- Ripple moved 200M XRP ($606M) to an unknown wallet, outside its usual unlock schedule, sparking speculation about whether it’s tied to institutional settlement, ODL operations, or potential selling pressure.

- XRP is struggling near $3 support, currently trading at $3.06; it sits just above the 50-day SMA ($2.95), while the longer-term 200-day SMA at $1.93 shows broader structure remains intact.

- Traders are split — the transfer could hint at institutional demand ahead of ETF news or trigger fresh selling pressure, with RSI neutral at 51 suggesting a wait-and-see market stance.

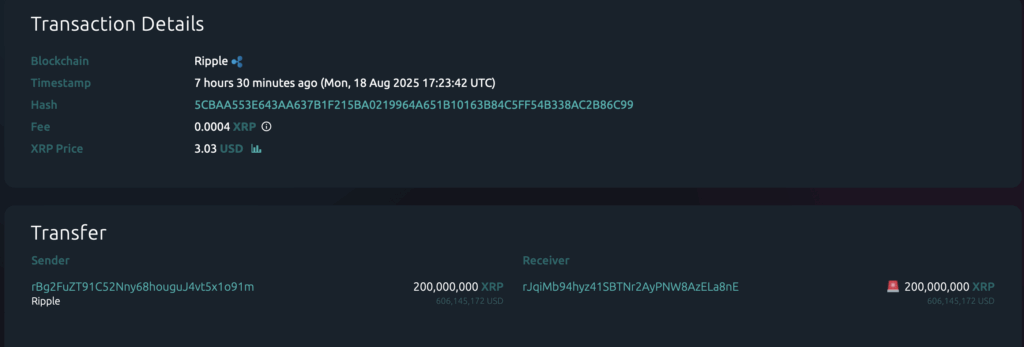

Ripple just moved 200 million XRP — worth about $606 million — into an unknown wallet, and the transfer has already set off a storm of speculation. What’s unusual here is that it didn’t line up with Ripple’s standard monthly unlock schedule, making traders even more curious about what’s going on.

Strategic Move or Selling Signal?

Some analysts think the transfer might be tied to Ripple’s On-Demand Liquidity network or maybe institutional settlements happening behind the curtain. Others aren’t so optimistic — they see it as a possible setup for selling pressure, something Ripple has been accused of before with its large reserves. Either way, it has left the market divided.

XRP Struggles Around $3

Meanwhile, XRP itself hasn’t been looking particularly strong. The coin dipped under $3 before bouncing slightly, now sitting at $3.06. It’s down 0.5% today and over 4% this past week. The 50-day moving average at $2.95 is now acting as the critical short-term support. If that breaks, traders warn momentum could slip further, even though the 200-day moving average at $1.93 shows longer-term structure is still intact.

What Comes Next for Traders

Right now, the real debate is whether Ripple’s massive move signals growing institutional demand — maybe even tied to possible ETF developments — or if it risks triggering another sell-off cycle. With RSI hovering neutral at 51, the market is in wait-and-see mode, but eyes remain glued to Ripple’s next steps.