- OCC conditionally approved national trust bank charters for Ripple, BitGo, Fidelity Digital Assets, Paxos, and First National Digital Currency Bank

- The charters allow crypto firms to operate nationwide under consistent federal oversight

- The move strengthens regulatory clarity for digital asset custody, stablecoins, and tokenized finance

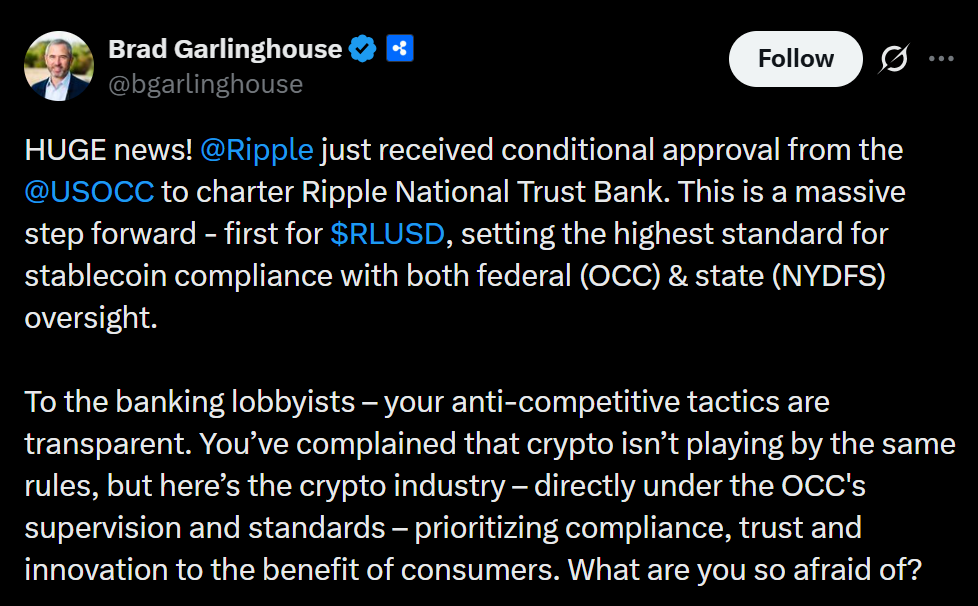

Crypto-native firms are moving deeper into the U.S. financial system after the Office of the Comptroller of the Currency (OCC) conditionally approved five national trust bank charter applications, including Ripple National Trust Bank and BitGo Bank & Trust. The decision marks another step toward integrating digital asset companies into federally regulated banking infrastructure.

Which Firms Received Approval

Alongside Ripple and BitGo, the OCC also approved applications from Fidelity Digital Assets, Paxos Trust Company, and First National Digital Currency Bank. BitGo, Fidelity, and Paxos are converting from existing state trust charters, while Ripple and First National Digital Currency Bank were approved as new, de novo national trust banks.

Once regulatory conditions are met, these firms will officially join the U.S. federal banking system, expanding the current pool of roughly 60 federally chartered national trust banks.

What National Trust Bank Status Allows

National trust bank charters allow firms to operate across state lines under a single federal regulator rather than navigating a patchwork of state rules. These charters permit custody of non-deposit financial assets, including digital assets, stablecoins, and tokenized instruments, but do not allow traditional deposit-taking like commercial banks.

For crypto firms, this structure provides regulatory clarity, operational consistency, and a stronger compliance framework for serving institutional and enterprise clients.

Why This Matters for the Crypto Industry

The approvals signal growing acceptance of crypto-native companies within the U.S. banking system. By bringing firms like Ripple, BitGo, and Paxos under federal oversight, regulators are acknowledging that digital asset custody and tokenized finance are becoming permanent parts of modern financial markets.

This move could also accelerate adoption by institutions that have waited for clearer regulatory footing before engaging deeply with crypto infrastructure.