- Polymarket odds for BTC ending 2025 at only $80K have climbed to 40%, showing rising caution.

- Probabilities for $95K and $100K have fallen to 61% and 32%, reflecting tempered expectations.

- Traders appear to be shifting focus toward 2026 for stronger upside potential.

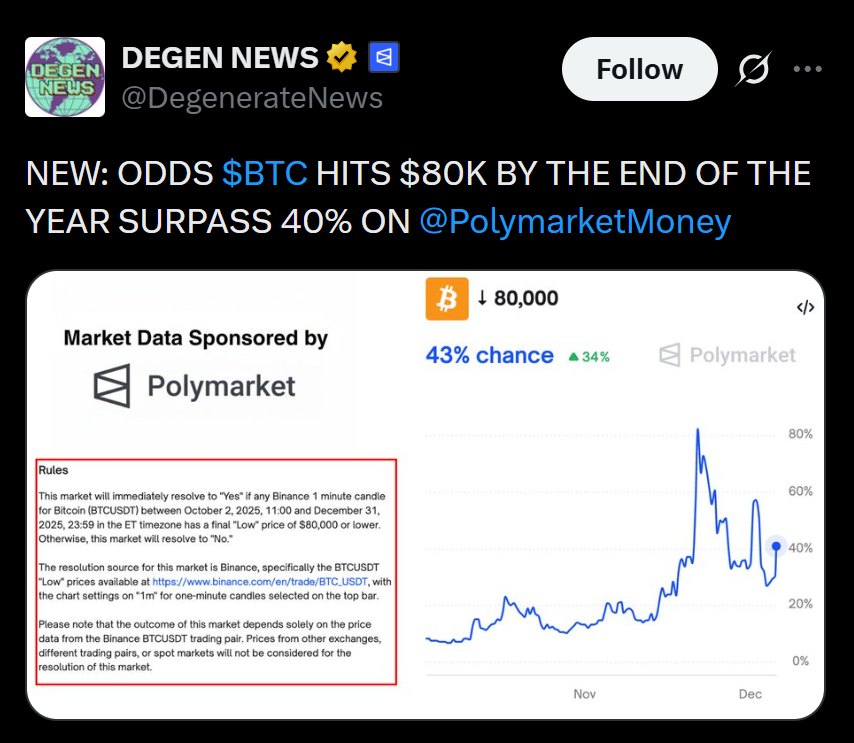

Polymarket traders are growing more skeptical about Bitcoin’s ability to push higher before 2025 closes out. Odds for BTC ending the year at only $80,000 have climbed to 40%, which is a noticeable jump from earlier weeks when traders were far more optimistic. The shift suggests that sentiment is cooling fast, with expectations softening around Bitcoin’s ability to reclaim its momentum after recent choppy price action.

Polymarket’s Real-Time Odds Paint a Different Picture

Polymarket functions as one of the largest global prediction markets, letting users place bets on future events — including crypto milestones — with live odds adjusting in real time. Bitcoin markets on the platform track probabilities for major price levels such as $80,000, $95,000, and even $100,000 before December 31, 2025. As traders recalibrate their expectations, these odds have become a kind of sentiment barometer, showing how confidence rises or fades depending on BTC’s daily swings.

BTC Targets Fall as Traders Reassess the Road Ahead

With only weeks left in the year, traders seem less convinced that Bitcoin can mount a strong breakout. Odds for BTC hitting $95,000 have slipped to 61%, while the chances of a $100,000 finish sit at a modest 32%. That number was far higher earlier this year but has gradually faded as volatility, macro noise, and liquidity concerns weigh on conviction. It’s not outright bearishness — but it shows a market that’s bracing for a quieter close.

What This Means for Bitcoin Going Into 2026

The shifting probabilities also suggest that traders may now be looking beyond the year-end and toward 2026, where many analysts still expect a larger cycle peak. For the moment, Polymarket odds simply reflect a market digesting recent turbulence and tempering its expectations. Whether BTC surprises to the upside — or stalls into the new year — will depend heavily on liquidity conditions, ETF flows, and how quickly sentiment can snap back.