- Monad’s MON token surged 78% above its ICO price, pushing its valuation near $4B and delivering major gains to early investors.

- The blockchain saw strong early adoption, processing over 3M transactions and 18K contract deployments in just days.

- ICO incentives and improving market conditions helped stabilize MON during launch volatility.

Monad’s debut week has turned into a major win for early buyers. Between November 17 and 22, the project sold 7.5 billion MON tokens at just $0.025 each, giving the network an implied valuation of $2.5 billion. When the blockchain went live on Monday, demand exploded. The MON token jumped 78% almost immediately, pushing its valuation close to $4 billion and delivering substantial gains to ICO participants. The timing also helped, since the broader crypto market has been rebounding; Bitcoin recovered about 5% from its recent lows, and that shift in sentiment helped smaller assets like MON benefit from renewed liquidity.

Strong On-Chain Activity Marks a Promising Launch

The project itself has been in development for more than three years, which is longer than many new L1 competitors, and that extended build cycle seems to be paying off. Monad is an Ethereum-compatible blockchain designed for fast, low-cost transactions, and it has attracted major investors including Paradigm, Dragonfly Capital, and Coinbase Ventures. In just a few days since launch, the chain has already processed over three million transactions across 140,000 addresses, with more than 18,000 smart contracts deployed according to Nansen data. For a new network, that level of activity points to strong developer interest and early adoption.

Caution Remains After Other L1s Burned Investors

Even with the excitement, some analysts warn that new blockchains have a habit of launching strong and then fading. Plasma is a clear example: it hit a $3 billion valuation at launch while pulling in nearly $10 billion in DeFi deposits—only for its token to crash 87% in two months. Berachain followed a similar pattern, with its BERA token falling 92% from its peak and its TVL shrinking from $3.4 billion to under $300 million. Monad will need sustained usage and developer retention to avoid becoming another case of early hype fading into decline.

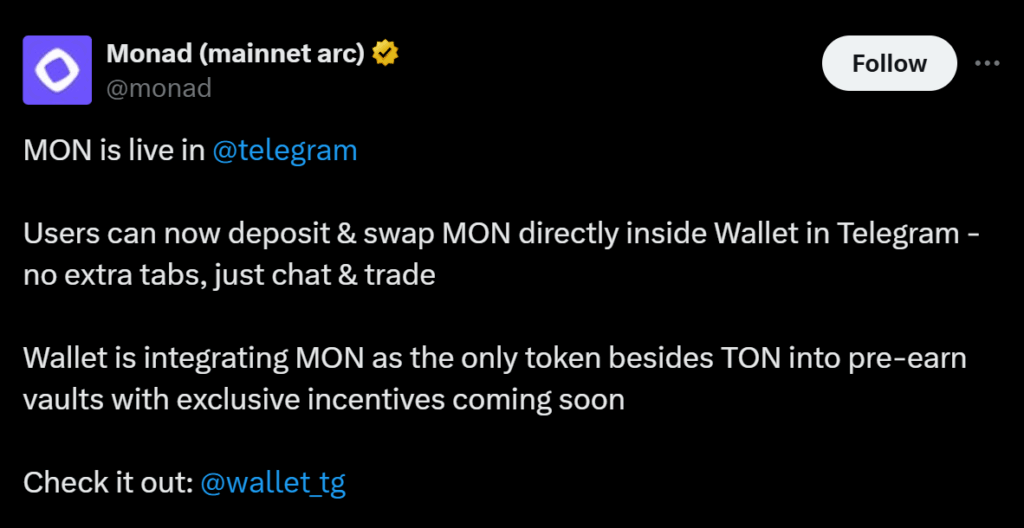

ICO Structure Helps Support MON’s Price

One factor supporting MON’s price is the way the ICO was structured through Coinbase. While investors were technically allowed to sell immediately after launch, Coinbase made it clear that doing so would limit their ability to receive allocations in future token sales. That incentive has discouraged early dumping and likely helped MON maintain its valuation during its first week—a period when most new tokens face heavy selling pressure.