• Metaplanet announces a $500M Bitcoin-backed share buyback after its market value slipped below BTC holdings.

• The buyback aims to boost confidence and increase Bitcoin yield per share.

• With 30,823 BTC held and a target of 210,000 by 2027 — here is why the firm’s Bitcoin leverage strategy could redefine corporate treasury models.

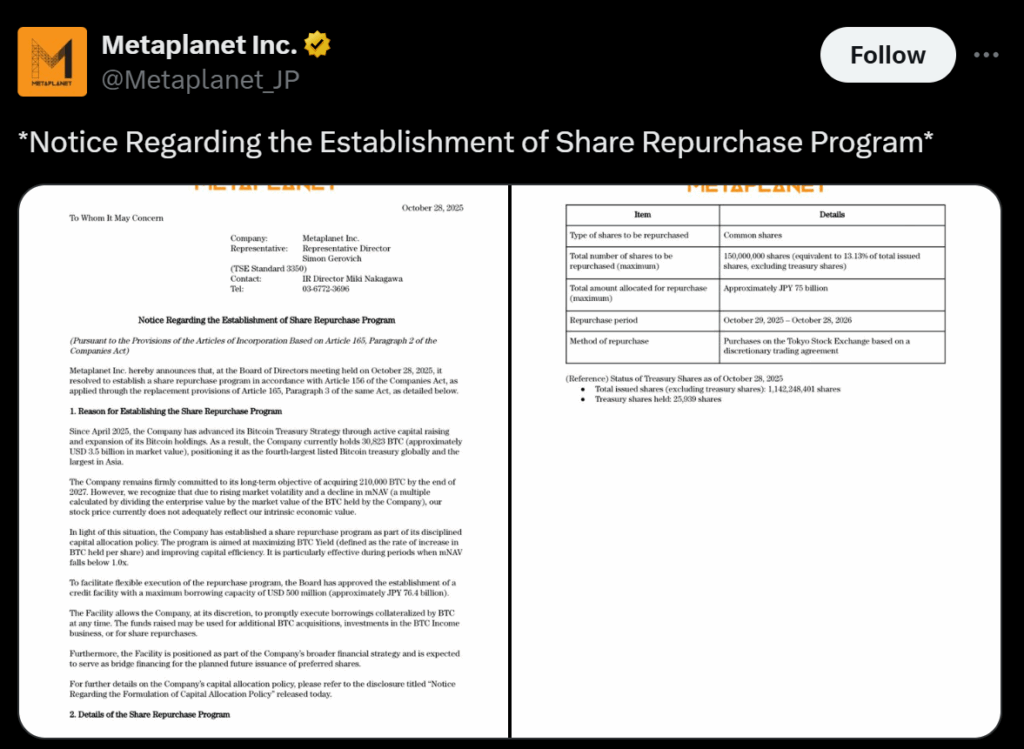

Japanese Bitcoin treasury firm Metaplanet Inc. has announced a 75 billion yen ($500 million) share repurchase program backed by a Bitcoin-collateralized credit line after its stock value fell below its Bitcoin holdings. The decision follows a drop in the company’s market-based net asset value (mNAV) to 0.88 last week before rebounding to 1.03, signaling that shares were trading below intrinsic value.

A Move to Restore Confidence

Approved by the board, the buyback authorizes the purchase of up to 150 million shares — about 13.1% of total stock — through the Tokyo Stock Exchange until October 2026. The plan aims to “maximize Bitcoin yield per share” while rebuilding investor confidence. The company’s new Bitcoin-backed credit facility, worth $500 million, provides flexible funding for the buyback, additional Bitcoin purchases, or future preferred share issuances.

Bitcoin Strategy Still on Track

Metaplanet currently holds 30,823 BTC ($3.5 billion) and remains committed to its ambitious goal of 210,000 BTC by 2027. Although it paused new acquisitions during recent volatility, its leveraged approach underscores confidence in long-term Bitcoin appreciation. By utilizing BTC as collateral rather than selling it, Metaplanet aims to preserve upside potential while boosting shareholder value.

Context Across Crypto Treasuries

The move mirrors a broader trend among Bitcoin treasury firms like ETHZilla, which are launching buybacks to close the gap between market value and underlying BTC holdings. Analysts say Metaplanet’s aggressive use of leverage could set a new precedent for crypto-backed corporate finance models — one that blends traditional equity management with Bitcoin’s decentralized capital power.