• Video-sharing platform Rumble’s stock rose after CEO Chris Pavlovski suggested interest in adopting a bitcoin treasury strategy

• Pavlovski’s tweet about adding bitcoin to Rumble’s balance sheet drew a response from MicroStrategy CEO Michael Saylor, who pioneered corporate bitcoin adoption

• Rumble posted $25.1 million in Q3 revenue, up 39% year-over-year, and had $130.8 million in cash and cash equivalents on its balance sheet

Rumble, a video-sharing platform competitor to YouTube, saw its stock price rise today as CEO Chris Pavlovski hinted at possibly adopting a bitcoin treasury strategy.

Pavlovski Sparks Speculation with Tweet

During Tuesday afternoon trading, Pavlovski tweeted “Should Rumble add Bitcoin to its balance sheet?” This seemingly playful question quickly drew a serious response from MicroStrategy CEO Michael Saylor, a pioneer of corporate bitcoin adoption. “Yes, I would be happy to discuss why and how with you,” replied Saylor.

Pavlovski’s tweet sparked a rally in Rumble’s stock, which had been trading slightly down earlier in the day. Shares rose around 7% following the exchange before pulling back somewhat to a 3.3% gain on the day.

Bitcoin Price Also Reaches New High

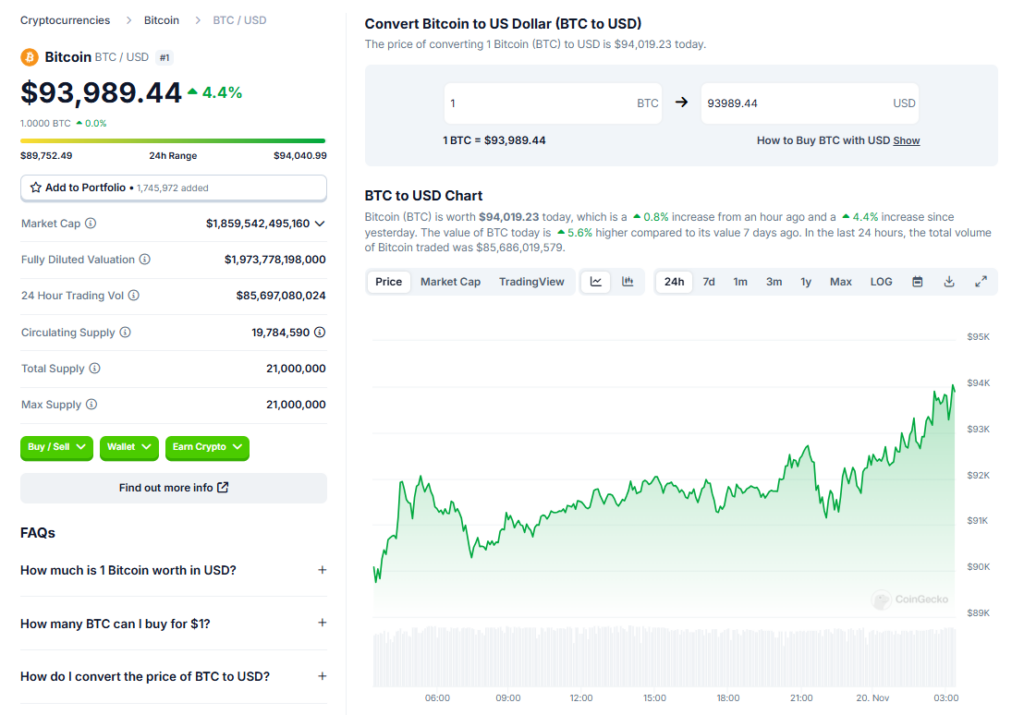

The conversation comes as bitcoin’s price set a new all-time high on Tuesday, crossing $94,000 for the first time amid growing corporate adoption.

Rumble is a competitor to YouTube in the video sharing space. In Q3, the company posted $25.1 million in revenue, up 39% year-over-year. Rumble had $130.8 million in cash and equivalents at quarter-end. The stock is up 26% year-to-date, giving Rumble a market cap around $1.6 billion.

Corporate Bitcoin Adoption Accelerating

Rumble is the latest company to consider adding bitcoin to its balance sheet following MicroStrategy, Tesla, Block (formerly Square), and others. This accelerating corporate adoption is contributing to bitcoin’s record rally.

While Pavlovski’s tweet alone doesn’t confirm Rumble will buy bitcoin, it shows the company is seriously considering following the lead of other firms. The CEO said he is direct messaging with Saylor to discuss “why and how” to adopt a bitcoin treasury strategy.