- Litecoin is trading sideways near $77, with $75.20 acting as key short-term support and $79.60 as resistance.

- On-chain data shows older LTC supply beginning to move, a signal often seen near market turning points.

- Litecoin’s next meaningful move remains closely tied to Bitcoin’s direction and broader market sentiment.

Litecoin has slipped into a bit of a holding pattern, and the mood around it feels cautious but not broken. After weeks of sideways movement, traders are starting to focus less on noise and more on whether LTC can finally commit to a direction, or if lingering sell pressure from older holders starts to weigh again.

Right now, Litecoin isn’t flashing panic signals, but it isn’t inspiring confidence either. It’s one of those moments where patience matters more than prediction.

Daily Structure Signals A Decision Is Close

Crypto analyst CRYPTOWZRD described Litecoin’s recent daily close as directionless, which often shows up right before a move. According to their view, the lower timeframes are now more useful for short-term setups, while Bitcoin continues to dictate broader market tone.

As Bitcoin pushed higher, both LTC/USD and LTC/BTC printed mildly positive daily candles. That’s important. For Litecoin to build anything sustainable, the LTC/BTC pair needs to stay constructive. As long as price holds above the $80 region, sentiment leans cautiously positive. Lose that, and attention quickly shifts to the $68 support zone.

At the time of writing, LTC trades near $77.53 with roughly $481 million in daily volume and a market cap around $5.96 billion. The 24-hour move is modest, up about 0.4%, but it reflects Litecoin moving in sync with Bitcoin rather than lagging badly.

Intraday Levels Define The Battlefield

Zooming into shorter timeframes, the chart becomes more tactical. The $75.20 level has emerged as a key intraday support. Reactions here matter. A clean bounce could offer short-term long opportunities, while a decisive break below would likely invite shorts.

On the upside, resistance sits near $79.60. If price pushes into that zone and stalls, it could act as a short-term rejection area. These levels don’t define the long-term trend, but they shape how traders navigate the chop while the market decides what’s next.

Old Supply Starts To Move Again

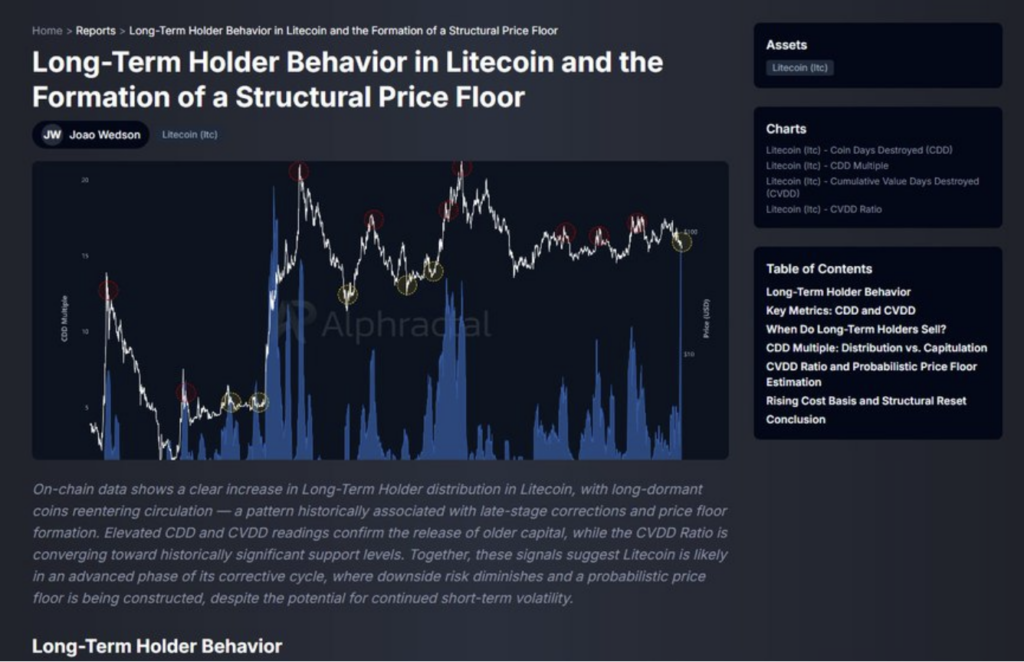

Adding another layer to the picture, on-chain data from Alphractal shows that some long-dormant Litecoin supply is beginning to circulate. Historically, this behavior has appeared near major turning points, sometimes at tops, sometimes during deeper pullbacks as markets search for a bottom.

It doesn’t confirm anything on its own, but it’s worth noting. When older holders start distributing after prolonged inactivity, it often marks a transition phase rather than a continuation of the same trend.

Litecoin’s Next Move Still Hinges On Bitcoin

For now, Litecoin’s short-term outlook remains tied closely to Bitcoin’s direction. The technical levels are clear, sentiment is balanced, and volatility is compressed. That combination usually doesn’t last long.

Until a confirmed trend emerges, waiting for clarity may be the smartest move. Litecoin is approaching a decision point, and the next break, up or down, is unlikely to be subtle.