- PEPE fell 7% to $0.0000093 as whales took profits and volumes surged to 2.29T tokens.

- The memecoin sector as a whole dropped 4.3%, while PEPE underperformed the wider market.

- Insider risks and political tensions fueled caution, though key holders still added to balances.

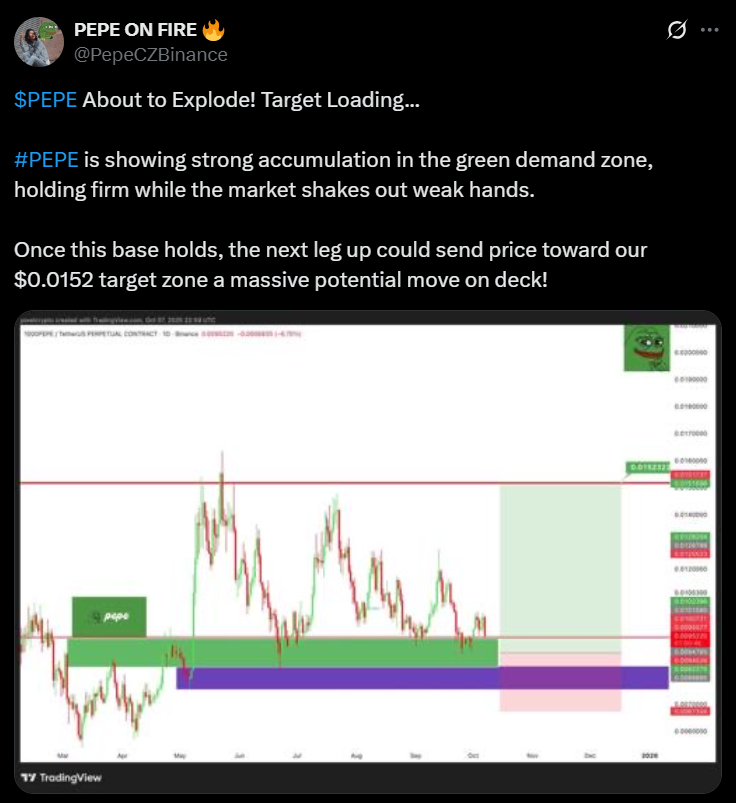

PEPE slid 7% in the last 24 hours, dropping from $0.00000995 to $0.00000931 before briefly stabilizing. Trading volumes surged to 2.29 trillion tokens, showing that the pullback was fueled by significant whale activity rather than thin liquidity. The token tested technical support around the $0.0000093 mark, attracting short-term buyers, but momentum remained weak as broader sentiment turned cautious.

Memecoin Sector Faces Broader Correction

While PEPE’s losses stood out, the entire memecoin sector faced pressure. The CoinDesk Memecoin Index (CDMEME) dropped around 4.3%, while the broader CoinDesk 20 index slipped 3.35%. PEPE underperformed both benchmarks, highlighting its sensitivity to profit-taking cycles and market rotation. The dip follows recent rallies that had pushed PEPE toward $0.00001014 earlier in the session before sellers took control.

Whales and Risks Behind the Pullback

The sell-off was linked to whales locking in profits and investors moving to safety amid rising political risks, particularly fiscal tensions in Japan. Blockchain analytics flagged new concerns about insider concentration, with Bubblemaps reporting that YEPE — a PEPE-inspired token — has 60% of its supply in the hands of insiders. Data from Nansen also showed exchange balances for PEPE growing by 0.35% over the week, hinting at mounting sell-side pressure.

Outlook: Stabilization or More Downside?

Despite the correction, long-term holders are still accumulating modestly, with the top 100 PEPE addresses adding 0.26% to their holdings last week. Traders now watch whether support near $0.0000093 holds or if further downside opens toward deeper retracement levels. With whales active and market-wide volatility elevated, PEPE’s path will likely mirror broader memecoin flows in the days ahead.