- Major banks like JPMorgan, Schwab, and Citibank are preparing BTC-backed loans

- Saylor says institutions adopted Bitcoin far faster than expected

- Trump’s pro-crypto environment accelerated the shift

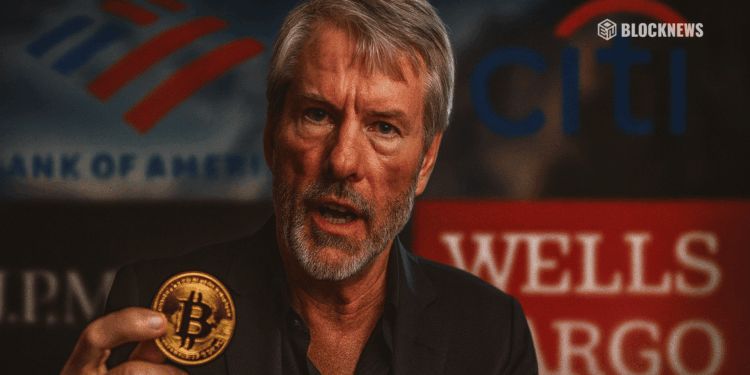

Speaking at Binance Blockchain Week, Strategy executive chairman Michael Saylor said he once believed it would take 4–8 years for major financial institutions to integrate Bitcoin. But over the past 12 months, that timeline has collapsed. Banks such as Citibank, BNY Mellon, Bank of America, PNC, JPMorgan, Wells Fargo, and Vanguard have pivoted from anti-crypto to openly supportive. Vanguard even now allows trading of crypto-linked ETF shares like Bitcoin and XRP.

Saylor emphasized that the shift isn’t theoretical — it’s happening right now, and at a speed he didn’t foresee.

Bitcoin-Backed Credit Lines Are Coming

Saylor highlighted a major turning point:

Where big banks once refused to accept Bitcoin as collateral, eight of the top ten U.S. banks are now preparing Bitcoin-backed lending products.

He noted that:

- Schwab plans to offer Bitcoin custody and BTC-backed credit lines as early as next year

- Citibank is preparing similar offerings

- JPMorgan is expected to roll out institutional BTC-backed loans before year-end

This marks a dramatic reversal from a few years ago, when Saylor says securing such loans was nearly impossible.

Trump Administration Accelerates the Shift

While banks have explored blockchain for years — Goldman Sachs issued a Bitcoin-backed loan in 2022 — the turning point came after President Donald Trump entered office.

His pro-crypto stance, regulatory easing, and push for national digital innovation have rapidly pushed institutions from “wait and see” to active participation.

According to Saylor, the difference in the last six months has been “massive,” with nearly every major bank now preparing crypto-integrated products.

Bitcoin Is Becoming a Core Part of Banking

With custody, lending, and credit lines rolling out across top institutions, Bitcoin is quickly moving from an outsider asset to a foundational part of U.S. financial infrastructure.

What was unimaginable a few years ago is now becoming mainstream — and Saylor expects adoption to accelerate from here.