- Canary Capital’s Form 8-A filing with the SEC marks the final regulatory step before the first-ever U.S. XRP spot ETF launches on Nasdaq, potentially unlocking a wave of institutional money into XRP.

- Ripple, under Brad Garlinghouse, is aggressively positioning itself as a major financial player, spending nearly $4 billion on acquisitions in 2025 and launching “Ripple Prime” to bridge traditional finance and digital assets with XRP at the core.

- Big banks like Citi and JPMorgan are rolling out their own blockchain-based services, while institutions pour billions into spot Bitcoin ETFs, signaling that regulated crypto products like an XRP ETF are moving into the financial mainstream.

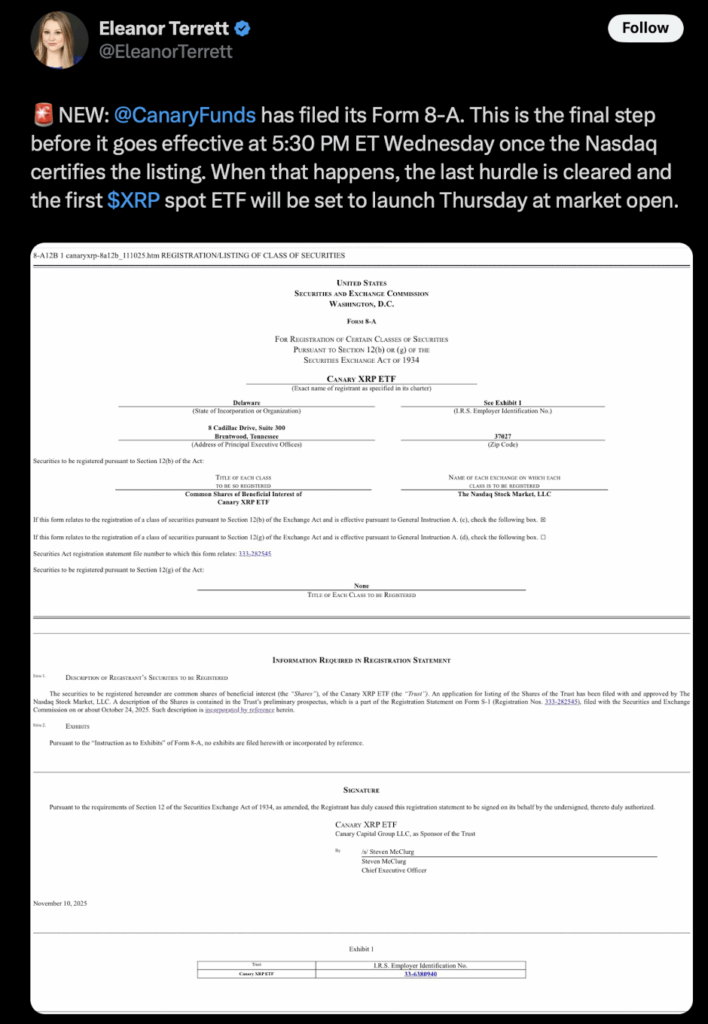

Canary Capital has quietly stepped into crypto history. The firm has filed Form 8-A with the U.S. Securities and Exchange Commission (SEC), which is basically the final box to tick before the first-ever spot XRP ETF can go live in the United States. It’s the kind of dry regulatory step that doesn’t look exciting on paper, but in practice, it’s the moment where paperwork turns into an actual tradable product.

Once Nasdaq signs off on the listing at around 5:30 p.m. ET on Wednesday, the fund is set to “go live” and be fully activated. That means trading is expected to kick off with the opening bell on Thursday, putting XRP right alongside traditional assets on one of the world’s biggest stock exchanges. Crypto reporter Eleanor Terrett has confirmed that this SEC filing is essentially the last stage before approval, which is why so many eyes are locked on this timeline. For a lot of observers, this feels just as big as the original launch moment for Bitcoin and Ethereum spot ETFs — a new door being opened for another major crypto asset.

XRP steps into the ETF big leagues

Within the crypto community, expectations are already running hot. Many believe a spot XRP ETF could unlock a new wave of institutional capital, especially from firms that are constrained by their mandates and can’t touch unregistered crypto directly on exchanges. An ETF wraps XRP in a familiar, regulated structure, making it easier for pension funds, asset managers, and conservative institutions to gain exposure without dealing with wallets, custody, or on-chain risk themselves.

At the same time, some voices in the space are warning that this doesn’t just bring “free money” — it also brings a new layer of scrutiny. Once XRP exists in ETF form and trades on mainstream venues, it steps deeper into the world of big-boy compliance, risk controls, and regulatory supervision. It’s no longer just a digital asset floating around on crypto exchanges. It’s now sitting on the same shelf as heavyweight financial products, shoulder to shoulder with blue-chip equities and other ETFs. That’s a big step up, and not all of it is comfy.

Garlinghouse wants XRP at the heart of global finance

While the ETF hype churns, Ripple itself is clearly not content with being “just a blockchain company.” CEO Brad Garlinghouse laid out a much bigger ambition in a recent CNBC interview, saying Ripple has evolved into a serious financial-sector player, not just a tech startup tinkering with ledgers. And the numbers back up that talk. The company has spent close to $4 billion on acquisitions in 2025 alone, which is not exactly small change.

This year, Ripple has already completed two major deals. In April, it poured about $1.3 billion into acquiring prime brokerage firm Hidden Road, bolstering its institutional-facing infrastructure. More recently, Ripple shelled out over $1 billion to acquire GTreasury Software, a company that specializes in corporate treasury solutions. These moves are clearly geared toward embedding Ripple deeper into the existing financial plumbing rather than staying on the fringes of “crypto-only” services.

On top of that, Ripple has rolled out “Ripple Prime” — an over-the-counter spot service tailored for U.S. institutions that want to trade multiple tokens in size, without slippage wrecking their orders. After a $500 million investment, Ripple’s current market value has climbed to roughly $40 billion. Garlinghouse describes the company’s mission as filling the gap between digital assets and traditional banking, using blockchain to streamline cross-border payments and make global settlement faster and cheaper. In his vision, XRP becomes the connective tissue for international transactions, the underlying rail instead of just another speculative coin.

Banks are racing to catch up on blockchain

Interestingly, Ripple isn’t moving in isolation. Traditional giants are waking up fast. Mainstream banks like Bank of America, Citigroup, and JPMorgan are all accelerating their digital asset strategies, each in slightly different ways. Citi is reportedly working toward launching a full-blown crypto custody solution by 2026, aiming to hold digital assets for clients much like it does with stocks and bonds. JPMorgan, meanwhile, has already rolled out a “deposit token” on Base, Coinbase’s Layer 2 network, blending familiar banking instruments with blockchain rails.

Institutional investors have been warming up all year too. Since the beginning of 2024, billions of dollars have flowed into spot Bitcoin ETFs, signaling that large firms are increasingly comfortable with regulated crypto exposure, as long as the structure feels familiar and the oversight boxes are checked. That same mentality is now poised to spill over into Ethereum, XRP, and potentially other assets as the ETF pipeline grows.

Regulators, for their part, have begun to loosen some of the tighter screws, particularly under the current Trump administration, with both the SEC and CFTC taking a more open stance toward structured digital asset products. This doesn’t mean “no rules,” but it does mean the door is a lot more open than it was a few years ago.

Put together, the picture is pretty clear: the XRP ETF isn’t just another ticker being added to Nasdaq. It’s part of a much larger shift, where crypto is getting wired directly into the traditional financial system, and XRP is trying very hard to be right at the center of that transformation.