- Schwab will launch spot BTC and ETH trading in early 2026, starting with internal trials.

- The firm is open to crypto acquisitions but only at the right valuation.

- Pricing remains uncertain, but analysts expect fees must stay below 50 bps to compete.

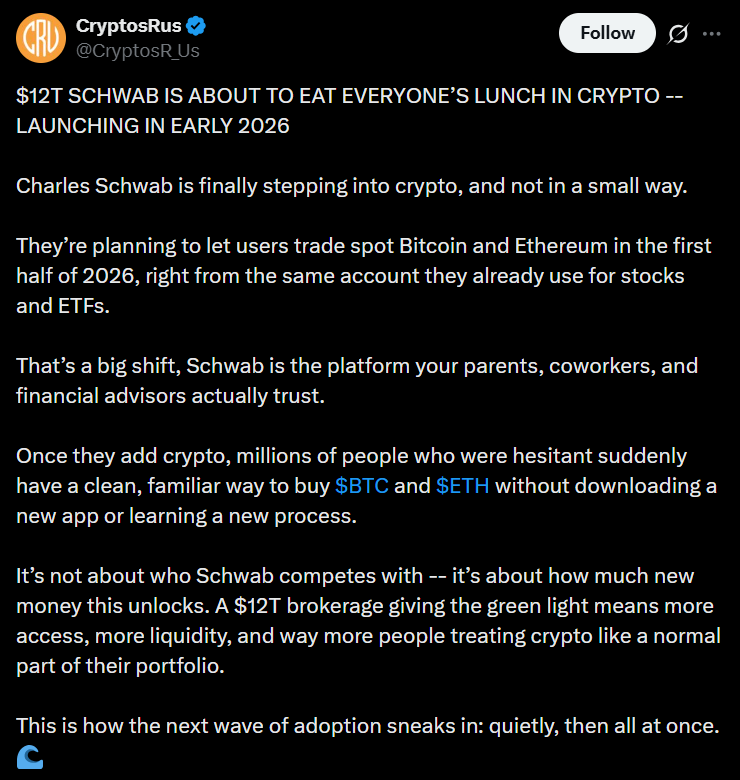

Charles Schwab is officially gearing up to enter the crypto trading arena, with CEO Rick Wurster confirming that spot Bitcoin and Ethereum trading will launch in the first half of 2026. The move marks one of the largest U.S. brokerages stepping deeper into digital assets — but with a cautious rollout designed to control risk, refine user experience, and ensure regulatory comfort.

Schwab Begins With Internal Trials Before Client Access

The first phase of Schwab’s crypto push will happen behind the scenes. The company plans to begin spot BTC and ETH trading with employees only, allowing the firm to test functionality, security, and execution quality before letting clients in.

Wurster explained:

“The firm will start with employees and then extend the testing to a limited client base.”

Once internal and limited-client testing is complete, Schwab will gradually expand access, giving the firm time to adjust pricing, improve UX, and tighten risk controls before opening the gates to millions of investors. For a platform of Schwab’s size, a phased rollout helps avoid the kind of operational strain that traditional crypto exchanges often face during periods of high volatility.

Open to Crypto M&A — But Only at the Right Price

Alongside product development, Schwab is keeping the door open for mergers and acquisitions — including in the crypto sector. Wurster said the firm is “monitoring the landscape” for opportunities that add value at scale, signaling interest but not urgency.

He stressed that Schwab would only consider a crypto acquisition if the valuation fits the company’s long-term strategy. No specific companies were named, and Wurster declined to confirm whether Schwab is currently in discussions with any crypto firms. Still, the message is clear: Schwab is exploring ways to accelerate its crypto expansion without overpaying.

A Major Step for a $12 Trillion Brokerage

Schwab’s move into spot crypto trading reflects growing demand from its massive client base, which is increasingly asking for broader investment options under one roof. With trillions in assets and one of the largest retail footprints in finance, Schwab entering the market could accelerate mainstream adoption — especially among traditional investors who prefer regulated, established institutions over crypto exchanges.

As 2026 approaches, all eyes will be on Schwab’s fee structure, M&A activity, and how quickly its phased rollout expands to the wider public.