- Markets assign an 80–95% chance of a September 2025 Fed rate cut.

- Inflation is cooling, unemployment is rising slightly, and GDP growth is slowing.

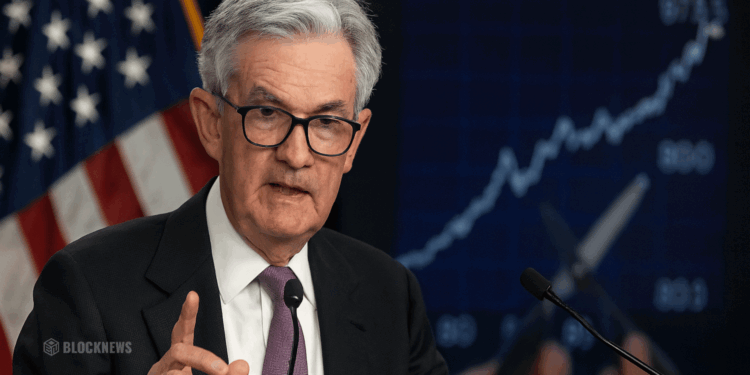

- Powell stresses a cautious, data-driven approach but has left the door wide open for cuts.

The financial world is watching closely as the Federal Reserve gears up for its September 16–17 meeting. Market tools like the CME FedWatch now put the odds of a 25 basis-point cut at more than 80%, with some analysts raising the range to as high as 95%. After over a year of rate reductions since the 2023 peak of 5.5%, the current target stands at 4.25%–4.50%. With inflation cooling and unemployment ticking slightly higher, markets are betting heavily that Chair Jerome Powell and the FOMC will act again.

Economic Data Supports Looser Policy

Inflation has eased to 2.7% in July 2025, down from the dangerous highs of 2022 but still above the Fed’s 2% target. Core inflation remains stickier at 3.1%, yet the overall trend shows steady improvement. Meanwhile, the jobs market has softened: unemployment reached 4.2% and payroll growth slowed to 114,000 new jobs in July. Combined with forecasts of slowing GDP growth into 2026, these data points give the Fed more room to cut rates without stoking fears of runaway inflation.

Powell’s Balancing Act

Jerome Powell has been consistent in stressing a “data-dependent” approach. At the July 2025 meeting, he emphasized progress on inflation while warning that risks remain. His upcoming appearance at Jackson Hole is expected to give further hints on policy direction. Powell has pushed back against expectations of rapid and aggressive cuts, instead signaling gradual moves—likely 25 bps at a time—while remaining open to stronger action if economic weakness accelerates.

What It Means for Consumers, Businesses, and Investors

If the Fed cuts rates, consumers could see lower borrowing costs on mortgages, car loans, and credit cards. Businesses would benefit from cheaper financing, potentially boosting investment and hiring. For investors, lower rates often fuel rallies in stocks and crypto while pressuring the U.S. dollar and bond yields. On the flip side, if inflation flares back up, the Fed may slow its pace of easing—something traders remain wary of.