- Intesa Sanpaolo, Italy’s largest bank, purchased 11 BTC for $1.03 million, marking its first direct cryptocurrency investment.

- CEO Carlo Messina called the purchase a low-risk experiment, emphasizing the bank’s readiness for client demand in digital assets.

- This move highlights growing institutional interest in Bitcoin as traditional finance explores cryptocurrency adoption.

In a move that underscores the growing prominence of cryptocurrency, Intesa Sanpaolo, Italy’s largest bank, has made its first-ever Bitcoin acquisition. The financial giant purchased $1.03 million worth of Bitcoin, securing 11 BTC, according to a report from Reuters. This marks a groundbreaking moment for the country, as Intesa Sanpaolo becomes the first Italian bank to invest directly in cryptocurrency.

A Landmark Decision in a Transforming Market

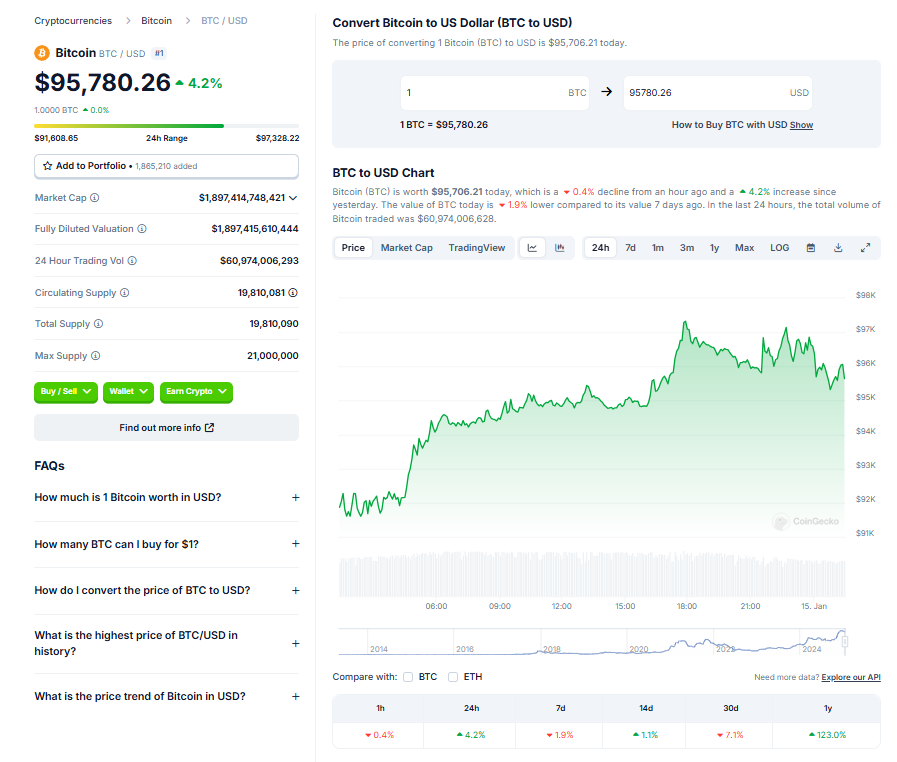

The cryptocurrency market has entered 2025 with unparalleled momentum. Just last year, the U.S. approved its first crypto-based ETF, propelling Bitcoin to cross the six-figure mark for the first time in history. Now, with pro-crypto policies expected under the administration of Donald Trump, the market is bracing for further gains.

Against this backdrop, Intesa Sanpaolo’s decision stands out as both bold and calculated. Describing the purchase as “an experiment,” CEO Carlo Messina emphasized the low risk relative to the bank’s $100 billion in securities. Messina explained, “This demonstrates our readiness to adapt if sophisticated clients seek digital asset investments.”

Setting the Stage for Broader Adoption

This move is significant not only for Intesa but for Italy’s financial sector as a whole. The bank’s purchase highlights a cautious yet forward-thinking approach to crypto adoption, showing a willingness to explore digital assets without overcommitting.

Messina reassured that the investment represents “very limited amounts” but signals an openness to digital channels and evolving client demands. As regulatory clarity improves and demand from high-net-worth individuals grows, more traditional institutions may follow Intesa Sanpaolo’s lead.

Final Thoughts: A Sign of the Times?

Intesa Sanpaolo’s entry into Bitcoin reflects a broader trend of institutional interest in cryptocurrency. As financial giants across the globe experiment with digital assets, the stage is set for Bitcoin and other cryptocurrencies to further cement their place in the financial ecosystem. Whether this experiment grows into a larger commitment remains to be seen, but it’s clear that the tide is turning in favor of crypto.