- Portugal blocked Polymarket after election bets surged ahead of official results.

- The move appears driven more by narrative control than by gambling concerns.

- Prediction markets unsettle institutions because they reveal sentiment faster than official channels.

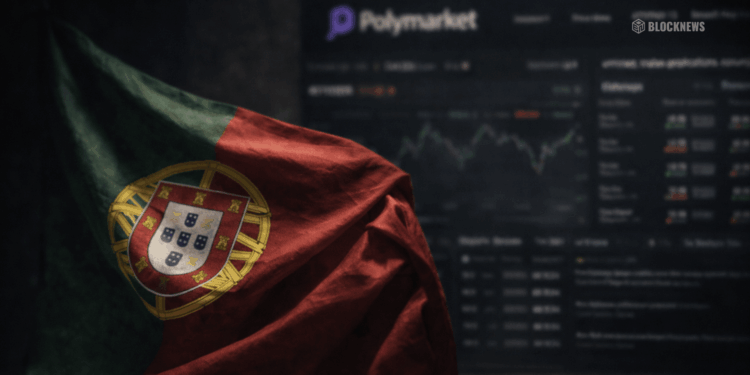

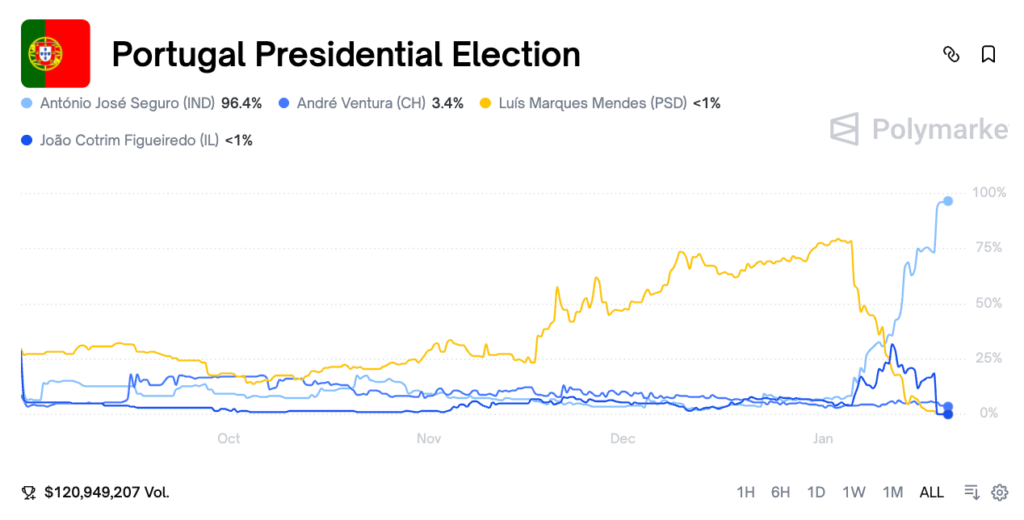

Portugal’s regulator moved quickly to block access to Polymarket after a sudden surge of money flowed into election contracts just before official results were announced. On the surface, the explanation was straightforward: unlicensed gambling and a national ban on political betting. But the timing tells a more complicated story. When millions suddenly cluster around one outcome, it highlights how thin the information barrier really is — and that’s what tends to make institutions uneasy.

Markets Don’t Leak Information, They Aggregate It

Authorities floated concerns about leaked exit polls or access to non-public data. That’s possible, but it’s not the only explanation. Prediction markets are designed to absorb thousands of small signals at once — conversations, turnout cues, local chatter, quiet shifts in sentiment — and turn them into a price. If insiders were leaking sensitive data, that points to weaknesses in election safeguards, not proof that prediction markets themselves are doing something wrong.

Blocking Access Doesn’t Solve the Problem

Network-level blocking feels like punishing the messenger. Prediction markets don’t create outcomes, they surface expectations. Shutting them down doesn’t protect democracy, it protects appearances. Even more concerning is the warning that users might not be able to retrieve funds after access is blocked. That kind of regulatory whiplash doesn’t look like consumer protection, it looks reactive and uncertain.

This Isn’t Just a Portugal Story

Portugal isn’t alone here. Similar scrutiny has appeared across France, Germany, Hungary, and even parts of the United States. The pattern is familiar. When a market produces signals faster than institutions can respond, enforcement suddenly accelerates. It’s hard not to notice how often regulation tightens precisely when prediction markets make officials look outpaced.

Why This Makes Regulators Nervous

Prediction markets are blunt, sometimes messy, and often uncomfortable. That’s their strength. They surface collective belief in real time, without waiting for press conferences or official confirmation. Portugal’s move suggests a deeper fear — not of betting, but of information escaping traditional channels. If democratic systems can’t tolerate transparent signals about public expectation, the issue isn’t the market. It’s confidence in the system watching it.