- Pepe trades near cycle lows but long-term forecasts show a potential rise toward $0.000045 by 2028.

- Technical indicators remain bearish, with extreme fear dominating sentiment.

- A Bitcoin rebound could help PEPE recover quickly, given its strong liquidity and community.

With Bitcoin crashing and altcoins following suit, investors are already shifting their attention toward the next potential bounce. Voices like Tom Lee and Arthur Hayes continue reinforcing the idea that Bitcoin is carving out a new bottom — one that could reshape the trajectory of the entire market. But with that narrative taking shape, a big question emerges: can Pepe (PEPE) follow suit and carve out its own path back to higher levels?

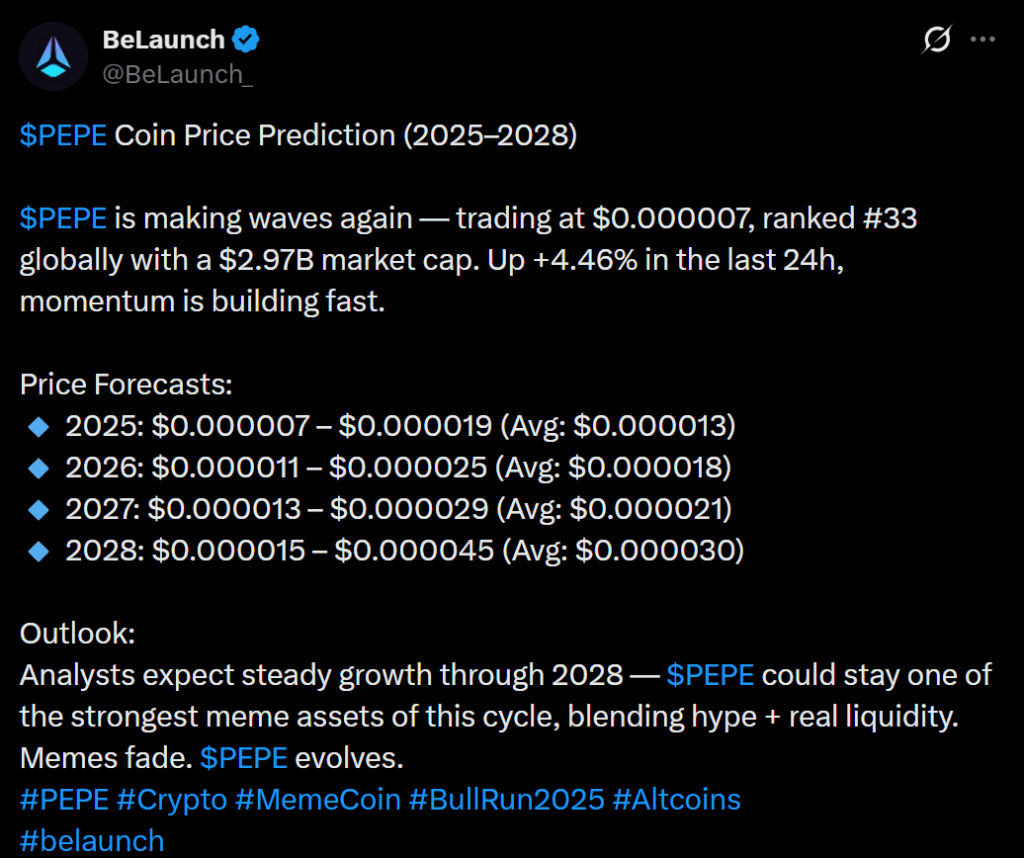

Analysts Predict Steady Growth Through 2028

Pepe is now trading near a cycle low at $0.000004021, but long-term forecasts remain surprisingly optimistic. Analysts suggest the token could rally toward $0.000045 by 2028 if liquidity remains strong and the meme-coin narrative continues evolving. Their yearly projections show a gradual grind upward:

2025: $0.000007–$0.000019 (avg. $0.000013)

2026: $0.000011–$0.000025 (avg. $0.000018)

2027: $0.000013–$0.000029 (avg. $0.000021)

2028: $0.000015–$0.000045 (avg. $0.000030)

Analysts frame PEPE as one of the meme tokens most likely to survive this cycle, leaning on hype but supported by real liquidity and strong community engagement. “Memes fade. $PEPE evolves,” the report notes — suggesting staying power as long as the broader crypto market stabilizes.

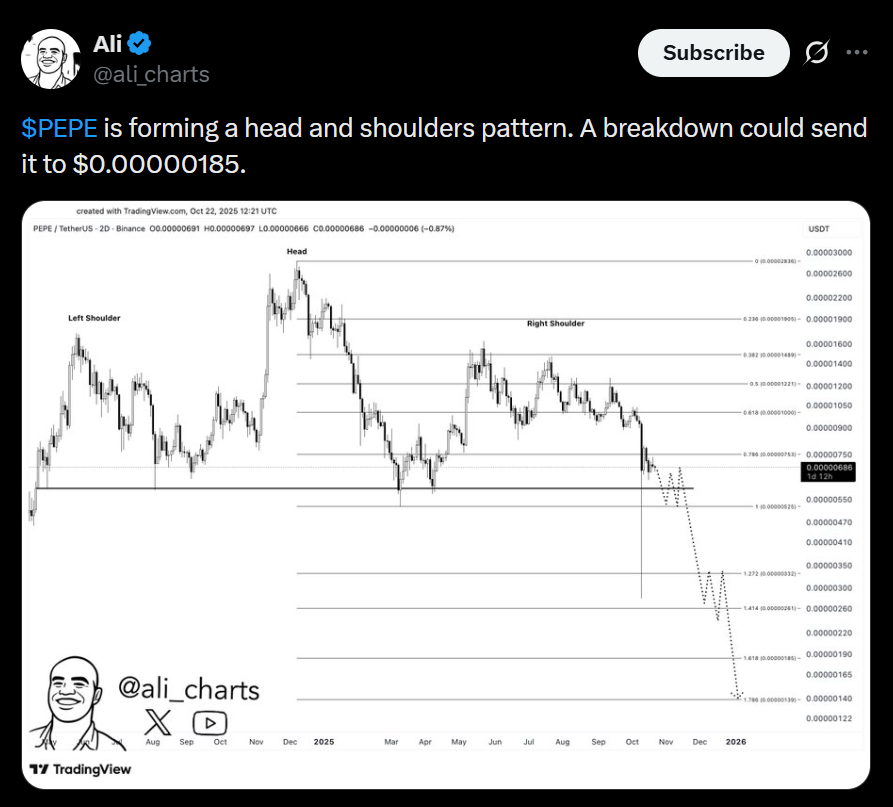

Technical Signals Offer a Mixed Outlook

While long-term projections look hopeful, current momentum is still leaning bearish. CoinCodex data shows Pepe could rise 114% and hit $0.000008621 by December 2026, but the Fear & Greed Index is sitting at 23 — firmly in “Extreme Fear.” Over the past 30 days, PEPE has posted 12 green days out of 30 with 14% volatility, indicating turbulence rather than a clear trend. Meanwhile, analyst Ali Martinez notes that SHIB is forming a head-and-shoulders pattern and targeting $0.00000185 — a sign that meme coins across the board are under pressure.

Can Pepe Ride the Next Market Bounce?

If Bitcoin rebounds as Lee and Hayes expect, meme assets like PEPE could be among the first to recover. Historically, liquidity flows back into high-beta tokens once market fear cools, and PEPE’s strong community support gives it an edge over newer meme coins. Still, in the near term, extreme fear suggests caution. A broader market recovery — especially if accompanied by rate cuts or renewed ETF inflows — may be the key to unlocking Pepe’s next leg upward.