- Ripple and the SEC have officially ended their nearly five-year legal battle by jointly dismissing all remaining appeals, bringing final clarity to XRP’s status in this case.

- The outcome reinforces that XRP programmatic sales on exchanges are not considered securities transactions under U.S. securities law.

- With the lawsuit behind it and $500M raised at a $40B valuation, Ripple is now focused on growth, payments innovation, and expanding real-world adoption of XRP and its RLUSD stablecoin.

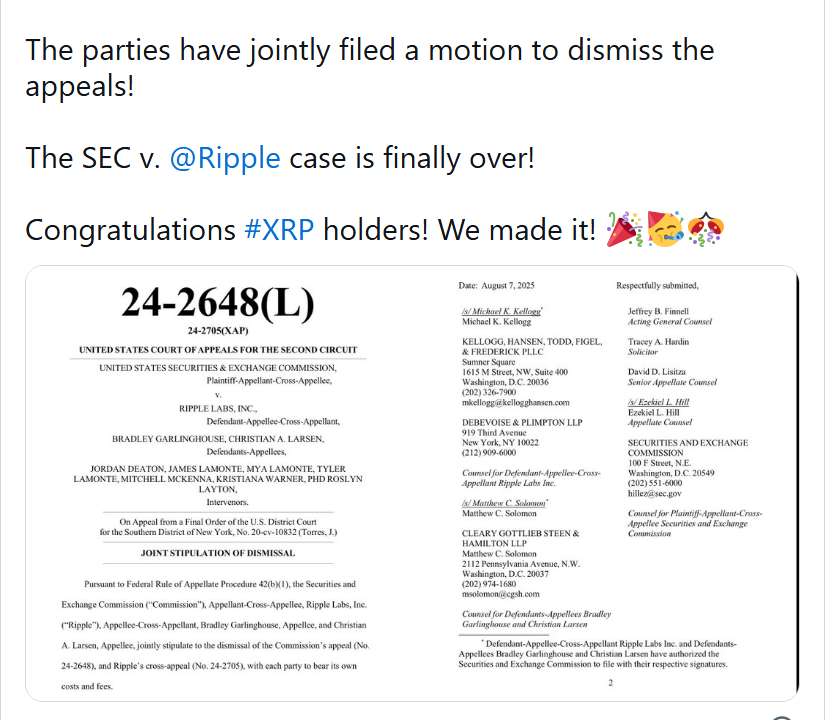

After years of back-and-forth filings, hearings, and headlines, Ripple Labs and the U.S. Securities and Exchange Commission have officially closed the book on their legal war. Both sides filed a Joint Stipulation of Dismissal with the U.S. Court of Appeals for the Second Circuit, agreeing to withdraw all remaining appeals and eat their own legal costs. That move formally ends a dispute that kicked off back in 2020 and has been hanging over XRP and the broader crypto market ever since.

The original case centered on the SEC’s claim that Ripple conducted an unregistered securities offering through its sales of XRP. The uncertainty around whether XRP was a security hit liquidity, scared off some exchanges, and weighed on sentiment for years. This joint dismissal doesn’t erase that history, but it does give the industry something it hasn’t had in a long time around XRP: finality.

What the final outcome really says about XRP

One of the most important takeaways from the case is the reinforcement of a key legal finding: programmatic sales of XRP on exchanges are not considered securities transactions. That means typical secondary-market trading of XRP does not fall under U.S. securities laws in the way the SEC initially argued. It’s not a blanket free pass for every type of XRP sale, but it’s a huge step in clarifying how at least one major token is treated under U.S. law.

Ripple’s leadership, including CEO Brad Garlinghouse and executive chairman Chris Larsen, has consistently maintained that they operated transparently and that XRP shouldn’t be classified as a security. With the appeals now dismissed, they finally get to move on from defending past actions to doubling down on building future products. For the wider crypto sector, this case will likely continue to be cited in future debates around digital asset classification and token sale structures.

From courtroom to capital: Ripple’s growth pivot

With the legal cloud finally cleared, Ripple is repositioning itself as a growth-story rather than a courtroom drama. The company recently raised $500 million in new funding, pushing its valuation to around $40 billion. Big-name backers like Fortress Investment Group, Citadel Securities, Pantera Capital, and Galaxy Digital participated, signaling that major institutional players are still willing to bet heavily on Ripple’s future.

At the same time, Ripple is leaning into real-world financial infrastructure plays. The company has teamed up with Mastercard, Gemini, and WebBank to pilot a credit card settlement system powered by its RLUSD stablecoin on the XRP Ledger. The goal is straightforward but ambitious: faster, cheaper, and more efficient cross-border settlements that improve on traditional rails. If these pilots scale, they could turn Ripple’s tech into embedded infrastructure behind everyday financial transactions.

XRP’s future: now it’s all about adoption

For XRP holders, the end of the SEC fight is basically a psychological and structural reset. The token is no longer defined by “the lawsuit” narrative; now its trajectory will depend on whether Ripple can drive real adoption of its blockchain products and payment solutions. That means enterprise deals, financial institution integrations, and actual transaction volume on the XRP Ledger matter more than ever.

The legal overhang being gone also gives Ripple more room to repair its brand and rebuild trust with institutions and retail investors who sat on the sidelines during the case. If Ripple can keep executing on partnerships, expand the RLUSD stablecoin ecosystem, and position the XRP Ledger as core infrastructure in global payments, XRP could be one of the clearer regulatory stories in a still-messy U.S. crypto landscape. From here on out, it’s less about judges and more about execution.