- Litecoin trades around $120.54, steady despite ETF decision delays.

- Technical structure remains bullish with EMAs aligned and open interest rising.

- Key breakout above $124.83 could unlock targets at $127 and $130.

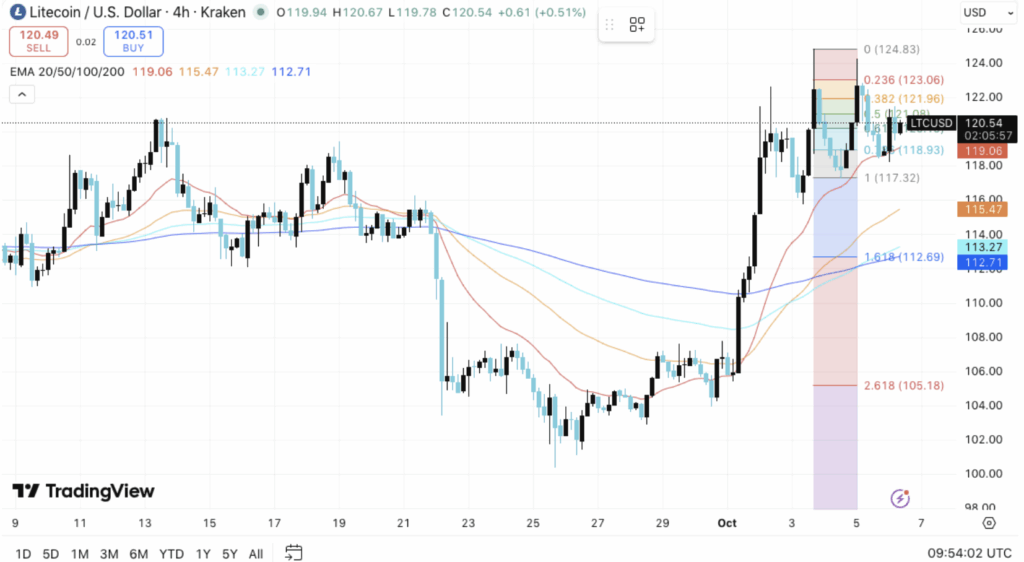

Litecoin (LTC) is keeping its bullish shape intact on the 4-hour chart, even after a bit of a hiccup from regulators delaying Canary Capital’s spot Litecoin ETF decision. At the time of writing, LTC trades near $120.54, holding steady while traders reset short-term expectations. Polymarket data still shows a huge 94% probability of approval, but with the verdict pushed back, one of the main bullish drivers is temporarily off the table. Even so, technicals suggest the momentum hasn’t gone away—as long as the key support zones keep holding.

LTC Trading Above Key EMAs Signals Strong Bullish Structure

On the charts, Litecoin is trading above all major EMAs, a classic sign that the trend remains upward. The 20 EMA sits at $119.06, the 50 EMA at $115.47, the 100 EMA at $113.27, and the 200 EMA at $112.71—all packed tightly, forming a strong cluster of support. Price action has been bouncing in the $118–$124.83 range, signaling consolidation before a possible next leg higher. A close above the $121.96 Fibonacci level could tilt momentum back to the upside, targeting $124.83. On the flip side, slipping below $118 might invite weakness, with layered supports around $117.32 and $112.69 ready to catch price if needed.

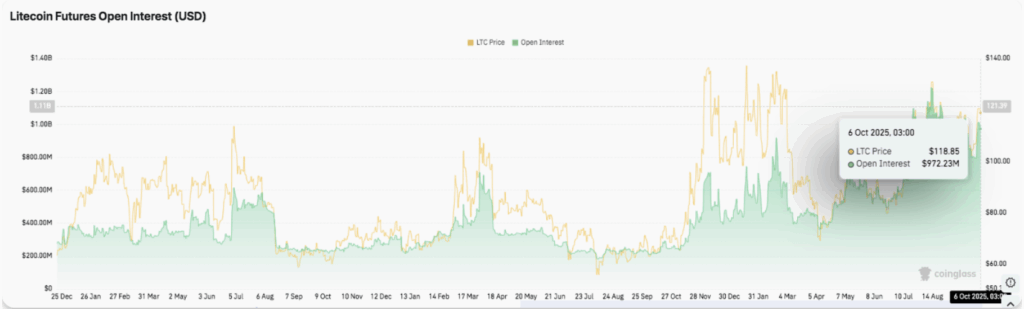

Rising Open Interest Highlights Growing Trader Participation

Derivatives data is also backing up the bullish case. Litecoin’s open interest climbed to $972.23 million as of October 6, 2025, rising in step with price. This parallel move suggests that traders are adding leverage exposure, often a precursor to heightened volatility. Historically, such climbs in open interest have set the stage for strong swings in price. If LTC can stay above $110, it could continue attracting speculative inflows, reinforcing the overall bullish structure.

Litecoin Exchange Outflows Suggest Long-Term Accumulation

On-chain flows tell another important story. Throughout 2025, Litecoin has seen consistent outflows from exchanges, a sign that holders are moving coins into private wallets. That usually points to accumulation, reducing the immediate selling supply. On October 6, about $688,000 worth of LTC left exchanges while the coin traded near $120.66, adding to the narrative of steady accumulation. Fewer coins sitting on exchanges often mean stronger price stability in the near term.

Litecoin Price Prediction: Key Levels at $124 and $130 for Bulls

For now, the roadmap for Litecoin is clear. Resistance levels sit at $121.96, $123.50, and $124.83, with a breakout above this zone potentially opening a run toward $127 and the psychological barrier at $130. On the downside, $118.93 marks the first key support, followed by $117.32 and the 200 EMA at $112.69. As long as LTC stays above $118, the short-term bullish bias remains intact. The tightening range between $118 and $124 suggests a volatility expansion phase may be close.

Will Litecoin Extend Its Rally?

Heading into mid-October, Litecoin’s trajectory hinges on buyers protecting the $118–$119 support zone. If they succeed, renewed momentum could carry price toward $127 and possibly $130. Failure to defend these levels, however, risks a pullback toward $113–$112. The technical structure still leans bullish overall, but a confirmed break above $124.83 is the trigger bulls need to prove the next leg higher is underway.