- MicroStrategy (MSTR) shares surged 20% in the week following Donald Trump’s victory in the 2024 US presidential election and another interest rate cut by the Federal Reserve.

- MSTR has seen its stock price skyrocket 486% over the past 12 months, largely due to its strategy of holding a massive Bitcoin reserve worth over $19 billion currently.

- The company plans to purchase an additional $4.2 billion worth of Bitcoin by 2027 to expand its cryptocurrency holdings further.

MicroStrategy (MSTR) stock has jumped nearly 20% over the past week, fueled by Donald Trump‘s victory in the presidential election and the Federal Reserve‘s latest interest rate cut. The enterprise analytics company has seen its share price skyrocket 486% in the past year, largely thanks to its Bitcoin investment strategy.

MicroStrategy’s Bitcoin Holdings

MicroStrategy currently holds a portfolio of over 250,000 Bitcoin worth over $19 billion at current prices. The company, founded by Bitcoin advocate Michael Saylor, recently disclosed a plan to buy $4.2 billion worth of Bitcoin by 2027.

Impact of Trump’s Victory and Rate Cuts

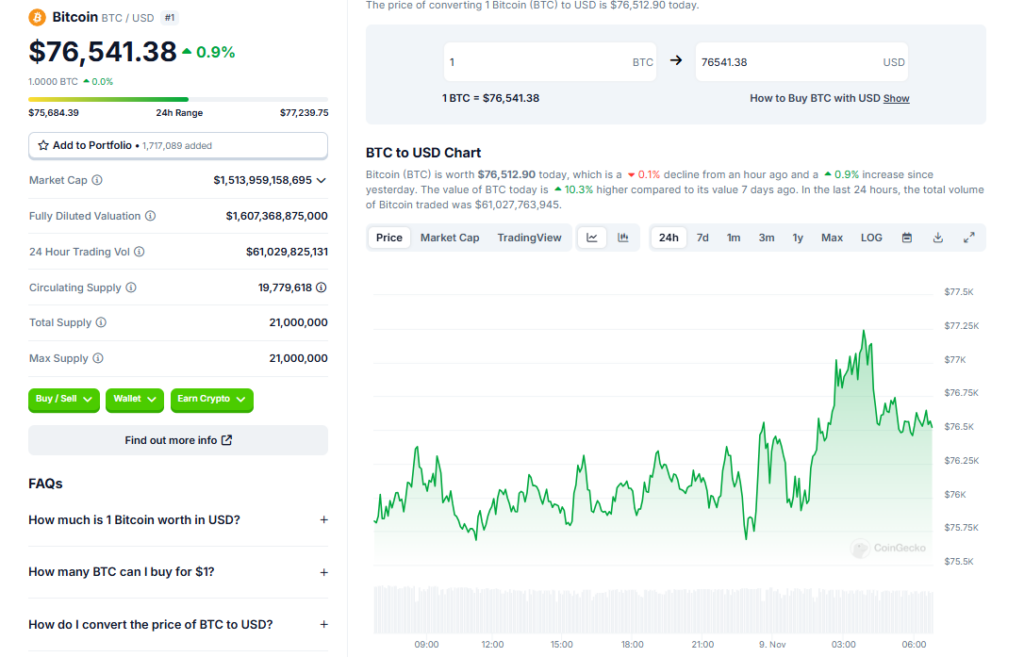

The cryptocurrency price reached an all-time high after Trump’s election, jumping over 10% and trading around $76,600 on November 8. Investor optimism is being driven by expectations of a more favorable economic environment under Trump’s reelection and further easing by the Federal Reserve. In September 2024, the Fed cut interest rates by 0.5 percentage points, its first reduction in over four years. On November 7, it followed up with another 0.25-point cut.

Broader Market Rally

In response to the rate cuts and election results, the broader market has rallied, with the S&P 500 up 5% for the week and the Dow Jones gaining 4.8%. This indicates growing confidence among investors. Other Bitcoin-linked stocks also performed well, with CleanSpark (CLSK) shares rising 35% and Coinbase (COIN) stock soaring over 48%.

Conclusion

MicroStrategy’s stock surge demonstrates that institutional interest in Bitcoin continues to grow. The company’s long-term Bitcoin accumulation strategy has paid off handsomely for shareholders amid the crypto bull run. With Trump securing four more years in the White House and the Fed committed to further policy easing, investor appetite for risk assets like Bitcoin appears poised for even greater growth.