- XRP is stuck at $2.90 resistance but could rally 18% to $3.41 by late November.

- Changelly predicts XRP won’t cross $3.50 until March 2027, though rate cuts and ETFs may speed things up.

- A Fed rate cut and potential XRP ETF approval are the biggest bullish drivers to watch.

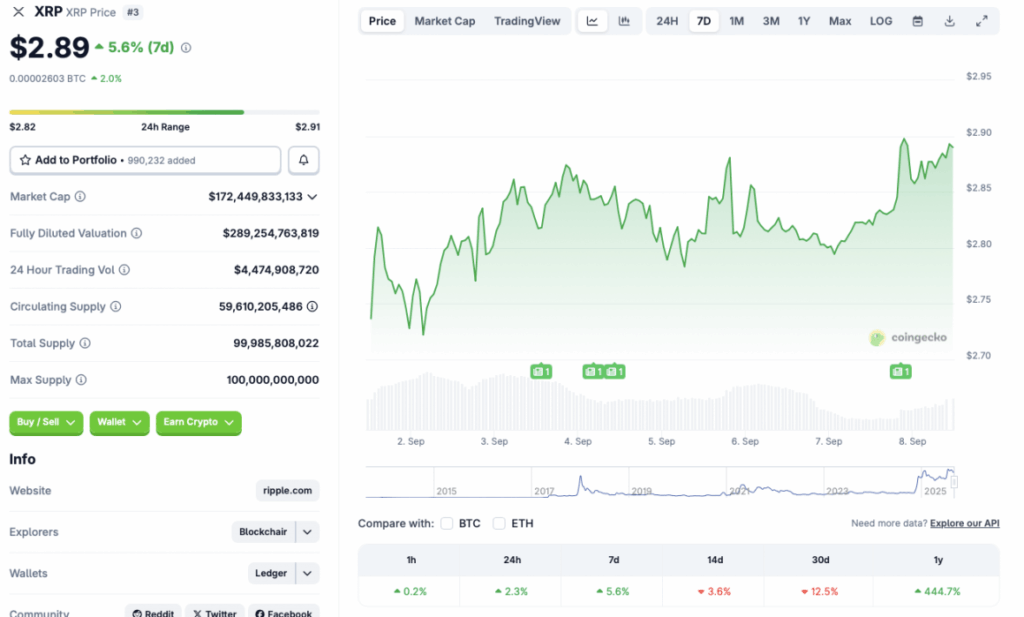

Ripple’s XRP token is dancing around a tough resistance level at $2.90, and traders are watching closely to see if it can finally break free. According to CoinGecko, XRP has climbed 2.3% in the past 24 hours and gained 5.6% over the last week. But it hasn’t been all smooth sailing—on the 14-day chart, the coin has slipped 3.6%, and over the past month it’s down more than 12%. So the big question now is this: can XRP reclaim $3.50 if it clears that stubborn wall at $2.90?

XRP Price Prediction: The Road to $3.50

Analysts over at CoinCodex expect XRP to hover between $2.80 and $3.20 in the coming weeks. Their forecast points to a possible rally up to $3.41 by November 26, which would be an 18% jump from current levels. Still, that leaves XRP just short of the coveted $3.50 mark.

Changelly, on the other hand, paints a more cautious picture. Their models suggest XRP might not breach $3.50 until March 2027—about six months from now. That’s a long wait for investors hoping for a faster breakout.

Can ETFs Push XRP Higher?

There are two key catalysts that could change the game. First, the Federal Reserve is widely expected to cut interest rates by 25 basis points in September. Rate cuts usually drive investors toward riskier assets, and crypto markets could thrive in that environment. XRP, being one of the top players, stands to benefit if the Fed does indeed take a dovish turn.

Second, the possibility of a spot XRP ETF approval this year looms large. If approved, it could attract a wave of institutional money—the same type of capital that helped Bitcoin and Ethereum reach record highs in 2025. A similar surge could easily push XRP beyond $3.50 sooner than many expect.