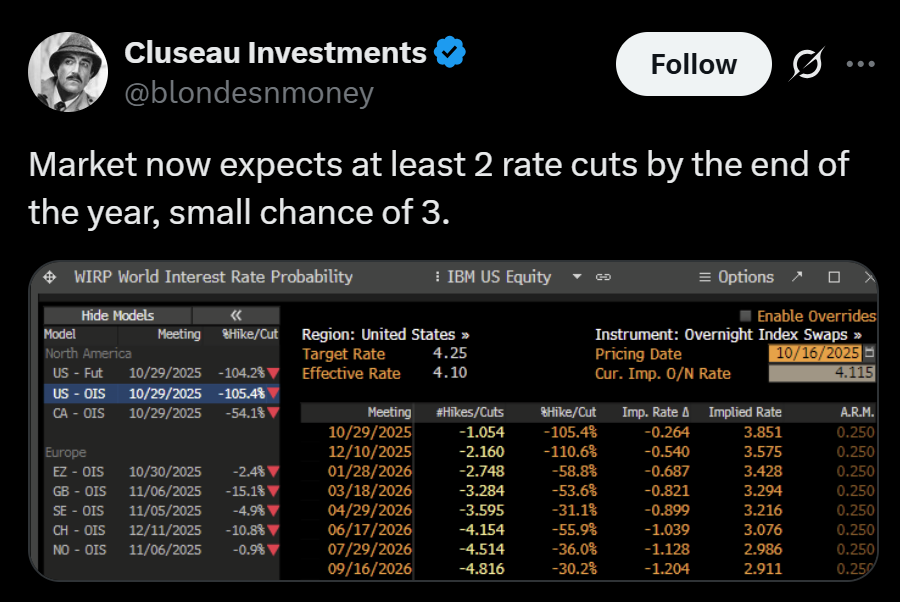

- Traders price in two Fed cuts—October and December.

- Equities and crypto rally on softer-rate expectations.

- Growth risks and inflation data remain the key spoilers.

The Fed story has shifted — it’s no longer if rates will be cut, but how many times. Futures markets now price in two 25 bps rate cuts before year-end, with one expected at the October 29 FOMC and another in December. Chair Jerome Powell’s recent tone, echoed by other Fed officials, has reinforced that easing bias as inflation cools and the labor market shows strain.

The Policy Setup: Dovish Path Firming Into Year-End

Fed officials have steadily laid the groundwork for cuts, citing a softening jobs market and easing price pressures. Futures-implied odds show near-certainty of one cut in late October and strong conviction for another before December. The policy rate could dip below 4%, marking a meaningful pivot from the post-pandemic tightening cycle.

The takeaway? The “two-cut base case” is now consensus. It would take a hot CPI or a shock payroll rebound to derail that path.

Stocks React: Growth and AI Names Lead the Charge

Lower rates are giving equities a lift, especially tech and AI-heavy growth stocks that thrive when discount rates fall. Investors rotated back into duration assets this week as Treasury yields eased and Fed rhetoric softened. The move has broadened market breadth, with small caps and cyclicals starting to catch up on dips.

If the two-cut glidepath holds, expect tech leadership to extend, followed by late-cycle rotation into industrials and consumer plays—unless trade tensions or global growth fears resurface to cap risk appetite.

Crypto: Liquidity Beta Returns to the Spotlight

Rate cuts mean easier liquidity—and for Bitcoin and crypto, that’s historically bullish. Just like in 2020–21, a softer dollar and falling yields tend to drive inflows into risk-on assets. BTC’s correlation to liquidity remains tight, and with ETF flows turning cautiously positive, the setup leans constructive into Q4.

Still, geopolitics remain a swing factor. If growth holds steady while rates ease, crypto benefits. But if cuts are seen as a response to economic weakness, the rally could stall as risk sentiment fades.

The Macro Tape: Dollar Eases, Gold Shines, Growth Wobbles

Markets opened Thursday with a modest risk-on tone: the dollar softened, yields drifted lower, and gold notched fresh record highs—all reflecting faith in the Fed’s dovish tilt mixed with lingering uncertainty. Treasury Secretary Bessent’s comments about “vigilance amid trade risks” underscored that cuts may coexist with elevated macro volatility.

Lower yields typically aid both equities and crypto, but the path to stability still depends on inflation data and China-U.S. trade headlines.

What’s Next: Three Scenarios to Watch

Base Case (two cuts by year-end):

- 25 bps in October, another in December.

- Stocks stay supported; crypto firms up as dollar weakens.

- Risks: sticky inflation or wage growth could delay the second cut.

Hawkish Scenario (only one cut):

- Triggered by upside inflation or strong jobs data.

- Yields climb, dollar strengthens; tech and crypto correct as valuations tighten.

Dovish Scenario (faster easing):

- Sparked by labor-market deterioration or financial stress.

- Equities and crypto rally hard initially—but if growth fears spike, cyclicals lag.

Bottom Line

Markets have accepted that Powell’s Fed is shifting into measured easing mode. Two cuts are now the default script, setting a friendlier backdrop for both stocks and digital assets—as long as inflation stays tame and trade shocks don’t disrupt the macro calm.