- MicroStrategy stock gains over 7%, reaching a 25-year high on Oct. 25.

- MSTR outperforms Microsoft, fueled by its strategic Bitcoin investments since 2020.

- The stock’s market cap nears $50 billion as investor interest in BTC rises.

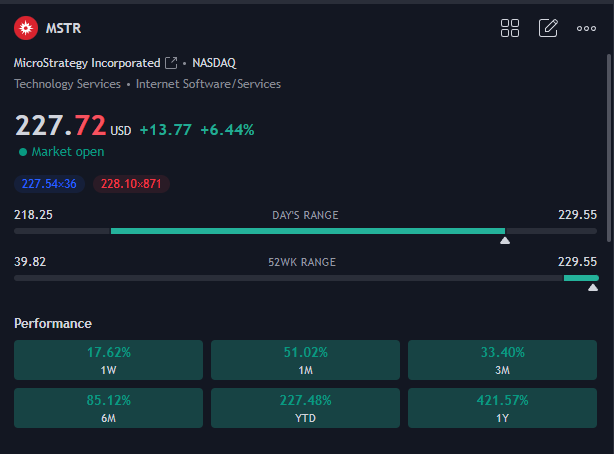

MicroStrategy’s stock surged more than 7% on October 25, reaching a new high of $236, its strongest performance in 25 years. The company’s significant stake in Bitcoin has driven a six-week rally that’s placed it among the top gainers in the market, with its shares surpassing Microsoft’s in performance.

Source: Crypto Coin Coach on X

MicroStrategy Surpasses Microsoft’s Gains on Bitcoin Strategy

Data shows MicroStrategy stock has outperformed Microsoft over the past five years. Since its decision to invest heavily in Bitcoin in 2020, MicroStrategy has seen its share price climb, fueled by its position as the world’s largest corporate holder of BTC. The company’s share price reflects this, with its all-time stock gains reaching 1,570% since its Nasdaq listing, compared to Microsoft’s 1,467% growth.

In September, MicroStrategy made its latest Bitcoin acquisition, purchasing 7,420 BTC for $458.2 million, bringing its holdings to 252,220 BTC, worth an estimated $17 billion today. This total represents over 1% of all Bitcoin in existence, underscoring the company’s commitment to BTC as a core strategy.

Market Cap Nears $50 Billion Amid Record Trading Volume

MicroStrategy’s rising stock value has pushed its market capitalization to $43.35 billion, closing in on the $50 billion mark. According to Companies Market Cap data, MicroStrategy’s valuation makes it the 477th-most valuable company globally. Additionally, MicroStrategy’s trading volume has gained ground against Nvidia’s, reaching a peak of 17.65% of NVDA’s volume in October.

As Bitcoin’s price remains around $68,000, MicroStrategy’s net asset value (NAV) premium has grown, nearing levels last seen in early 2021. Rising trading volumes, an expanding NAV, and investor optimism suggest MicroStrategy’s stock could see continued momentum in the coming months.