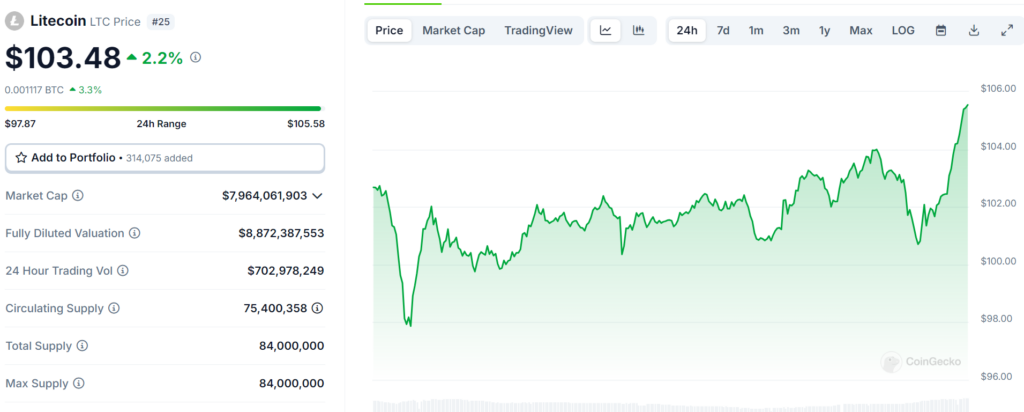

- Litecoin’s price rises to $102.76, reflecting a 2.5% daily increase.

- Market cap at $7.96 billion with $702 million in 24-hour trading volume.

- Circulating supply nearing its maximum of 84 million coins.

Litecoin remains a notable cryptocurrency in the digital asset market, showing steady growth as its price climbs to $102.76. This 2.5% daily increase highlights the asset’s resilience and growing investor interest. With its capped supply of 84 million coins and efficient blockchain network, Litecoin continues to maintain its appeal among both traders and long-term holders.

Market Overview And Price Activity

Litecoin’s current market cap stands at $7.96 billion, reflecting its solid position among the top cryptocurrencies. A 24-hour trading volume of $702 million showcases active market participation, with traders seizing opportunities created by price fluctuations. Over the past day, Litecoin has traded between $97.87 and $105.58, indicating moderate volatility in its price movements.

The asset’s circulating supply of 75.4 million coins brings it closer to its capped limit, increasing scarcity and contributing to its perceived value. Historically, Litecoin has been favored for its fast transaction speeds and low fees, which make it suitable for payments and transfers. These qualities keep the asset competitive in an increasingly crowded market.

Factors Driving Litecoin’s Momentum

Several factors could explain Litecoin’s recent performance. Its consistent adoption for payment solutions worldwide remains a significant driver, as more merchants integrate Litecoin into their systems for its efficiency and cost-effectiveness. The anticipated halving event, which reduces mining rewards and increases scarcity, also plays a role in boosting interest among traders and investors.

Despite its strengths, Litecoin faces challenges in remaining competitive. Emerging blockchain projects offering new functionalities and innovations create a crowded environment. Additionally, Litecoin’s close correlation with Bitcoin means its price often mirrors broader market trends, potentially limiting its independence as an asset.

The CoinGecko chart shows potential resistance at the $105 mark, where selling pressure may increase. Conversely, support levels around $97 could act as a safety net for prices if the market cools. Traders should watch these levels closely to adjust their strategies accordingly.

Litecoin’s strong fundamentals and enduring use cases make it a reliable choice in the cryptocurrency space. Its established position, combined with ongoing improvements and market activity, ensures its continued relevance even as the digital asset landscape evolves.