- Michael Saylor framed Bitcoin’s future as either zero or $1 million

- The statement reflects extreme volatility and split market sentiment

- Binary narratives can amplify both fear and euphoria in crypto markets

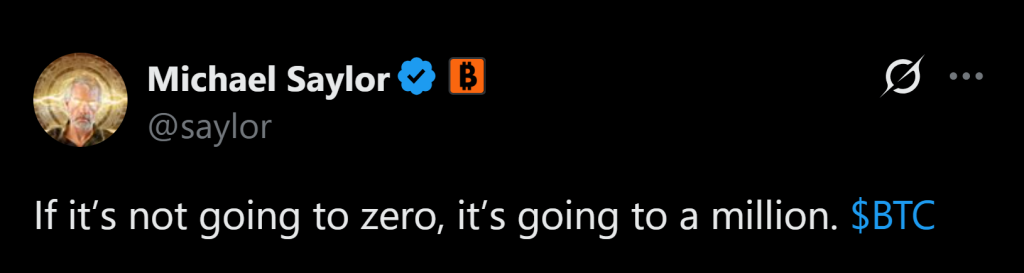

Michael Saylor has never been subtle about Bitcoin, but his latest framing might be his most polarizing yet. He suggested Bitcoin’s future is strictly binary: it either crashes to zero or eventually reaches $1 million. That’s not a price target. It’s a philosophical stance wrapped in headline energy.

On the surface, it sounds absurd. Markets rarely move in pure absolutes. Assets don’t typically go from global adoption to literal zero without a systemic collapse. But Saylor isn’t really forecasting a specific path. He’s reinforcing a conviction narrative: Bitcoin either becomes foundational to the financial system or it fails completely.

Why the “Zero” Scenario Isn’t Just Fearbait

To be fair, the idea of Bitcoin going to zero isn’t invented out of thin air. Search interest in “Bitcoin to zero” spikes whenever prices slide hard. Sentiment has deteriorated sharply in recent downturns, especially when Bitcoin pulled back from record highs and macro pressure mounted.

Critics point to regulatory crackdowns, technological displacement, state-level bans, or catastrophic protocol failures as potential black swan risks. Are those likely? That’s debatable. But they exist in the risk spectrum. Bitcoin is still a relatively young asset class, and young asset classes carry existential risk.

The $1 Million Case Has Structural Backers

On the other side of the spectrum, the $1 million thesis is not purely fantasy either. Institutional flows, ETF access, sovereign accumulation, and Bitcoin’s fixed supply narrative all support long-term upside arguments. Halving cycles historically tighten supply. Adoption curves continue expanding. Capital markets infrastructure around BTC keeps maturing.

The bullish case assumes Bitcoin evolves into digital gold at scale or even something larger. Under that lens, $1 million is not tomorrow’s target, but a multi-cycle possibility. The key is timeframe. Extreme upside scenarios usually rely on decades, not months.

Binary Thinking Fuels Volatility

Here’s where things get messy. Framing Bitcoin as “zero or $1M” encourages emotional positioning. Investors either go all-in with blind conviction or panic out entirely. Markets don’t thrive on absolutes. They thrive on probabilities.

When high-profile figures promote binary narratives, they amplify irrational behavior. Fear spikes harder. Euphoria stretches further. Leverage builds faster. And corrections cut deeper. That doesn’t mean Saylor is wrong. It just means his framing shapes psychology more than valuation models.

The Real Takeaway

Bitcoin likely won’t move in a straight line to either outcome. The more realistic path is messy, volatile, and full of cycles. But Saylor’s comment captures something true about crypto: conviction and skepticism coexist at extreme levels.

Whether you believe Bitcoin becomes a million-dollar asset or collapses under its own weight, reducing it to a coin flip oversimplifies a complex system. Investors would be wise to focus on risk management, adoption data, and macro conditions, not just the loudest soundbite.