- PIPPIN surged to $0.7593 while Bitcoin fell back to $68,000

- Open interest climbed to $290M with longs dominating positioning

- The rally lacks major fundamental catalysts, raising correction risks

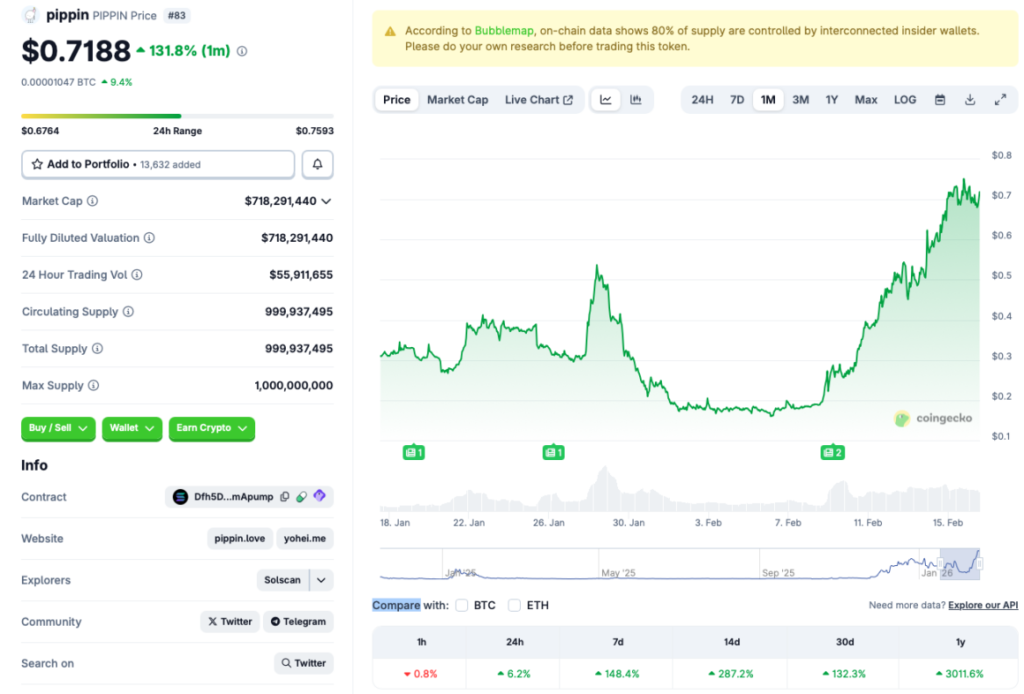

While Bitcoin briefly reclaimed $70,000 before sliding back to the $68,000 range, Pippin (PIPPIN) moved in the opposite direction. The AI agent token climbed to a new all-time high of $0.7593 on Feb. 15, 2026. According to CoinGecko, the token is up 6.2% in the last 24 hours, 148% over the last week, and more than 3,000% since February 2025.

That kind of performance stands out, especially in a market where most major assets are still nursing deep drawdowns. When smaller tokens rally while Bitcoin struggles, it usually signals aggressive speculative positioning rather than broad market strength.

Open Interest Is Fueling the Move

One of the biggest drivers behind PIPPIN’s surge appears to be derivatives activity. CoinGlass data shows open interest climbing to roughly $290 million. At the same time, the long-short ratio remains above one, meaning traders are leaning bullish and expecting further upside.

That combination can create a feedback loop. More longs push price higher, which attracts more momentum traders, which pushes price higher again. But that same structure can unwind quickly if sentiment shifts.

We’ve seen this movie before.

The December Parallel Shouldn’t Be Ignored

Pippin also hit a previous all-time high in December 2025, during another fragile market environment. That rally was controversial, with some observers questioning whether the move was fueled by organic demand or more coordinated speculative activity.

The current surge looks similar in one key way: it’s happening without a clear fundamental catalyst. There have been no major development announcements, no breakthrough integrations, and no ecosystem expansion headlines driving the move.

When price outruns narrative, volatility tends to follow.

Macro Conditions Still Favor Caution

Broader market conditions remain risk-sensitive. Investors are still cautious, with many shifting toward gold and silver as defensive plays. Liquidity conditions are tight, and Bitcoin’s inability to hold above $70,000 shows that confidence isn’t fully restored.

In that environment, high-beta tokens like PIPPIN can rally fast, but they can also correct even faster.

Conclusion

Pippin’s rally is undeniably strong, and open interest suggests traders are betting on further upside. But without clear fundamental drivers, the move looks heavily momentum-driven. If Bitcoin stabilizes and sentiment improves, PIPPIN could extend gains. If broader risk appetite fades again, a sharp correction would not be surprising.

For now, this looks less like structural adoption and more like leveraged enthusiasm.