- Rumors of a $1B MicroStrategy Bitcoin sale were false, with analysts confirming the wallet transfers were internal and not sent to exchanges.

- Michael Saylor reaffirmed the company’s long-term BTC accumulation strategy, stating MicroStrategy is still buying daily despite market volatility.

- MSTR stock is nearing a key support level around the 200-week SMA as Bitcoin trades below $94K, making it highly sensitive to further BTC price movement.

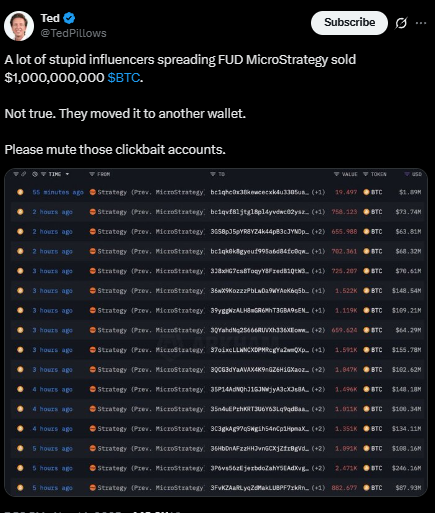

MicroStrategy found itself at the center of fresh market drama after large transfers from its Bitcoin wallets triggered speculation of a massive $1 billion BTC sell-off. As soon as blockchain watchers flagged the movements, social media influencers rushed to frame them as evidence that the company was exiting a significant portion of its position. This narrative quickly fueled fear among retail traders already on edge from Bitcoin’s latest price drop. In reality, however, the story was built on misreading on-chain data rather than any confirmed liquidation.

On-Chain Analysts Confirm: No Bitcoin Was Sold

On-chain analyst Ted, known as @TedPillows, stepped in to cool things down and dismantle the rumor. He clarified that the transactions in question were internal wallet transfers, not flows to exchanges typically associated with selling. According to Ted, there was no data backing claims of coins moving to trading platforms, a key sign that a real exit was taking place. His warning to traders was simple but important: verify wallet activity and destinations instead of amplifying sensational headlines that can distort market sentiment.

Saylor Doubles Down on Bitcoin Accumulation

Amid the noise, MicroStrategy founder Michael Saylor once again reinforced his long-term Bitcoin strategy. In a recent televised interview, he acknowledged Bitcoin’s volatility, describing sharp drawdowns as part of the journey rather than a reason to abandon the asset. He highlighted Bitcoin’s history of deep corrections followed by strong recoveries, arguing that its long-run performance still eclipses many traditional investments. Saylor also revealed that MicroStrategy has kept buying through the turbulence, noting on X that the firm “bought Bitcoin every day this week,” signaling zero intention to slow down accumulation.

Long-Term Horizon vs Short-Term Panic

Saylor’s message targeted investors shaken by price swings and social media rumor cycles. He stressed that Bitcoin should be viewed through a multiyear lens, not a day-trading time frame, especially during high volatility periods. His metaphor captured the mindset required: if you want to ride the rocket, you have to be ready for the G-forces. Despite chatter about MicroStrategy’s balance sheet risk, his public comments suggest the company is structurally committed to BTC, not looking for an exit at the first sign of market stress.

MicroStrategy Stock Tracks Bitcoin and Approaches Key Support

While the Bitcoin sale rumor has been debunked, MicroStrategy’s stock (MSTR) is still feeling the pressure of BTC’s downside volatility. With Bitcoin trading below the recent support area around $94,000, MSTR has drifted toward a critical technical level on the weekly chart. Analysts watching data from Stock Trader Hub note that the stock is nearing its 200-week simple moving average, a zone that often acts as long-term support during deep pullbacks. If Bitcoin fails to stabilize, MSTR could retest support near the $138 area, keeping the stock highly sensitive to every major move in BTC’s price.

Market Volatility, Narrative Risk, and What Comes Next

The episode underscores just how quickly narratives can spiral when large on-chain transactions are spotted without context. A few misinterpreted wallet transfers turned into a full-blown rumor of a billion-dollar sell-off, shaking confidence and adding to existing volatility. For now, the data and direct statements from both analysts and Saylor point in the opposite direction: MicroStrategy is still accumulating, not dumping. As Bitcoin price action remains choppy and MSTR hovers near key levels, traders will be watching both the charts and the wallets closely, hopefully with a more cautious approach to unverified claims.