- Michael Saylor now sees Bitcoin reaching $21 million by 2046, citing massive adoption shifts.

- Strategy holds over 592K BTC, but remains quiet on custody details amid past criticism.

- Self-custody gained strong traction at BTC Prague 2025, with open-source tools in the spotlight.

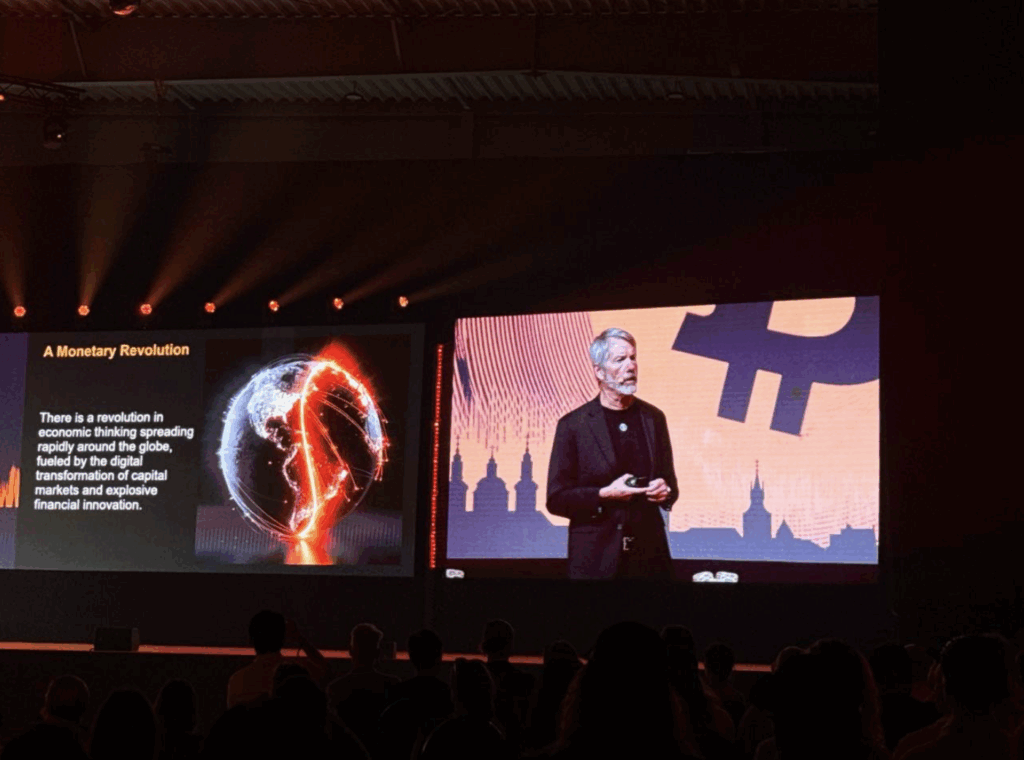

Bitcoin bull and Strategy co-founder Michael Saylor is back in the spotlight — and this time, he’s not holding back. Speaking at BTC Prague 2025, Saylor tossed out a bold prediction that turned heads: Bitcoin, he says, is going to hit $21 million… in 21 years. Yep, you heard that right.

“I think we’re going to be $21 million in 21 years,” Saylor said during his keynote. “It’s a very special time in the network. Maybe the one time in history where you look out 21 years and you see $21 million.” Hard to say if he meant it as a metaphor, but knowing Saylor — probably not.

From $13M to $21M: A Forecast on Fire

This new call is a massive step up from last year’s forecast at Bitcoin 2024 in Nashville, where he predicted a still-ambitious $13 million BTC target by 2045. What’s changed? A lot, apparently.

Saylor pointed to a wave of unexpected developments that, in his view, no one really saw coming. “What’s happened in the past 11 months has been extraordinary,” he said. “The White House has embraced Bitcoin. We didn’t see that coming.”

He didn’t stop there. According to Saylor, the election of Donald Trump last November marked a pivotal shift in U.S. political sentiment toward crypto. “We thought we might get a pro-Bitcoin president. We didn’t think we’d get a strategic Bitcoin reserve. That’s insane,” he added.

Laws, Adoption, and the Road Ahead

Saylor also touched on regulation, pointing to several major crypto bills currently moving through Congress, including the Genius Act (focused on stablecoins), the Digital Asset Market Clarity Act, and the Bitcoin Act. “This is something nobody guessed a year ago,” he said. “States are embracing Bitcoin. That’s not noise — that’s momentum.”

Meanwhile, Strategy (formerly MicroStrategy) is still stacking BTC like it’s on clearance. The firm scooped up another $1 billion worth last week, bringing its total holdings to a staggering 592,100 BTC as of June 15.

As for where Strategy keeps that mountain of crypto? Good luck finding out. Saylor’s tight-lipped on specifics, refusing to publish proof-of-reserves due to security risks — a move that didn’t exactly win over the self-custody crowd.

Self-Custody Debate Still Heating Up

Last year, Saylor took heat for suggesting that holders should trust their BTC with banks instead of managing it themselves. That didn’t go over well with Bitcoin purists. But in October 2024, he changed his tone: “I support self-custody,” he said — at least “for those willing and able.”

Still, the topic was alive and well at BTC Prague this year. “Be your own bank” was more than a slogan; it was a theme. Trezor, one of the main sponsors, reported over 5,000 attendees — a mix of devs, hardcore Bitcoiners, and fresh faces all digging into open-source tools and sovereignty-focused ideals.

“The energy was focused,” said Danny Sanders, CCO at Trezor. “People were locked in on the future of Bitcoin. You could feel it.”