- Nvidia posted $57B in Q3 revenue, beating expectations across the board.

- The company expects $65B in Q4 revenue, far above analyst forecasts.

- Data center sales surged 66% YoY to reach $51.2B.

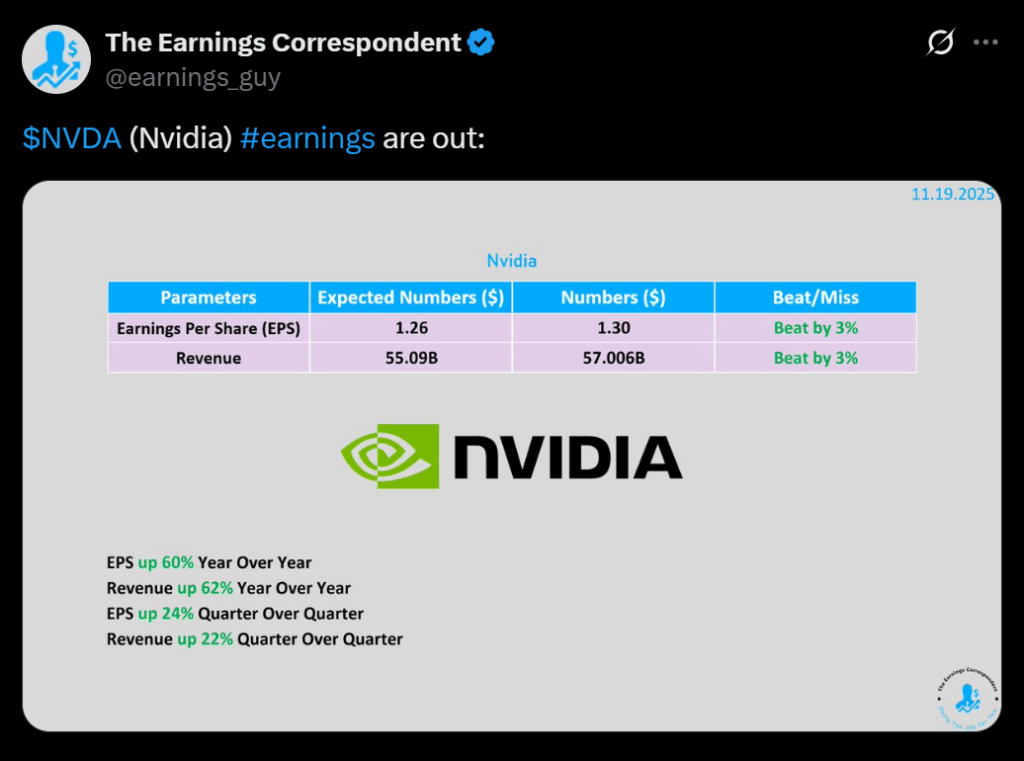

Nvidia delivered another monster quarter on Wednesday, posting fiscal Q3 earnings that easily topped analyst expectations across the board. Revenue came in at $57.01 billion, beating the estimated $54.92 billion, while adjusted earnings per share hit $1.30, surpassing the $1.25 forecast. Shares climbed as much as 3% in after-hours trading as investors reacted to yet another blockbuster result from the world’s most valuable public company.

Guidance Signals Even More Explosive Growth Ahead

The company isn’t slowing down. Nvidia told investors it expects roughly $65 billion in revenue for the current quarter — far ahead of the $61.66 billion analysts predicted. Net income for the quarter reached $31.91 billion, or $1.30 per diluted share, a 65% jump from last year. The numbers reinforce what the market already knows: the demand for AI chips is not just strong — it’s overwhelming.

AI Chip Demand Continues to Dominate

Driven by its unmatched GPU lineup, Nvidia now sits at the center of nearly every major AI breakthrough. Microsoft, Amazon, Google, Meta, and Oracle are all top customers, relying on Nvidia hardware to build and train advanced AI systems. The company’s performance has become the industry’s most important signal for the health of the global AI build-out, and this quarter confirms the boom is nowhere near cooling down.

Data Center Revenue Breaks Another Record

Nvidia’s data center segment — now the core of its business — delivered $51.2 billion in sales, crushing estimates of $49.09 billion. That number represents a massive 66% year-over-year increase, driven primarily by demand for compute power. Of the total data center revenue, $43 billion came from GPU compute alone, while $8.2 billion came from networking hardware that allows clusters of GPUs to operate as a single supercomputer. The scale of these figures illustrates how deeply Nvidia is embedded in the infrastructure of modern AI.

A Market Leader Pulling Even Further Ahead

With Q3 results shattering expectations and Q4 guidance pointing even higher, Nvidia is reinforcing its position as the defining company of the AI era. The firm’s unmatched dominance in GPU compute has transformed it into the most valuable publicly traded company — and here is the clear takeaway: as long as AI demand keeps accelerating, Nvidia remains the engine powering nearly all of it.