- $585M in long positions were liquidated Friday as Bitcoin dipped below $116K.

- Ethereum and Dogecoin also saw heavy losses, with DOGE down 7%.

- Despite the sell-off, sentiment remains bullish, with Bitcoin’s next target eyed at $136K.

The crypto market got hit with a heavy shake-out on Friday, with more than half a billion dollars in long positions being liquidated. Bitcoin led the drop, sliding under $116,000 after a sharp 2.6% dip.

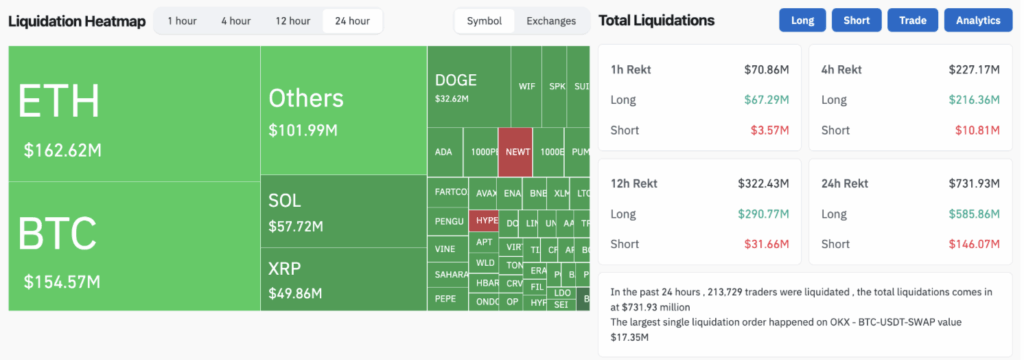

Data from CoinGlass shows that a total of $585.86 million in longs got wiped out, and Bitcoin accounted for $140 million of that pain as it dropped to $115,356.

“Pure Leverage Flush,” Says Trader

Ethereum didn’t escape the carnage either. It saw $104.76 million in long liquidations as the price fell to $3,598, down 1.3% during the same period. Dogecoin took one of the hardest hits among the top 10 coins, losing 7% in a day and clearing $26 million worth of long positions, per Nansen.

Crypto trader Ash Crypto summed it up in a blunt post on X:

“Many people longed alts after seeing ETH pump hard, so market makers dumped and liquidated the late longs. This dump is a pure leverage flush.”

In total, 213,729 traders were liquidated in the last 24 hours, as the sudden drop wiped out $731.93 million across both long and short positions.

Sentiment Still Bullish Despite Pullback

Bitcoin had just tapped new all-time highs of $123,100 on July 14, so many were expecting the rally to continue. Yet, even with this drop, sentiment hasn’t turned sour. The Crypto Fear & Greed Index still shows “Greed” with a score of 70.

Analysts remain confident in higher prices ahead. Michael Novogratz of Galaxy Digital predicts ETH will soon hit $4,000 — a nearly 10% climb from current levels. Meanwhile, Bitfinex analysts say that if Bitcoin’s momentum returns, its next major target is $136,000.

Short Squeeze Risk Looms

Interestingly, a quick rebound could put shorts in danger. If BTC pushes back to Thursday’s price of $119,500, over $3 billion worth of short positions could be liquidated.

This mix of high leverage, volatile moves, and strong sentiment suggests the next few sessions might be anything but quiet.