- PEPE is consolidating just under recent highs despite a 5% daily dip, still holding above major EMAs and showing long-term bullish structure.

- RSI cooled from overbought levels, and while MACD remains bullish, flattening could suggest a short-term pause.

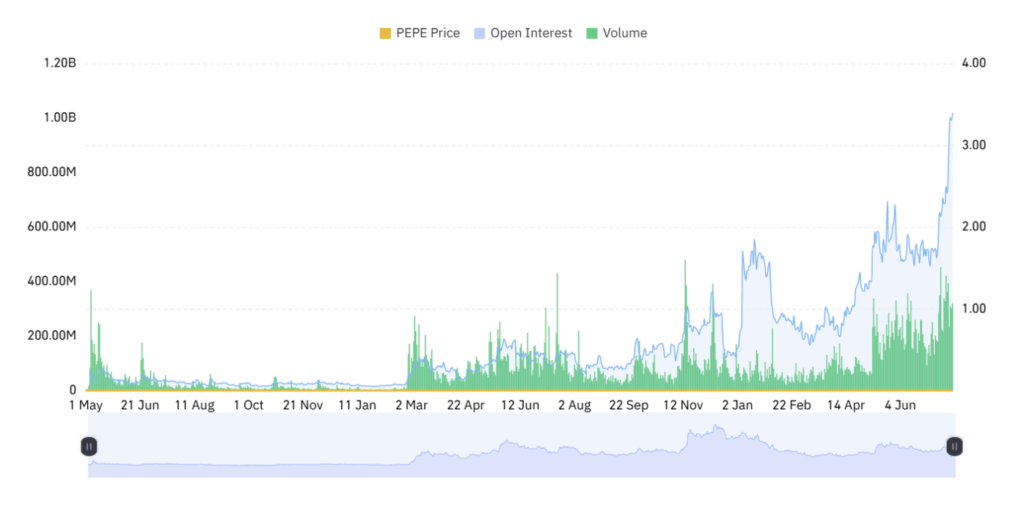

- Open interest and volume have dipped, hinting at cautious sentiment, but overall momentum remains intact for a potential push toward $0.00002.

Even with the crypto market kind of just drifting sideways lately, Pepe (PEPE) isn’t backing down. Sure, it dropped close to 5% in the last 24 hours, but when you zoom out a little? The weekly trend still leans bullish—just a bit more quietly now.

Right now, PEPE’s sitting around $0.00001313. Daily trading volume is holding solid at $1.35 billion, even after a 1.35% slip today. Market cap? Still hefty at $5.52 billion. It’s staying in the meme coin spotlight, no doubt about that.

Signs of Consolidation—But Bullishness Lingers

Technically, things are getting interesting. PEPE touched the upper Bollinger Band not long ago, then cooled off a bit with a 7% pullback. That suggests it bumped into some short-term resistance—but hey, nothing unusual there.

More importantly, it’s still trading above all the big EMAs (20, 50, 100, 200). So structurally, it’s still riding an uptrend. RSI dipped from near 66 to 58.8, which means the buying pressure eased, but it’s still not in danger territory.

MACD? Still bullish—kinda. The line’s still above the signal, but if it flattens out, we could be looking at a sideways chop for a while. Nothing scary, just one of those pause-and-breathe moments.

Derivatives Cool Off, But No Panic

On the futures front, Open Interest nudged up slightly to 0.0225%, hinting that traders might be gearing up for some action. That said, both OI and trading volume have dipped—OI is down 9.48%, and volume slid 20% to $2.94 billion.

So yeah, a bit of a cooldown. But long-term sentiment? Still leaning positive. You can feel it—nobody’s ditching their positions just yet, they’re just not as trigger-happy right now.

Where PEPE Could Be Headed Next

If this little pullback keeps going, PEPE might revisit the mid-Bollinger Band or test the 50 EMA for support. But if it flips and heads north again? We might see a breakout back toward that dreamy $0.00002 level—and maybe even beyond if the stars align.

Traders will want to keep an eye on RSI slipping under 50 or MACD lines getting too cozy—those would be early signs that momentum is fading. Until then, probably smart to stay patient and not get too caught up in the intraday noise.