• Ethereum price targets $3,700 due to soaring interest from ‘smart money’ or experienced traders

• Growing network activity, including rising daily active addresses and transaction counts, supports Ether’s bullish momentum

• Ether’s price action has formed a U-shaped recovery pattern, suggesting a potential move towards $3,700

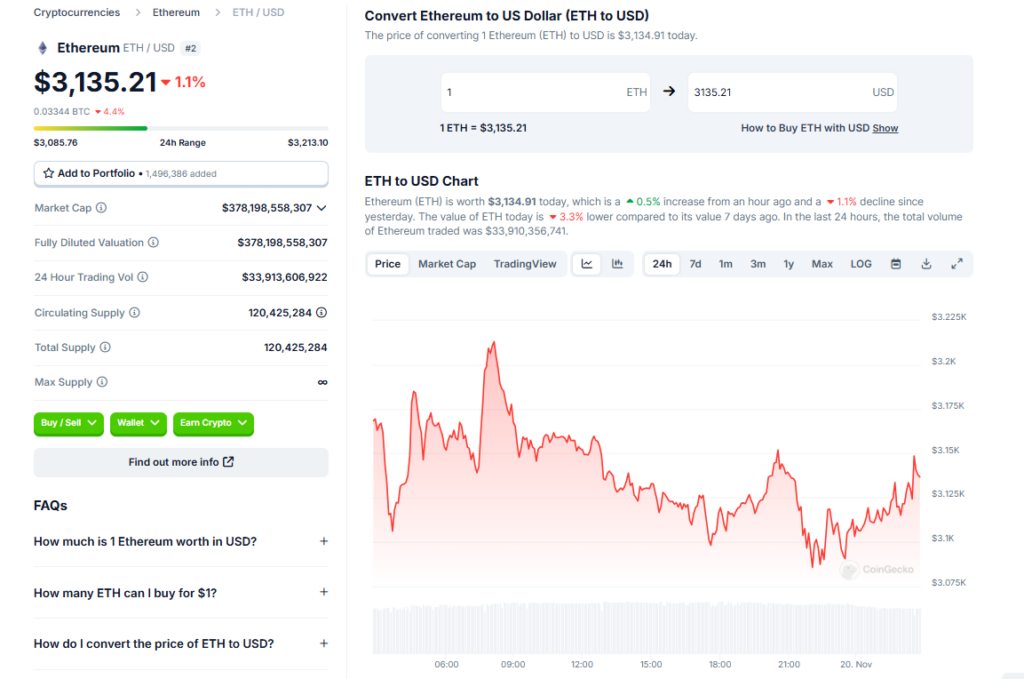

Ether (ETH) has seen strong price action recently, breaking above $3,000 for the first time since August. While momentum has slowed in the past few days, on-chain and technical factors suggest there is more upside for ETH.

Increasing Network Activity

Ethereum’s recent bullishness has coincided with more users and transactions on the network.

Daily Active Addresses on the Rise

The number of daily active addresses (DAAs) on Ethereum has risen over the past month, from 377,065 on October 27 to 487,941 on November 19. This indicates rising engagement across Ethereum chains like Polygon, Arbitrum and Optimism.

More Transactions

Transaction counts also reflect this growth, with daily transactions reaching 129 million on November 15, up from 962,160 on October 27. The increase suggests more DeFi and dApp usage, with Ethereum’s total value locked rising 25% since November 5.

Smart Money Sentiment Turning Positive

Sentiment data shows increased interest in ETH from experienced investors or “whales.” While regular investors were mildly bullish, smart money held highly positive sentiment, potentially signaling further upside.

Technicals Point to $3,700

ETH has formed a bullish U-shaped pattern on the 4-hour chart. A close above the neckline at $3,376 could send ETH toward the pattern target of $3,735. Support lies at $3,000 where significant ETH was previously bought. Stiff resistance is at $3,200 where a large amount of ETH was acquired.

Conclusion

On-chain activity is increasing, smart money is growing more confident, and Ethereum is forming bullish chart patterns. These factors suggest ETH could soon rise to $3,700.