- Michael Saylor’s MicroStrategy has purchased another $101 million worth of Bitcoin, acquiring 1,070 BTC.

- MicroStrategy’s total Bitcoin holdings now stand at a staggering 447,470 BTC.

- The company sold off 319,586 MicroStrategy shares to finance the latest Bitcoin purchase.

MicroStrategy, under the leadership of Michael Saylor, further strengthens its position in the digital currency market by investing an additional $101 million in Bitcoin. This strategic acquisition increases the company’s Bitcoin holdings to a staggering 447,470 BTC.

MicroStrategy’s Persistent Investment Strategy

MicroStrategy continues to demonstrate unwavering confidence in Bitcoin by acquiring an additional 1070 BTC, valued at $101 million. This latest purchase, announced by Michael Saylor on X (formerly Twitter), is in line with the company’s consistent accumulation strategy. The funding for this substantial acquisition was generated through the sale of 319,586 MicroStrategy shares.

Bitcoin’s Momentous Year and MicroStrategy’s Ongoing Commitment

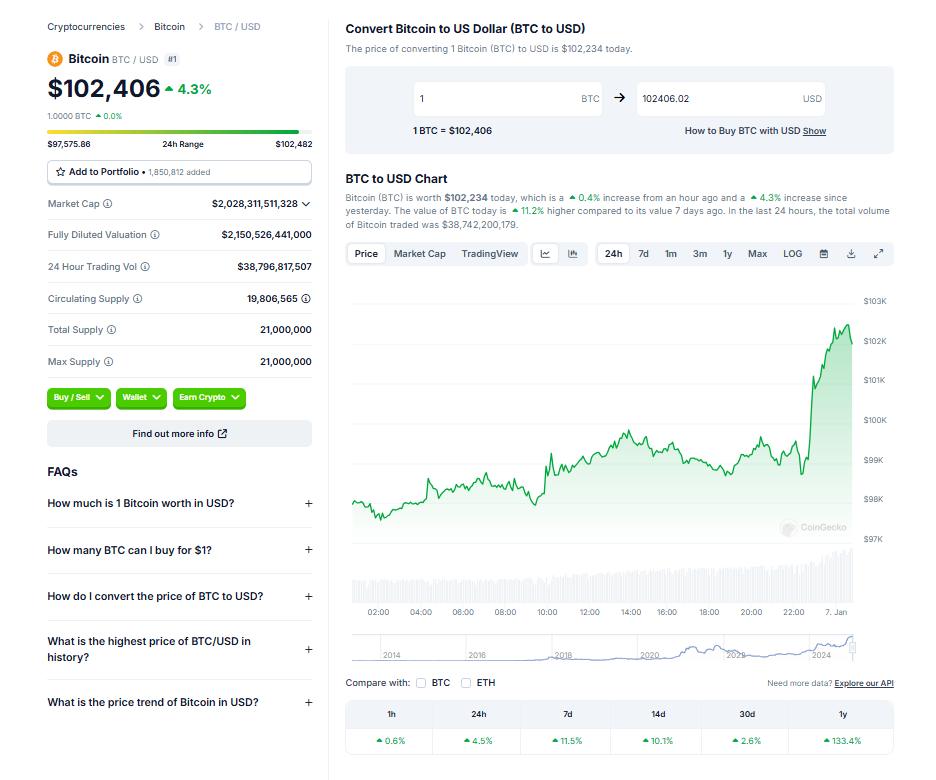

Bitcoin had a landmark year in 2024, launching its first-ever crypto-based ETF and surpassing the six-figure threshold for the first time. Ripple CEO, Brad Garlinghouse, predicts a bullish market for 2025, further emboldening MicroStrategy’s investment strategy. The company’s continued investment in Bitcoin, despite the digital currency’s volatility, is a testament to their deep-seated belief in its potential.

MicroStrategy’s Future Investment Plans

MicroStrategy’s commitment to Bitcoin is far from over. The company still has $4.2 billion earmarked for additional Bitcoin purchases. This follows the $6.77 billion worth of shares still available for sale, indicating an aggressive investment strategy in the pipeline for 2025. The company recently unveiled its 2121 plan, which includes a $21 billion equity offering and $21 billion in fixed-income securities capital raise. This ambitious plan, coupled with a potential $2 billion preferred stock offering, will allow MicroStrategy to significantly increase its current Bitcoin holdings.

Conclusion

MicroStrategy’s consistent and calculated investment in Bitcoin is a clear demonstration of its belief in the digital currency’s future. With massive investment plans set for 2025, the tech titan continues to affirm its position as a key player in the digital currency market. As the world watches with bated breath, Michael Saylor’s strategic moves are shaping the future of Bitcoin investment.