- Strategy added another 130 BTC to its holdings, bringing its total to 499,226 BTC worth $33.1 billion.

- Bitcoin is struggling to regain momentum, down 14.6% over the past month despite a 24.4% yearly increase.

- Analysts predict BTC could skyrocket to $160,519 by June if market conditions align.

Looks like Michael Saylor’s Strategy is at it again—snapping up more Bitcoin like it’s on clearance. Between March 10 and March 16, the company scooped up another 130 BTC, shelling out roughly $10.7 million. That puts the average price per coin at a cool $82,981. Seems like a classic “buy-the-dip” move—something Saylor’s firm has turned into an art form. As of March 16, Strategy’s BTC vault now holds a staggering 499,226 coins, collectively valued at around $33.1 billion. Their average purchase price? About $66,360 per BTC. Not too shabby, assuming Bitcoin’s long-term trajectory keeps climbing.

Bitcoin’s Crawling Its Way Back

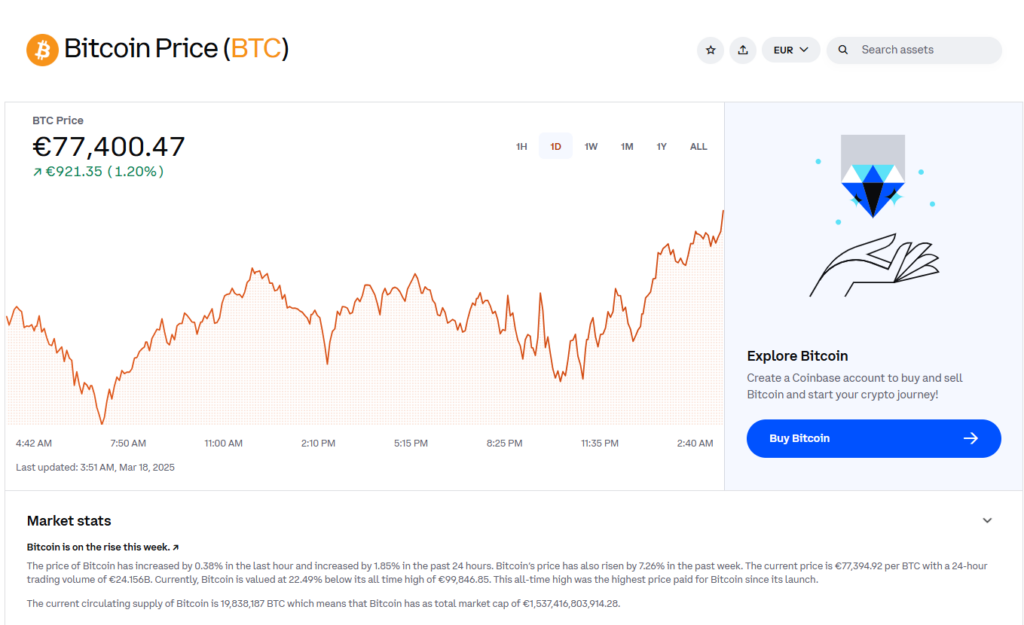

For those glued to the charts, BTC’s price action has been, well… less than thrilling. After dipping below $80,000 last week, it’s clawed back some ground, though not exactly in a dramatic fashion. A modest 0.9% bump in daily charts and a 1.1% increase over the past week—hardly enough to set off fireworks. But zoom out a bit, and it’s clear the king of crypto has had a rough time lately: down 10.1% over the last two weeks, and a steeper 14.6% drop across the past month. The silver lining? Yearly performance still shows BTC up 24.4% since March 2024. Not exactly a face-melting rally, but hey, green is green.

So what’s keeping Bitcoin from making a bigger comeback? Macroeconomic jitters, mostly. Global trade tensions have left investors skittish, and with U.S. tariffs fueling uncertainty, the appetite for risk assets has taken a hit. But here’s the wildcard—if the Federal Reserve decides to cut interest rates, we could see BTC break free from this sluggish phase. A serious bounce might even push it past the $100K barrier.

A New All-Time High in Sight?

Flashback to January 2025—Bitcoin soared to an eye-watering $108,786. But since then, it’s taken a 23% haircut, leaving traders wondering: Is another peak on the horizon?

Well, if CoinCodex is to be believed, BTC’s next major rally is just around the corner. Their projections suggest the asset could hit an astonishing $160,519 by June 14. If that forecast holds true, we’re talking about a 92.5% surge from current levels—an absolute monster move.

Of course, in crypto, nothing’s guaranteed. But if the right conditions align—rate cuts, renewed institutional interest, and another wave of FOMO—Bitcoin might just smash through its previous records, leaving skeptics scrambling to catch up.

Strap in, because the next few months could get interesting.