- Pepe remains heavily down but shows early signs of stabilizing after months of decline

- A possible Fed rate cut and bullish 2026 Bitcoin forecasts could boost PEPE

- If markets ignore the rate cut again, PEPE may face another correction

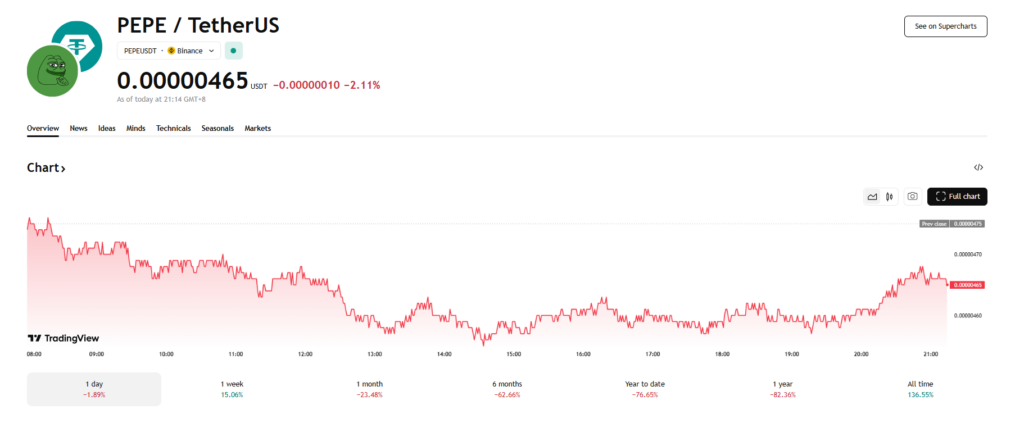

Pepe has spent the past few months sliding further down the market rankings, now sitting around the 60th spot by market cap. The token has dropped more than 83 percent since December 2024, with the broader market downturn pulling memecoins sharply lower. Even so, PEPE has managed small gains over the past week, suggesting that selling pressure may finally be easing. This comes as traders look for signs of stability across the market after an October crash that delivered the largest single-day liquidation event in crypto history.

Fed policy could decide the next major price direction

The October crash was unexpected, especially because it occurred shortly after the Federal Reserve cut interest rates by 25 basis points. Macroeconomic uncertainty overshadowed the policy move and triggered broad risk-off behavior, sending PEPE sharply lower. With another potential rate cut on the horizon after this week’s FOMC meeting, traders are watching closely to see whether liquidity returns to risk assets. If markets respond positively, PEPE could benefit from renewed inflows similar to earlier periods of easing.

A strong BTC outlook could support a wider memecoin recovery

Beyond short-term Fed-driven volatility, major institutions like Bernstein and Grayscale expect Bitcoin to hit a new all-time high in 2026. Their outlook suggests BTC may break out of its traditional four-year cycle and trigger a broader sentiment shift across crypto. If Bitcoin rallies into 2026, memecoins like PEPE tend to follow the broader trend, historically benefiting from waves of speculative capital and stronger retail enthusiasm when the market turns risk-on again.

But a repeat of October remains a real risk

Despite the possibility of a rebound, traders cannot ignore that rate cuts do not always spark immediate bullish momentum. October’s price action showed how quickly macro fears can override liquidity boosts. If markets fail to respond to the Fed’s next move, PEPE may face another downturn as volatility remains elevated. For now, the token sits in a fragile position where sentiment can flip quickly depending on how macro events unfold.