- Litecoin has extended its losing streak to seven days, with price hovering just above critical support near $77

- Fading social interest and a negative funding rate suggest sentiment continues to weaken

- A breakdown below $77 could open a deeper move toward the $66 support zone

Litecoin is still stuck under heavy selling pressure, trading below $78 on Tuesday and stretching its losing streak to seven straight days. The latest leg down came after LTC was rejected once again at a key resistance zone, and since then, momentum hasn’t really recovered. With social interest fading and technical signals turning more bearish by the day, downside risks continue to dominate the picture.

There’s no panic here, but there’s also no urgency from buyers. That quiet lack of demand can be just as damaging.

Social Interest Dries Up, Sentiment Softens

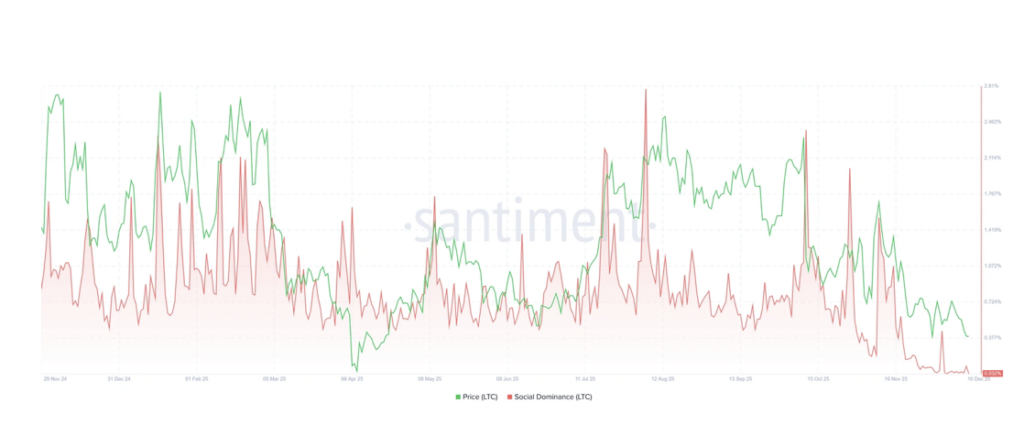

One of the more telling signals comes from social data. Santiment’s Social Dominance metric, which tracks how much attention Litecoin gets across crypto media, has been sliding steadily since early December. On Tuesday, it dropped to just 0.032%, the lowest reading of the year.

That decline suggests Litecoin is slowly falling out of the conversation. Fewer discussions usually mean weaker sentiment, and weaker sentiment often translates into lower conviction when price starts to slip.

Derivatives data backs that up. According to Coinglass, Litecoin’s OI-weighted funding rate flipped negative, sitting around -0.002%. In simple terms, more traders are betting on further downside than a bounce, with shorts now paying longs. Historically, when funding rates turn negative like this, LTC has struggled to hold its ground.

Bears Tighten Their Grip on the Chart

From a technical standpoint, the structure still favors sellers. Litecoin was rejected near the 38.2% Fibonacci retracement level at $84.63 on December 10, and that rejection kicked off a sharp pullback. Since then, price has printed a series of red daily candles, dropping nearly 9% and revisiting weekly support around $77.19.

At the time of writing, LTC is hovering near $77.50, sitting uncomfortably close to that level. A clean daily close below $77.19 would likely open the door to the next support zone near $66.51, which sits much lower on the chart.

Momentum indicators aren’t offering much encouragement either. The daily RSI is around 37, well below the neutral 50 mark and still pointing down, a sign that bearish momentum is building. On top of that, the MACD printed a bearish crossover on Monday, reinforcing the idea that sellers still have the upper hand.

What Could Change the Setup

There is, however, a path for relief, even if it’s narrow. If the $77.19 weekly support manages to hold and buyers step in with some conviction, Litecoin could attempt a recovery back toward the $84.63 Fibonacci level. That zone has already proven tough to break, so any bounce would need real follow-through to shift sentiment.

Until that happens, the trend remains fragile. With interest fading, shorts leaning in, and momentum pointing lower, Litecoin continues to trade in defensive mode, and the next few daily closes could prove decisive.