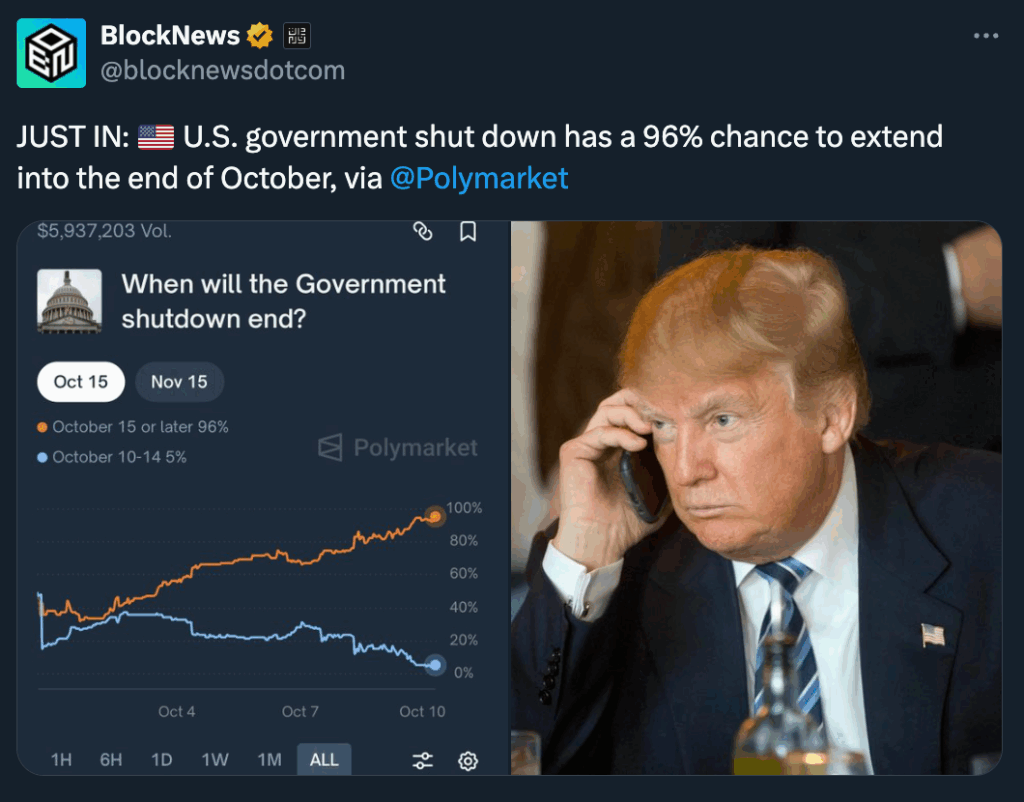

- Prediction markets, led by Polymarket, now price a 96 % chance that the U.S. shutdown will stretch into late October.

- Odds for a resolution before mid-October have collapsed, reflecting sharp political deadlock in Congress.

- The market signal is rattling investors and adding urgency to stalled negotiations in Washington.

Traders on Polymarket have dramatically increased the probability that the current government shutdown will last into the end of October. Recent data show that contracts tied to a resolution date in late October now command odds as high as 96 % (via Polymarket reporting). This shift marks a sharp departure from earlier estimates that favored an earlier reopening.

The market is treating any resolution before October 15 as increasingly unlikely. The implied odds of a mid-October end have reversed direction entirely, with participants leaning hard into a protracted stalemate.

Political Gridlock and Market Ripples

The dramatic odds shift reflects deep divisions in Congress. The Senate remains unable to pass a funding bill, and partisan demands over healthcare subsidies and spending priorities have hardened. Neither side appears confident about ceding ground, and the window for compromise is narrowing.

Markets beyond Polymarket are reacting too. Observers warn that delayed resolution could ripple into U.S. credit markets, federal borrowing costs, and investor sentiment — especially if key economic data (jobs, inflation) get postponed due to agency shutdowns.

If the shutdown drags on, the political and economic cost will mount — and right now, the market thinks October is just the beginning