- Polygon PoS now leads the RWA space with $1.13B TVL, controlling 62% of tokenized global bonds.

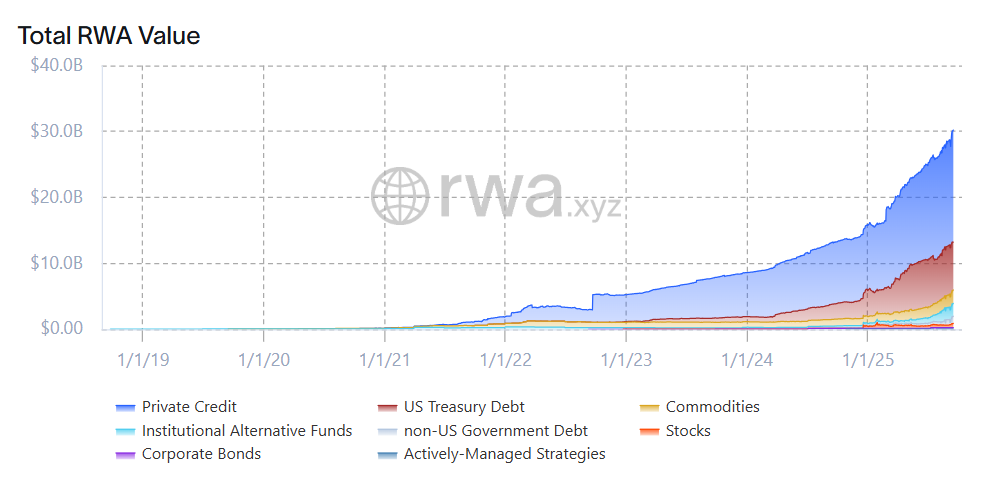

- The RWA market has grown 224% since early 2024, with capital shifting from Treasuries into higher-yield assets like private credit and bonds.

- Competition is rising (e.g., Solana $500M RWA value), but Polygon remains the standout, driving real adoption and liquidity in tokenized assets.

Polygon is making serious noise in the Real World Asset (RWA) space. A fresh report from Dune and RWA.xyz (Sept. 17) shows the Polygon PoS chain holding over $1.13 billion in RWA total value locked (TVL), spread across 269 assets. That puts Polygon right at the front of the tokenization race.This comes not long after Polygon rolled out its big “Rio” upgrade on the Amoy testnet, aimed at scaling the network for future demand. The timing lines up with the RWA Summit happening in New York, keeping tokenization as one of the hottest topics in crypto right now.

Polygon co-founder Sandeep Nailwal flagged the numbers on X, pointing out how wide the RWA adoption has spread across the chain

Insights From the 2025 RWA Report

The new joint report takes a deep dive into how fast the tokenization sector is growing. Some highlights:

- Tokenized Treasuries opened the door. The early wave of U.S. Treasuries proved the concept, bringing credibility and a first product-market fit.

- Capital chasing yield. Investors are now leaning into higher-return assets like private credit and bonds, showing a willingness to move up the risk curve.

- Integration with DeFi. RWAs aren’t just sitting idle. They’re being plugged into lending markets and other protocols, turning into programmable money blocks that can fuel more complex financial systems.

So yeah, RWAs aren’t just experiments anymore—they’re starting to act like real infrastructure.

Polygon’s Edge (and Rivals)

The report makes it clear: Polygon’s big strength lies in global bonds. With 62% market share there, it’s way ahead of Ethereum, which despite leading in total RWA activity, only holds around 5% in this specific niche.

Competition’s not sleeping, though. Solana has been pushing hard in the same direction, hitting around $500M in RWA value earlier this month. And on the U.S. Treasury side, Polygon also claims a solid 29% share of Spiko’s U.S. T-Bill token (USTBL).

It’s all part of the larger trend: traditional finance is inching closer to blockchain rails. Nasdaq, for example, recently filed with the SEC to set up trading for tokenized securities.

The Bigger Picture

Polygon’s Global Head of RWA, Aishwary Gupta, summed it up in the report: this isn’t just about pilots anymore. The industry is shipping real products, unlocking liquidity, and showing how on-chain transparency can actually work in traditional markets.

If the numbers keep stacking like this, Polygon’s role in RWAs could end up defining the next wave of adoption—bridging DeFi speed with TradFi trust.