- Dormant ETH whale dumps $16.8M worth of Ethereum, acquired at $8 back in 2016—sparking speculation over panic selling or smart timing as the market dips.

- ETH crashed to $1,400 but quickly bounced to $1,612, with analysts spotting a bullish falling wedge pattern and a 36% spike in trading volume.

- Analysts like Ali Martinez suggest it could be prime time to accumulate, especially with SEC-approved ETH ETF options possibly drawing in institutional money soon.

An early Ethereum investor just made a splash—dumping a whopping 10,702 ETH, worth around $16.86 million, at about $1,576 per coin. Yeah, ouch. According to on-chain sleuths digging through Etherscan, this ETH was originally picked up way back in 2016, when you could grab a token for just $8. Not a bad return, huh?

But here’s the kicker: this whale didn’t sell during the 2021 peak, when ETH was flying high above $4,000. Nope—he (or she, or they) held tight. Two years of silence, then bam, back in the game just as prices are sliding. Curious timing, to say the least.

Oh—and they’re not alone. Word is, World Liberty Financial, the DeFi project tied to Donald Trump, has also been offloading ETH during the recent market panic. That’s got some folks wondering: are the whales running for the exits?

Contrarian Play? Analysts Say It Might Be Time to Buy

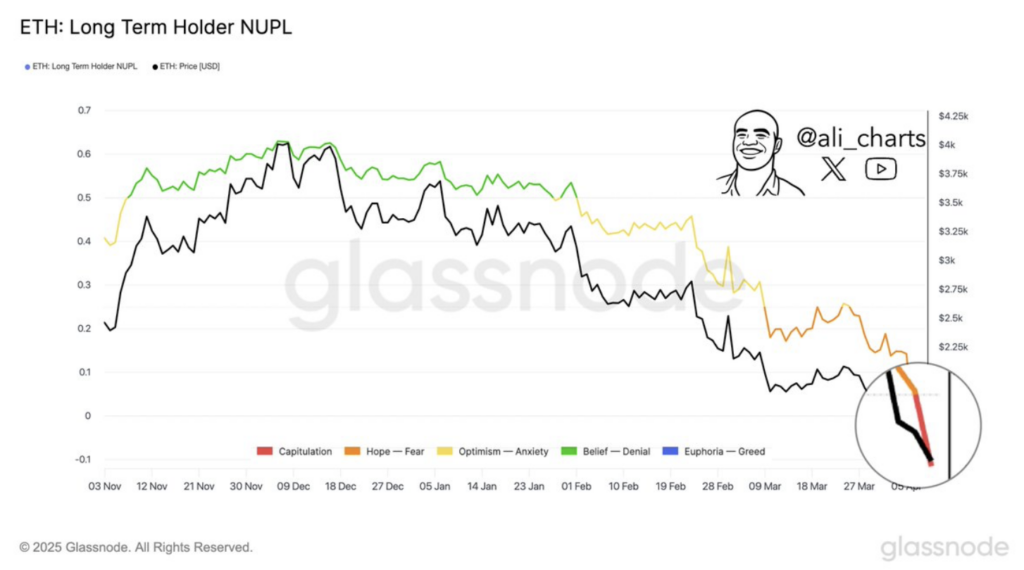

Not everyone’s feeling the fear. Ali Martinez, a well-followed crypto analyst, is throwing out the classic contrarian playbook. According to him, when long-term holders start selling en masse—that’s often when new blood steps in and scoops up coins at a discount.

He pointed out that these kinds of capitulation events often set up ideal entry zones. Basically: high panic = high opportunity (if you’ve got the stomach for it).

Signs of a Bullish Breakout?

After plunging to $1,400 on Tuesday, ETH has shown signs of life—bouncing back to about $1,612. That’s a tidy 13% recovery, with volume up 36% in just one day. Some analysts are starting to talk reversal.

One trader, @Luciano_BTC, flagged a falling wedge pattern forming on the charts. That’s one of those setups traders get excited about—often seen as a bullish signal if it breaks to the upside.

And there’s more good news: the SEC has just greenlit options trading on spot Ethereum ETFs. That’s a hugedevelopment—it could open the floodgates for institutional money to roll in, adding support under the price and smoothing out volatility (in theory, at least).