- Peter Brandt criticized XRP supporters, calling them overly optimistic despite long drawdowns

- XRP community members pushed back, citing adoption, regulation, and shifting sentiment

- The debate reflects a deeper clash between technical trading models and utility-driven theses

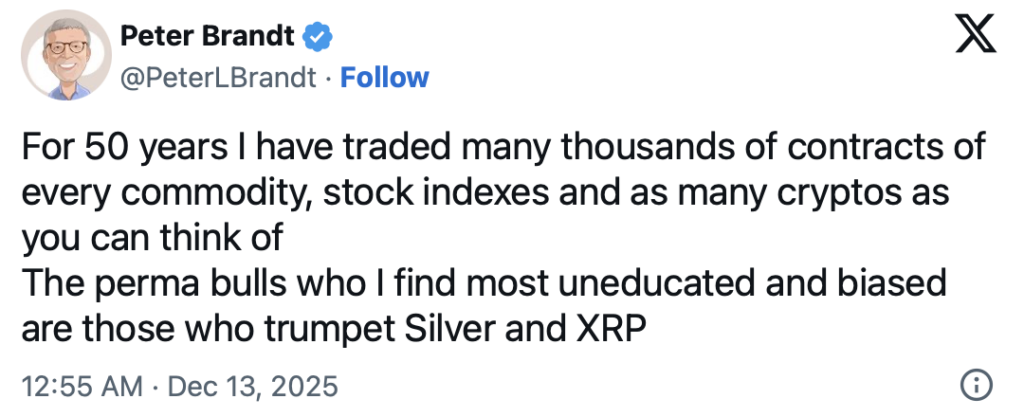

Veteran trader Peter Brandt has once again stirred discussion across the crypto space, this time by taking aim at XRP supporters. With more than five decades of experience across commodities, equities, futures, and digital assets, Brandt argued that XRP backers show a level of conviction he typically associates with what he calls poorly informed “perma bulls.” The comment landed hard and fast, reopening a long-running divide between classical technical traders and XRP’s adoption-focused community.

Brandt framed his critique as behavioral rather than personal. From his perspective, some investor groups stay relentlessly optimistic regardless of extended drawdowns, shifting macro conditions, or repeated technical breakdowns. He placed XRP supporters in the same category as long-term silver investors, suggesting both groups tend to hold firm even during long stretches of underperformance, almost on principle.

Pushback From the XRP Community

The response from the XRP community was immediate. Analyst Zach Rector pointed to signs that sentiment around XRP is evolving, even among former skeptics. He highlighted a recent comment from YoungHoon Kim, a well-known Bitcoin maximalist, who revealed on December 12 that he had begun accumulating XRP. Given Kim’s historically hardline stance against altcoins, that move raised eyebrows.

Others took a more measured approach. Market commentator X Finance Bull acknowledged Brandt’s long trading career but questioned whether traditional chart-based analysis fully captures XRP’s current setup. In his view, XRP’s valuation may increasingly hinge on regulatory clarity, institutional involvement, and its role in cross-border payment systems, not just near-term price structures.

Altcoin Buzz echoed a similar sentiment, arguing that many XRP holders aren’t overly concerned with short-term volatility. Instead, they’re focused on long-range utility and infrastructure growth. From that angle, Brandt’s criticism reflects a difference in investment philosophy rather than a definitive verdict on XRP’s future.

A Familiar Dispute With Deep Roots

Brandt’s skepticism toward XRP isn’t new. Over the years, he has repeatedly questioned its valuation and, at times, projected continued weakness against Bitcoin. XRP supporters often counter by pointing out moments when those forecasts didn’t play out as expected, which keeps the back-and-forth alive.

It’s also worth noting that Brandt hasn’t been consistently bearish. Earlier this year, he flagged a bullish technical pattern on XRP that did lead to a price advance before broader market pressure reversed the move. That mixed record suggests his criticism is aimed more at investor behavior than at dismissing XRP outright as a tradable asset.

At its core, this exchange highlights a broader divide in crypto. Traditional traders like Brandt lean heavily on historical price action and classical technical frameworks. XRP investors, by contrast, often emphasize legal progress, institutional adoption, and evolving financial infrastructure. That tension continues to shape how XRP is discussed, and it’s unlikely to fade anytime soon.