Announcement

To make cryptocurrency payments in international trade legal, the Bank of Russia and the Ministry of Finance have decided to take action. Deputy Finance Minister Alexei Moiseev said in an interview with Russia-24 TV that the Ministry of Finance and the Bank of Russia had changed their positions on cryptocurrencies and now recognize the significance of legalizing cross-border payments in digital currencies shortly.

Statement from FM

“The disparity in methods for regulating the bitcoin industry has persisted. But I can also say that the Central Bank has reconsidered [the strategy] in light of the evolving circumstances, and we are doing the same. We must somehow legalize the infrastructure to use cryptocurrencies in cross-border settlements. The infrastructure we intend to develop is too inflexible. Give people the chance to do it, but also control it so that there is no money laundering or buying drugs, among other things,” added Moiseev.

Reason of Switch

According to TASS, the two governments have decided it is “impossible” to proceed without accepting cryptocurrency as a legitimate form of payment for cross-border transactions.

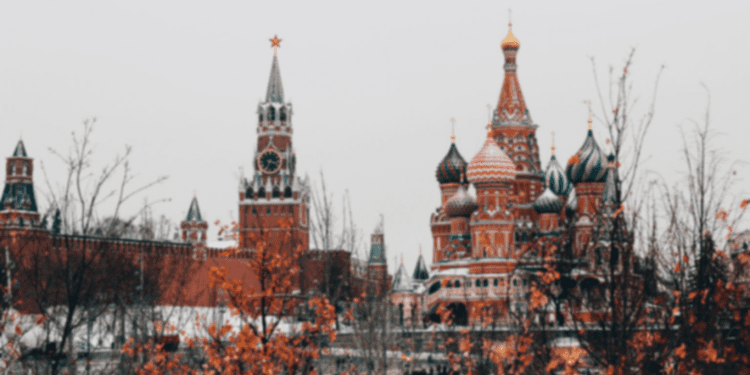

The action is being taken as Russia tries several approaches to regulating the Bitcoin and cryptocurrency markets. The largest country in the world, which is under heavy Western sanctions, has looked for alternatives to the U.S. dollar to ensure the practical trade of its goods.

In March, Pavel Zavalny, the nation’s congressional energy committee chairman, announced that the government was open to accepting bitcoin payments for exporting natural gas and other resources.

“When it comes to our “friendly” nations, like China or Turkey, which don’t put any pressure on us,” Zavalny continued, “We have been offering them to move payments to national currencies, like rubles and yuan. With Turkey, it might be both lira and rubles. Consequently, it is typical to have a range of currencies. We’ll let them trade in bitcoin if they want.”

According to a report, Russia was “actively discussing” using cryptocurrencies in foreign trade in May.

Putin’s Statement

The fact that such a plan is about to become a reality has changed the dynamics since President Vladimir Putin ruled it out in an interview at the Russian Energy Week conference in Moscow last year. At the time, Putin remarked to bitcoin, “I think it has worth. But I don’t think it can be employed in the oil trade.”

The Russian president expressed his concerns about the energy required to run the Bitcoin network, but he clearly said that “he intended to wean his nation off the US dollar.”

“I believe that the United States is making a serious mistake by using the dollar as a tool for sanctions, he said. “We are forced. For our transactions, we must resort to alternative currencies like bitcoin and crypto.” In June, Russia announced it would take U.S. dollars-denominated assets out of its national wealth fund.

Conclusion

TASS reports that the regulatory framework to allow cross-border cryptocurrency settlements in Russia will still be introduced. However, by being open to the idea and engaging in pilot transactions with interested parties, Russia is setting the stage for a future development wherein countries confronted by sanctions may decide to conduct business in the stateless, global monetary system.