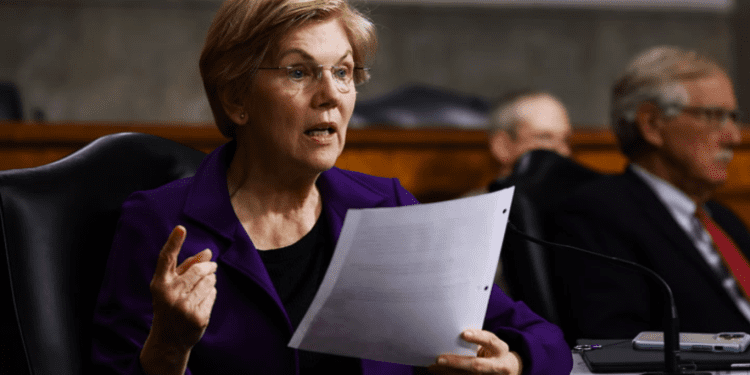

- Senator Elizabeth Warren has voiced concerns over cryptocurrency’s role in facilitating illegal fentanyl trade, particularly with companies based in China.

- Drawing from reports by blockchain analytics firm Elliptic, Warren states that crypto transactions linked with Chinese fentanyl dealers surged by 450% in the previous year.

- In response to this alarming trend, Warren plans to reintroduce the Digital Asset Anti-Money Laundering Act, targeting crypto loopholes that aid illegal activities.

In recent discussions regarding cryptocurrency, a more sinister use case has emerged. Senator Elizabeth Warren, a Democrat from Massachusetts, brought to light alarming evidence of a potent link between the use of cryptocurrency and the escalating opioid crisis, particularly related to the drug fentanyl. Drawing heavily from an Elliptic report, Warren expressed concern over the alarming increase in the number of crypto transactions associated with Chinese fentanyl brokers, which she noted has surged by an astonishing 450% just last year alone.

According to Elliptic’s study, a staggering 90% of approximately 90 China-based firms supplying fentanyl precursors were willing to accept payment in cryptocurrencies, notably Bitcoin. This statistic should be cause for concern, considering that despite ostensibly banning cryptocurrencies, China appears to be a hotbed of such transactions, thereby highlighting the clandestine nature of the crypto sphere.

Legislative Action: The Digital Asset Anti-Money Laundering Act

In light of these disturbing findings, Senator Warren is taking concrete action. She announced plans to reintroduce legislation aimed at tackling these ominous trends. Specifically, the senator first introduced the Digital Asset Anti-Money Laundering Act in 2022, a bipartisan bill aimed at addressing regulatory gaps affecting these payments, particularly those that enable companies engaged in the illegal drug trade.

In the senator’s words, “Congress has talked about fentanyl long enough. We propose to do something to fight back.” The bill intends to bring transparency to an industry operating in the shadows. The legislation seeks to enforce better ‘know-your-customer’ rules, limit the potential for money laundering, and make it more challenging to use privacy mixers to hide the source of funds.

Fentanyl’s Unseen Toll and the Crypto Connection

Fentanyl, a synthetic opioid, is the driving force behind an escalating drug crisis. In 2021, over 70,000 deaths in the United States were attributed to synthetic opioid overdoses. With the revelations about the intersection of the crypto industry with the fentanyl trade, this public health issue takes on a new and chilling dimension.

Crypto transactions offer anonymity and ease of cross-border transactions, making them an attractive payment option for these illicit dealings. The fact that many Chinese companies involved in the fentanyl trade are willing to accept cryptocurrencies despite the country’s crypto ban is particularly alarming. The ban has done little to curb the use of cryptocurrencies in these transactions, thus illustrating the challenges authorities face in managing and regulating the sprawling, decentralized nature of the crypto industry.

The revelations of cryptocurrency’s role in facilitating the fentanyl trade may spur a reckoning within the crypto industry, forcing it to grapple with these darker implications. While crypto enthusiasts often tout cryptocurrencies’ privacy, decentralization, and borderless nature as virtues, these same characteristics can, unfortunately, also provide cover for illicit activities. Therefore, the Digital Asset Anti-Money Laundering Act introduced by Senator Warren serves as a critical step toward mitigating these risks, and it is a wake-up call to the industry to police itself better and innovates to prevent such misuse.