After three years of deliberation, Honorary US District Judge Analisa Torres has ruled in favor of Ripple, concluding that XRP is indeed NOT a security.

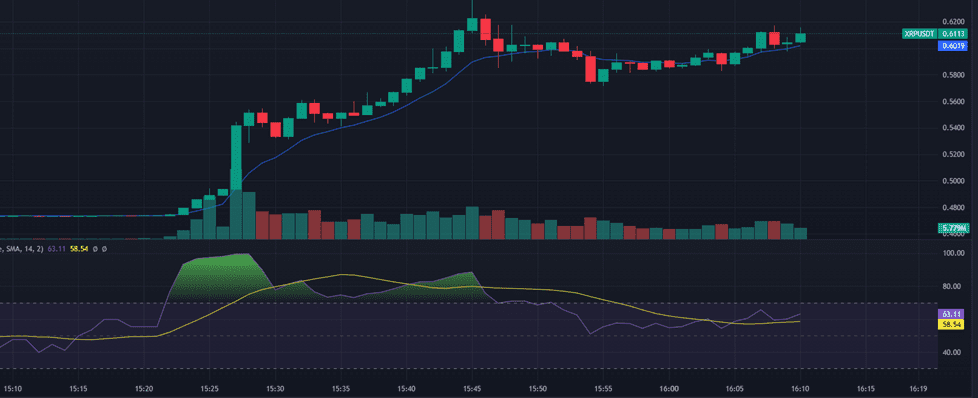

Immediately following the news, XRP exploded in value, increasing over 25% from $0.47 to over $0.60.

Implications of the News

Juge Torres’ ruling has huge bullish implications for the market. Firstly, XRP avoiding a security classification deals a huge blow to the credibility of the Securities and Exchange Commission (SEC), which has been on a war path in recent months, hellbent on completely eradicating crypto from the US.

The approximately 63 cryptocurrencies that SEC chair Gary Gensler and his goons have labeled as securities could now be in the clear. The SEC’s ongoing lawsuit against Coinbase could also be in shambles.

Altcoins have already started pumping following Judge Torres’ ruling because of the potential to be deemed commodities. If XRP isn’t a security, many other cryptocurrencies aren’t as well. While the ruling doesn’t exclusively define XRP as a commodity, the case for it to become one is justified.

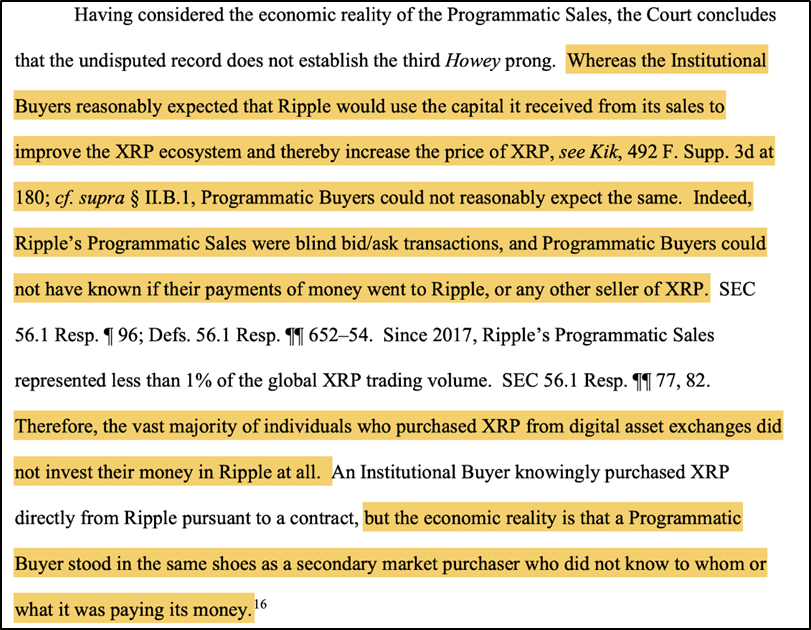

Secondly, this ruling brings into question the legitimacy and effectiveness of the over 70-year-old Howey Test, which determines an asset as a security if there is an investment of capital into a common enterprise with an expectation of profit derived from the efforts of others.

As assets evolve and break away from traditional regulatory definitions, as with cryptocurrency, this test may no longer be able to accurately categorize assets (as demonstrated by the Ripple case).

Torres’ ruling deems that no one purchasing XRP was ever investing money into a common enterprise, which would have been Ripple Labs in this context. By virtue of this finding, XRP fails on the second criterion of the Howey Test and cannot be considered a security as a security requires an investment of capital into a “common enterprise” defined as an incorporated entity.

Retail investors are gaining new avenues of acquiring equity and yield outside purchasing shares issued by a single company. The Howey Test dictates the status of returns within the stock market. It is completely irrelevant to the cryptocurrency market based on how the governance of tokens and coins evolves and decentralizes as their supplies are unlocked.

Is the SEC doomed?

This case marks the first time in history that the SEC has lost a lawsuit against a private cryptocurrency entity in the form of Ripple Labs. An inability to win a lawsuit against a company it claims partakes in the trading of unregistered securities (the core SEC operations) exposes a major turning point in the authoritative power of the SEC.

Congress has been losing faith in the ability of the SEC to appropriately regulate digital assets in the name of consumer protection, with clashes between the House Financial Services Committee (FSC) and Gensler highlighting government ill-will toward the SEC. The FSC also intends to reintroduce the “SEC Regulatory Accountability Act” to drastically reign in the organization’s power.

Recently, House representatives proposed an “SEC Stabilization Act” to restructure the SEC and remove Gensler as chair. The US Chamber of Commerce also filed an Ammicus Brief against the SEC during its initial suit against Coinbase, citing harm to US investors and a lack of transparency.

Furthermore, former director of the Commodities Futures Trading Commission (CFTC), Matthew Kulkin, holds that most cryptocurrencies, upwards of 70%, are, in fact, commodities and contends that the CFTC should be granted authority over regulating digital asset markets and not the SEC; this XRP case affirms this.

These sentiments of US policymakers and financial regulatory bodies, coupled with Ripple’s win, all point to one possibility: the disbanding or drastic reshaping of the SEC.

Conclusion

By determining that XRP is not a security, Judge Torres’ ruling challenges the SEC’s aggressive stance in its attempts to regulate and potentially eradicate cryptocurrencies from the US market.

The decision also casts doubt on the effectiveness and relevance of the longstanding Howey Test, which has been used for over a century to classify assets as securities. This case highlights the need for a more adaptable regulatory framework to categorize and oversee digital assets accurately.

The outcome of this lawsuit marks a historic moment as it undermines the SEC’s authoritative power and exposes a turning point in its ability to enforce regulations within the crypto industry.

XRP beating the SEC also catalyzes a broader discussion on regulatory frameworks, consumer protection, and the evolving nature of cryptocurrencies within the United States. Following this news, the bears could be coming out of hibernation.