• Sam Bankman-Fried claims FTX was never insolvent and blames lawyers for its collapse.

• His new document argues FTX’s assets could be worth over $100B today, contradicting filings.

• SBF’s public defense aligns with reports of a presidential pardon campaign and image rehab.

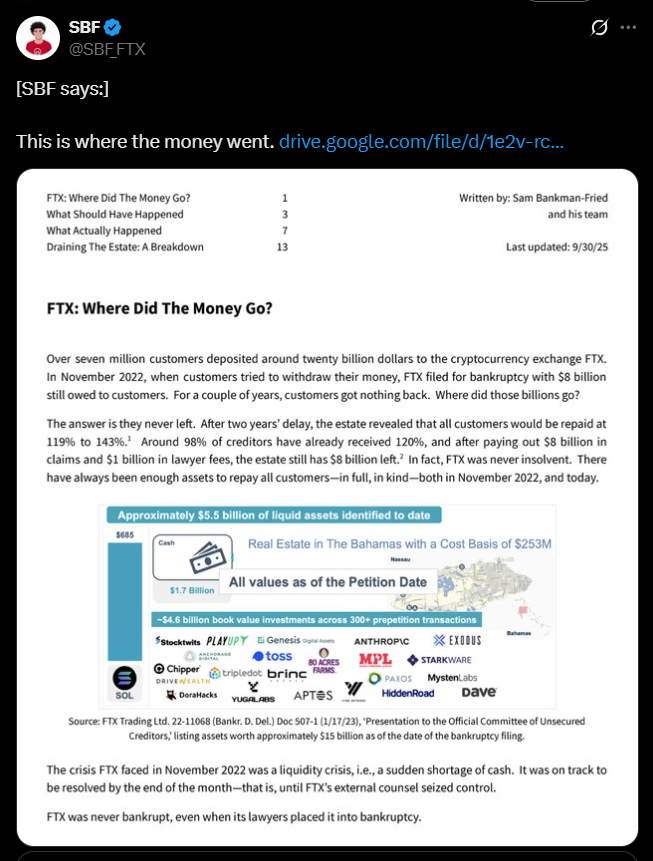

In a surprising move, Sam Bankman-Fried has reappeared on social media, releasing a sprawling document defending his actions during the FTX collapse. The former exchange boss insists that FTX “was never insolvent” and blames the company’s downfall on bankruptcy lawyers, not financial mismanagement.

The document, shared on X, outlines what he calls “mark-to-market” valuations of FTX’s former holdings — including assets like Solana (SOL) and Anthropic — arguing that the company could be worth over $100 billion today if it hadn’t entered bankruptcy in 2022. Bankman-Fried suggests that customers could have been repaid in full had the lawyers not taken over operations, painting himself as a victim of legal overreach rather than a reckless executive.

Claims Clash With Official Records

While the post attracted immediate attention, financial experts and court documents paint a very different picture. FTX’s bankruptcy filings revealed an $8 billion hole in customer funds, alongside evidence of misused assets and intercompany loans between FTX and Alameda Research. Bankman-Fried’s claim that the exchange was solvent at the time of collapse directly contradicts sworn testimony and verified accounting reports.

Critics have described his latest post as part of a broader image-rehabilitation campaign — an effort to shift public perception while legal avenues narrow. Many observers see this as an attempt to rewrite the narrative rather than present new evidence.

The Pardon Play and Political Strategy

Reports from The New York Times indicate that Bankman-Fried’s team, including his parents and a Trump-connected attorney, Kory Langhofer, have been quietly lobbying for a presidential pardon. They’ve even arranged a jailhouse interview with Tucker Carlson to help reshape his public image.

Still, the odds appear slim. Prediction market data from Kalshi shows only a 10% chance that Bankman-Fried receives a pardon from President Trump. Yet the move may be less about winning immediate clemency and more about regaining influence and sympathy among investors, politicians, and crypto circles.

Why This Matters

This latest chapter underscores how the FTX saga continues to evolve even after the verdict. Bankman-Fried’s renewed public defense shows that he’s not giving up on the court of public opinion, even if his legal options are limited. His attempt to frame FTX as a victim of legal mismanagement — rather than fraud — could shape how history remembers one of crypto’s biggest collapses.