- MicroStrategy bought 2,138 Bitcoin for $209 million between December 23 and December 29, 2022.

- MicroStrategy’s Bitcoin yield, a metric tracking the performance of its Bitcoin investments, reached 74% year-to-date as of December 30, 2022.

- MicroStrategy funded the Bitcoin purchase by selling 592,987 shares during the same week.

Business intelligence company MicroStrategy continues its streak of Bitcoin purchases, acquiring 2,138 Bitcoins for $209M. As a result, the firm’s BTC yield for the year has hit an impressive 74%.

MicroStrategy’s Persistent Bitcoin Investments

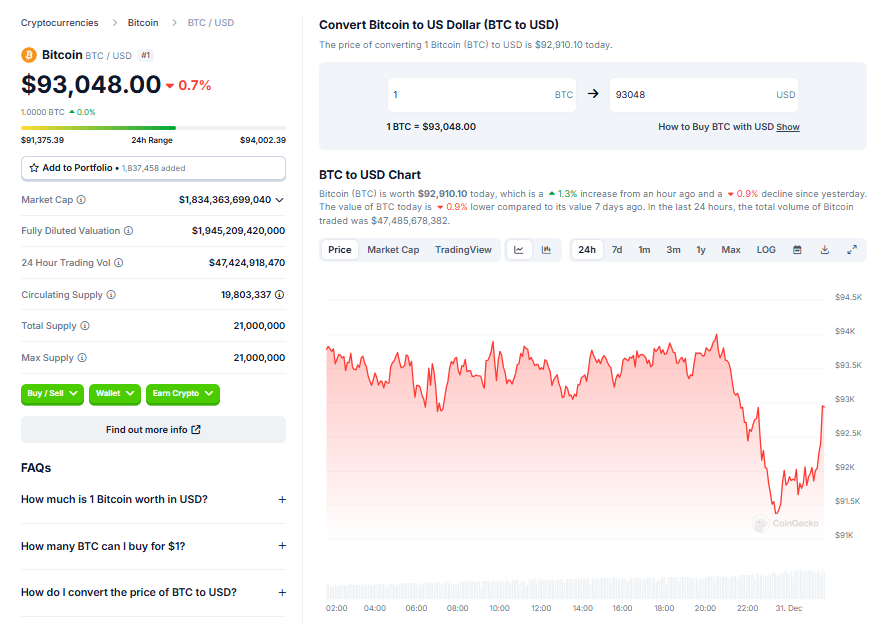

For the eighth consecutive week, MicroStrategy has bought Bitcoin, pushing its total holdings to a staggering 446,400 BTC, worth roughly $41.5 billion at current market prices. The firm’s recent acquisition between December 23 and 29 saw it add 2,138 BTC to its holdings, spending $209 million in cash for the purchase. The average price per Bitcoin during this period was about $97,837. The funding for the acquisition was sourced from the sale of 592,987 shares during the same week.

MicroStrategy’s Bitcoin Yield Performance

MicroStrategy’s year-to-date Bitcoin yield, a metric used to gauge the performance of its Bitcoin investments, reached 74.1% as of December 30. Between October 1 and December 29, the metric stood at 47.8%. Michael Saylor, MicroStrategy’s co-founder and executive chairman, had previously stated the company’s commitment to continue buying Bitcoin at any price, even if the price hits $1 million.

Continued Bitcoin Purchases and Future Plans

The latest Bitcoin acquisition marked the eighth straight week the business intelligence firm purchased Bitcoin. Since October 31, MicroStrategy has been buying BTC weekly, adding 194,180 BTC to its holdings. However, the amount of BTC the company bought had significantly decreased compared to its purchases in November, when MicroStrategy bought over 100,000 BTC. In a filing with the United States Securities and Exchange Commission on December 23, the firm expressed its intention to increase the number of authorized shares for its Class A common stock and preferred stock. This move would provide them with more flexibility to issue additional shares as needed.

Conclusion

With solid plans to continue investing in Bitcoin, MicroStrategy continues to demonstrate its confidence in the potential of the cryptocurrency. The firm’s relentless investments and impressive yield performance underline its strategic commitment to Bitcoin as an asset, regardless of its price.