- PayPal has made Solana the default network for PYUSD payments, giving SOL a major mainstream stablecoin rail.

- Solana led blockchain revenue in January 2026, reportedly generating $245M and outpacing Ethereum and other Layer-1 chains.

- Despite bullish network signals, SOL price remains under pressure as demand stays weak and the token trades inside a falling channel.

PayPal just made a move that’s bigger than it looks on the surface. In the latest Solana news, the company has quietly made Solana the default network for processing payments made through its PYUSD stablecoin. No dramatic press conference, no hype campaign. Just a routing decision that effectively hands Solana a mainstream stablecoin rail, and that’s the kind of thing that tends to matter later, not instantly.

PYUSD launched in 2023 on Ethereum, which made sense at the time. But in May 2024, PayPal expanded the stablecoin to Solana, largely because Solana offers faster settlement and much cheaper transfers. Now, with Solana becoming the primary route, most PYUSD volume will run through Solana’s high-throughput network rather than Ethereum’s slower, more expensive base layer.

For SOL investors, this is the kind of adoption signal you want. Not a meme narrative, but real payment flow.

PayPal Brings a Serious On-Ramp Into Solana

PayPal isn’t just another crypto app. It’s a legacy payments giant with hundreds of millions of users globally, and it’s estimated to handle over $140 billion in payment volume per month. Routing stablecoin payments through Solana pushes real-world financial activity closer to the ecosystem, and it also gives Solana something most chains still struggle to secure: a mainstream distribution channel.

This doesn’t mean every PayPal user is suddenly using Solana directly. Most won’t even know. But that’s the point. Adoption that happens invisibly, under the hood, tends to be the stickiest kind.

According to DeFiLlama, Solana currently accounts for about 20.76% of PYUSD supply in circulation. Ethereum still holds the majority at roughly 73.74%. If PayPal’s default routing shifts more stablecoin flow onto Solana, it could naturally increase PYUSD usage on the chain over time, without needing users to “choose” it manually.

Solana Led Blockchain Revenue in January 2026

This PayPal development also lands at a time when Solana is already showing unusually strong network monetization. Data suggests Solana finished January 2026 as the top blockchain by revenue, pulling in more fees than Ethereum and every other Layer-1 combined.

An infographic shared by Velora, an on-chain analyst on X, showed that transaction volume and activity ticked higher month-over-month, suggesting real usage rather than temporary farming. Solana reportedly generated $245 million in revenue, while TRON came in second at $160 million. Ethereum dropped to third with only $89 million.

That’s a major shift in the Layer-1 conversation.

According to Velora, this cycle is rewarding monetized demand over pure narratives. In past cycles, Layer-1 chains competed on tech and theoretical scalability. Now the market is increasingly looking at revenue, usage, and whether networks are actually being used for settlement at scale. Solana’s numbers suggest it is.

SOL Price Still Looks Weak, Even With All the Good News

Here’s the frustrating part: the price chart isn’t celebrating.

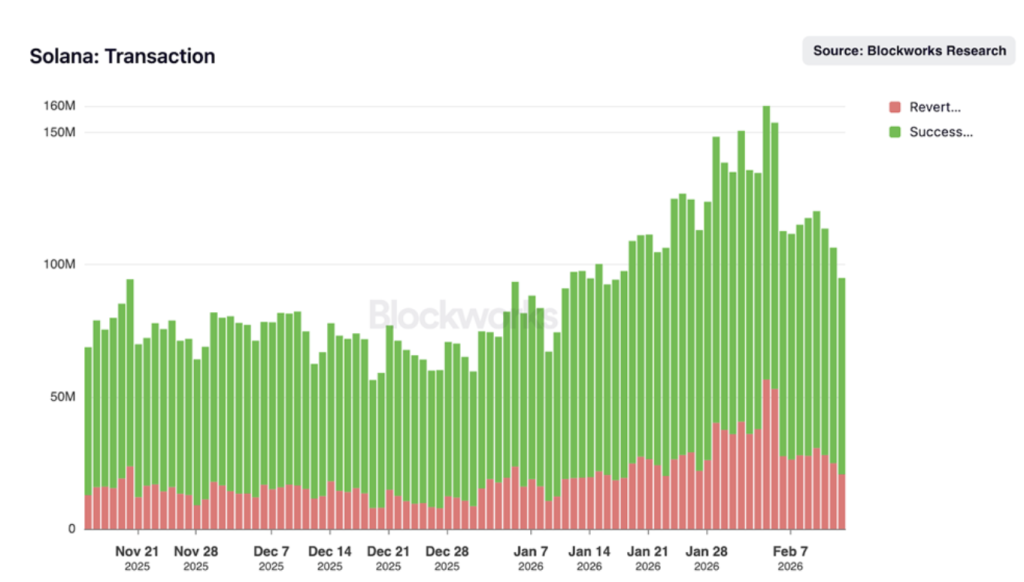

Despite the bullish PayPal headline and the revenue metrics, SOL is still trading like a market that can’t fully commit. Weak demand has kept the token range-bound, and data from Blockworks shows daily on-chain volume has been dropping for the last four days. February 14 reportedly printed the lowest volume level of the past month, which is not what you want to see if a breakout is supposed to be starting.

At press time, Solana is down about 5% over the last 24 hours, trading near $85.72. On the SOL/USDT chart, the token has been grinding lower inside a falling channel. It did exit oversold territory over the weekend, which hints that some accumulation may be happening, but so far it hasn’t been strong enough to spark a meaningful rally.

The current price action still reflects uncertainty. Bears haven’t fully let go, and bulls haven’t reclaimed control either. It’s that annoying middle zone where good news shows up, but price barely reacts.

Why the Market Isn’t Reacting Yet

The lack of immediate price excitement likely comes down to timing. PayPal routing PYUSD through Solana is a long-term adoption catalyst, not an instant pump trigger. Markets don’t always price in infrastructure shifts immediately, especially when broader sentiment is cautious.

But over time, stablecoin flow tends to become sticky. If Solana becomes the default settlement layer for PYUSD, it strengthens the chain’s role as a payments rail, and that can translate into more activity, more fees, and potentially more organic demand for SOL.

For now, though, SOL is still waiting for the chart to catch up to the fundamentals. And that’s usually where the best long-term setups quietly form.