- Bitcoin’s surge past $100,000 on December 4 triggered $676 million in crypto liquidations, affecting over 209,359 traders.

- Long positions accounted for $373 million in liquidations, while short positions contributed $305 million.

- XRP briefly reclaimed its spot as the third-largest cryptocurrency by market capitalization, overtaking Tether, but its upward trajectory was short-lived, leading to $69 million in liquidations.

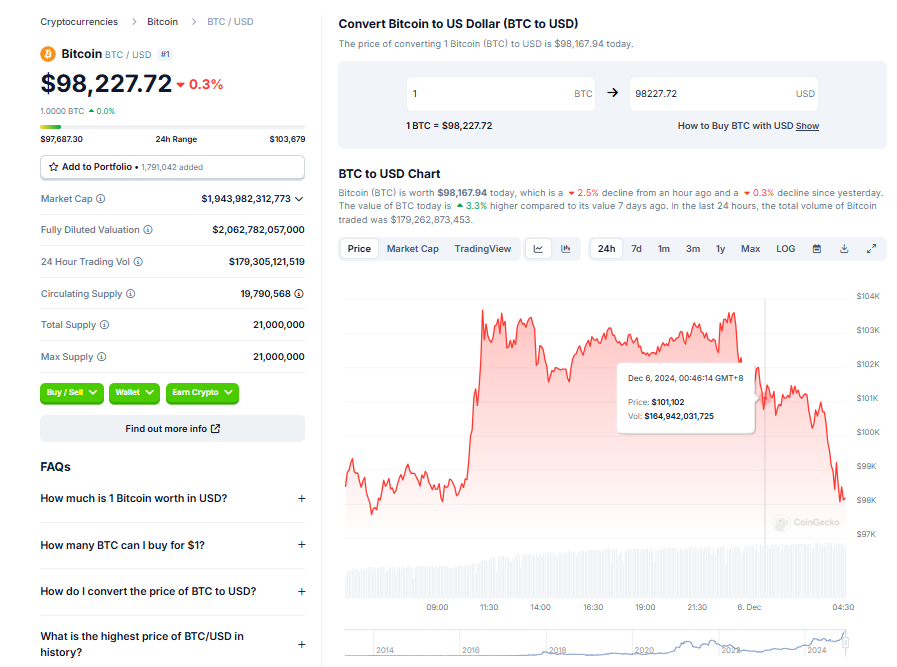

The world of cryptocurrency was set abuzz when Bitcoin surpassed the $100,000 milestone. However, the euphoria was not universal since the surge also triggered significant liquidations. This piece delves into the details of the liquidations and the overall impact on the market.

The Broader Picture of Bitcoin’s Surge

Bitcoin’s surge past the $100,000 milestone on December 4 led to $676 million in liquidations. Over 209,359 traders were affected during this period, with a staggering $373 million lost in long positions and $305 million in short positions. This unprecedented surge has set the market abuzz with excitement and anxiety in almost equal measure.

Bitcoin’s Historic Rally and Its Market Impact

The rally of Bitcoin started in November and was fueled by renewed optimism following Donald Trump‘s re-election as the US president. The currency’s sharp ascent to an all-time high of $103,361 caught many derivatives traders off guard, resulting in significant losses. Bitcoin alone contributed $182.5 million to the total liquidations. Other cryptocurrencies like Ethereum, Ripple’s XRP, and Solana also recorded significant losses.

Liquidations and Their Impact Across Exchanges

Binance led the liquidation activity among exchanges, wiping out more than $260 million in leveraged positions. Other exchanges like OKX and Bybit also recorded significant losses, further intensifying the market volatility. The liquidation surge also led to considerable volatility for derivatives traders, with $588 million in futures contracts being liquidated in just a day.

The XRP Phenomenon

The liquidation surge saw XRP briefly reclaim its spot as the third-largest cryptocurrency by market capitalization, overtaking Tether for the first time in years. However, this upward trajectory was short-lived, as the token’s price later declined, leading to $69 million in liquidations.

Influence of Global Events on Crypto Market

In the midst of this market tumult, the political crisis in South Korea, where President Yoon Suk Yeol imposed martial law, significantly impacted the crypto market. Exchanges like Upbit witnessed sharper price declines than their global counterparts, causing more ripples in the already volatile market.

Conclusion

The surge of Bitcoin past the $100,000 milestone was a historic moment in the world of cryptocurrency. However, the resulting liquidations have been a stark reminder of the risk and volatility inherent in this market. It underlines the importance of cautious and informed trading in the crypto sphere.