- Public firms like Upexi and DeFi Development now hold millions of SOL in their treasuries.

- Unlike Bitcoin, Solana’s staking rewards turn reserves into revenue streams.

- Partnerships with R3 and Big Tech point to Solana becoming core financial infrastructure.

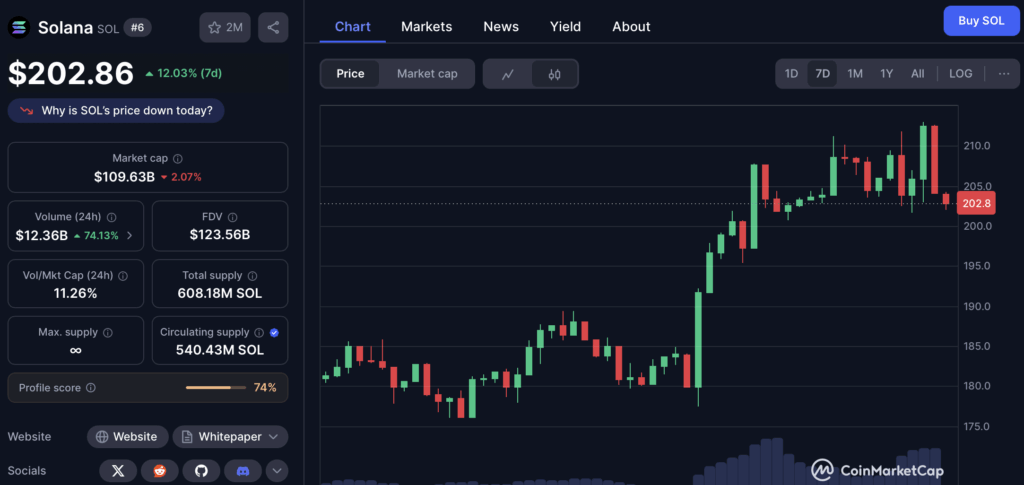

Forget guessing which of the tech giants will be first to buy crypto. The story’s already unfolding with a very different cast of players—and they’re not stacking Bitcoin, they’re stacking Solana. A handful of publicly traded companies are openly building treasuries in SOL, not just holding it, but staking it for yield. It’s a move that’s slowly redefining what a corporate balance sheet can actually do.

The Early Movers: Upexi, DeFi Development, and Friends

Public filings tell the tale. Upexi, Inc. (UPXI), a consumer goods company, has gone deep, buying 1.9 million SOL with equity and convertible notes, then staking nearly all of it at around 8%. They estimate the position could pump out $26M a year in staking rewards at today’s prices. DeFi Development Corp. (DFDV) isn’t far behind with 1.18 million SOL—and they’re even running their own validators, plugging directly into the network. Toronto’s SOL Strategies Inc. (HODL) is holding close to 400K SOL, while Torrent Capital Ltd. (TORR) built up over 40K. Even an ed-tech play, Classover Holdings (KIDZ), is trying to raise $500M to start its own Solana treasury. Together? More than 3.5 million SOL is now on corporate books.

Why Solana, Not Bitcoin? It’s All About Yield

Bitcoin is digital gold—it sits in a wallet and waits. Solana, by design, pays you for showing up. Its Proof-of-Stake system lets holders secure the network and collect rewards. That’s why these companies are piling in. Instead of idle cash reserves, they’ve turned treasuries into income engines. For CFOs, that’s a double play: the SOL itself could appreciate, and at the same time, it spits out yield every year. In an inflationary world, it’s an attractive hedge.

Big Tech’s Role: Plumbing, Not Staking—Yet

Don’t expect Amazon, Google, or Microsoft to suddenly admit they’re hoarding SOL. Their strategy is subtler. Google Cloud runs its own validator and hooked Solana into BigQuery for easier on-chain data access. AWS makes spinning up Solana nodes push-button simple. Right now, the giants are building the plumbing, but if they ever move from providing tools to actually holding SOL, the game changes.

Red Tape and Old Wounds

Of course, this corporate shift isn’t without headaches. The SEC has in the past called SOL a security, a label that keeps big U.S. firms skittish. Accounting rules add another wrinkle: new FASB standards force companies to mark crypto to market every quarter, so Solana’s price swings would show up in earnings reports. And no one has forgotten Solana’s rocky past—network outages in 2022 raised real doubts. But since early 2024 the chain’s been stable, and with the Firedancer client in the pipeline, resilience looks better. The fact that public companies are now comfortable staking treasuries on it shows confidence that those risks are fading.

Solana as the New Financial Rail

This isn’t just about staking rewards. A deal with enterprise blockchain firm R3 will connect its private Corda platform—already used by HSBC and Bank of America—directly to Solana. That means regulated, real-world assets could eventually flow onto the public chain, a shift worth trillions. The companies grabbing SOL today are placing bets on more than price action; they’re betting that treasuries should be active, not passive, in the digital economy. For anyone watching closely, this isn’t a side note. It’s a flashing sign of where corporate finance might be heading next.