- PEPE sees a pullback, but trading volume remains high, signaling strong activity.

- Market cap decline suggests cautious investor sentiment amid broader crypto shifts.

- Full circulating supply means no future dilution risks, keeping price purely demand-driven.

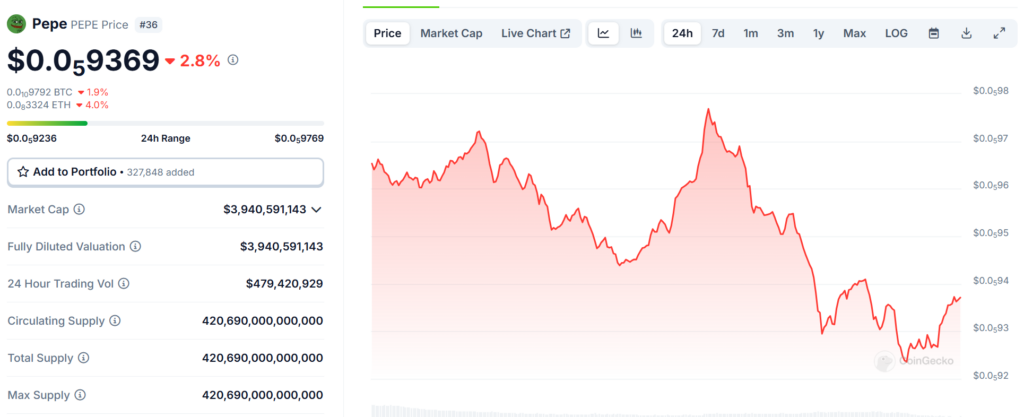

PEPE has been on a bit of a downward trend, now priced at $0.059371 after moving between $0.059236 and $0.059769 over the past 24 hours. While this dip might seem concerning, it’s worth noting that meme coins are naturally volatile, and quick fluctuations like this are nothing new for PEPE.

Looking at the CoinGecko data, PEPE saw some strong peaks before hitting resistance, followed by a gradual decline. The bounce toward the end of the chart suggests that buyers are still stepping in, but the momentum is weaker compared to its previous surges. The real test now is whether PEPE can stabilize at these levels or if further drops are ahead.

PEPE’s Price Action: A Temporary Cooldown or a Shift in Momentum?

PEPE’s market cap now sits at $3.94 billion, a drop that mirrors its price movement. However, what stands out is the high 24-hour trading volume of nearly $480 million. This level of liquidity suggests that even as some investors sell off, others are still actively trading, keeping PEPE’s market highly engaged.

Another thing to keep in mind is that PEPE’s fully diluted valuation (FDV) is the same as its market cap, meaning all tokens are already in circulation. That removes any fear of future token unlocks or dilution affecting price action, making PEPE’s movement entirely dependent on demand and market sentiment.

Unlike newer meme coins that might suffer from unexpected supply increases, PEPE’s total 420.69 trillion supply is already fully out there, so price shifts are purely driven by trading behavior.

Can PEPE Hold This Level or Is More Volatility Ahead?

The next few days will be crucial in determining whether PEPE finds strong support around these levels or dips further. If buying pressure increases, we could see another push toward resistance points, but if volume starts fading, there’s a chance of more pullbacks before another attempt at recovery.

One thing to watch is how the broader crypto market is performing. When Bitcoin and Ethereum see volatility, meme coins like PEPE tend to react even more dramatically. If major cryptos stabilize, PEPE might follow suit, but if the market sees further declines, we could see another round of dips before a true recovery attempt.

Despite this pullback, PEPE’s high liquidity and engaged community make it one of the more resilient meme coins. Whether this is just a cooldown before another breakout or the start of a larger trend shift remains to be seen.

The Origins of PEPE

PEPE is inspired by the legendary Pepe the Frog meme, an internet icon that has been part of online culture for years. Unlike traditional cryptos with specific utilities, PEPE thrives on community-driven hype, speculation, and meme power.

It has managed to separate itself from countless other meme coins by maintaining high trading volume, strong market engagement, and ongoing relevance in the crypto space. While meme coins are often unpredictable, PEPE has shown that it’s not just a short-lived trend—it has solidified its spot among the top meme tokens in the market.

Will PEPE bounce back from this dip, or is the hype cooling off? The next few days will give us some answers.