- Litecoin ETF filing: Canary Capital’s amended S-1 filing positions Litecoin as a strong contender for the next spot crypto ETF.

- Market reactions: Litecoin surged 16% as whales accumulated coins, signaling strong investor interest.

- Leadership shift: Paul Atkins’ SEC leadership could reshape the regulatory outlook, potentially accelerating ETF approvals.

The race for crypto exchange-traded funds (ETFs) in the U.S. just got more competitive, with Litecoin stepping into the spotlight. Canary Capital has filed an amended S-1 form for a proposed Litecoin ETF, signaling its intent to join the ETF frenzy.

Litecoin Makes Its Move

On January 16, Canary Capital announced the updated filing, sparking speculation about the SEC’s stance. Bloomberg ETF analyst James Seyffart weighed in on X, noting that the filing likely reflects ongoing dialogue between Canary and the SEC. However, the 19b-4 filing, the critical step that starts the official approval process, is still missing.

“This filing is a positive sign for Litecoin’s chances, but the upcoming leadership change at the SEC could be a game-changer,” Seyffart added.

If approved, the Litecoin ETF would mark the third spot crypto ETF in the U.S., following Bitcoin and Ethereum. Investors seem optimistic: Litecoin’s price surged over 16% in just 24 hours, reaching $117.92. According to Santiment, large-scale “whales” holding at least 10,000 LTC have accumulated 250,000 coins since January 9, driving this rally.

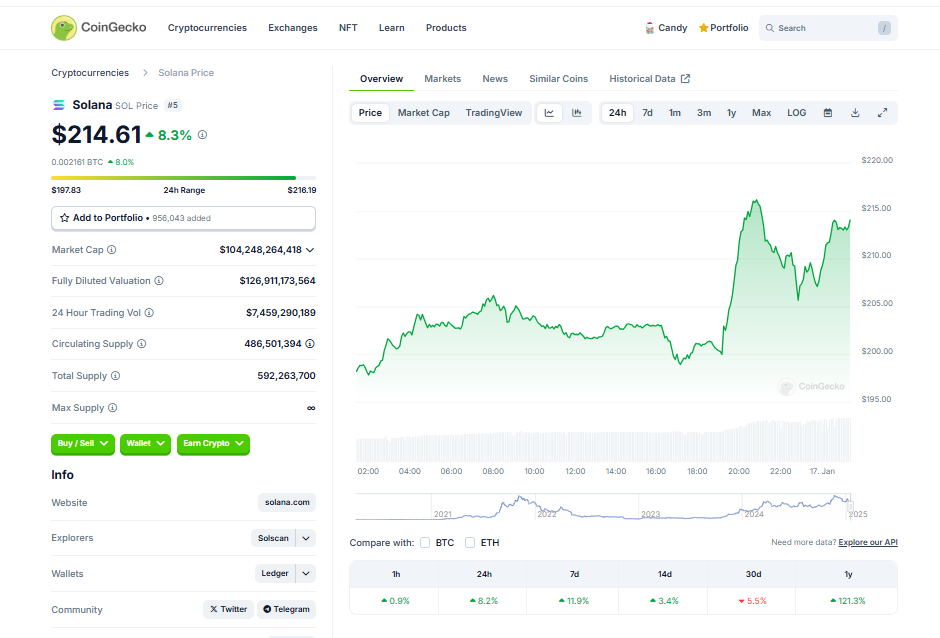

Solana and XRP: Still Leading the Pack

Litecoin’s entry is significant, but Solana and XRP are already ahead in the ETF race. Multiple firms, including VanEck and Grayscale, have filed 19b-4 forms for spot Solana ETFs, with some deadlines for SEC decisions fast approaching.

For Solana, Grayscale’s ETF is up first, with a response due by January 23, while others like Bitwise and 21Shares await decisions by January 25. XRP is in a similar position, with WisdomTree’s application requiring SEC feedback by January 16.

JPMorgan estimates these ETFs could attract $14 billion in their first year—$3 billion to $6 billion for Solana and $4 billion to $8 billion for XRP. However, these approvals hinge on the SEC’s willingness to adapt. Under outgoing SEC Chair Gary Gensler, the agency has been resistant to approving spot crypto ETFs unless backed by robust futures markets—a hurdle neither Solana nor XRP has fully overcome yet.

A New SEC Era: What’s Next for Crypto ETFs?

The biggest wild card in this ETF race might not be the cryptocurrencies themselves, but the SEC’s incoming leadership. On January 20, Gary Gensler steps down as SEC Chair, making way for Paul Atkins, a figure seen as much more crypto-friendly.

Atkins is expected to collaborate closely with Republican commissioners like Hester Peirce, potentially freezing or withdrawing enforcement actions that don’t involve fraud. This shift could create a more welcoming regulatory environment for crypto ETFs, significantly increasing their chances of approval.

As the crypto industry watches closely, the stakes couldn’t be higher. Will Litecoin’s ETF leap ahead under new SEC leadership, or will Solana and XRP maintain their lead? Either way, the coming weeks promise big changes for crypto’s ETF landscape.